HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Stella Osoba, CMT

With GM's recent announcement that it would be shutting five manufacturing plants in America and eliminating almost 15,000 jobs in North America, amounting to 15% of its workforce, would now be a good time to get into the stock? Let's look at the technicals.

Position: N/A

Stella Osoba, CMT

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

Is Now a Good Time to Buy General Motors?

12/05/18 01:20:38 PMby Stella Osoba, CMT

With GM's recent announcement that it would be shutting five manufacturing plants in America and eliminating almost 15,000 jobs in North America, amounting to 15% of its workforce, would now be a good time to get into the stock? Let's look at the technicals.

Position: N/A

| General Motors Company (GM) is an iconic American company. It has been around in some form since 1908 when it was founded by William C. Durant as a holding company. For much of the 20th century and the early part of the 21st century, GM was the world's largest motor-vehicle manufacturer. Until it went bankrupt and had to be bailed out by the American Government in the last decade, GM was a classic orphans and widows stock, meaning that it was perceived by investors as a stable stock providing safety of capital and paying dividends. |

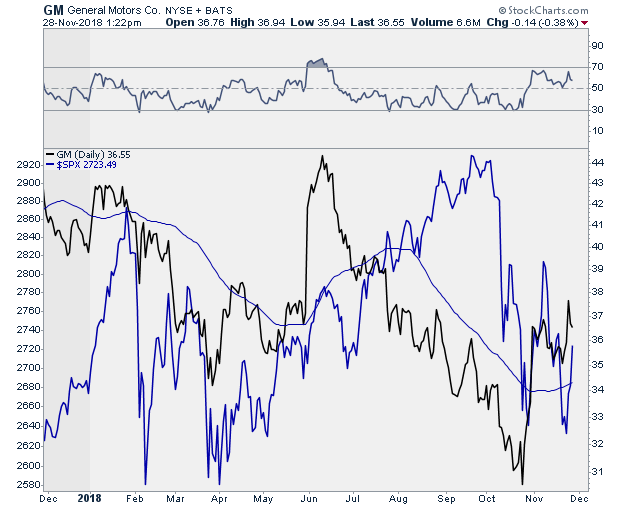

| As of late, GM's stock price has not fared so well as it has faced a number of structural problems both internally and also in the wider auto industry. A look at Figure 1 shows that GM has underperformed the S&P 500 index for much of 2018 and this underperformance accelerated in July. The black line on the chart is GM and the blue line is the S&P 500 index. A rising blue line, which we see here, shows that the S&P 500 is outperforming GM which is represented by the falling black line. |

|

| Figure 1. GM vs. S&P 500. |

| Graphic provided by: StockCharts.com. |

| |

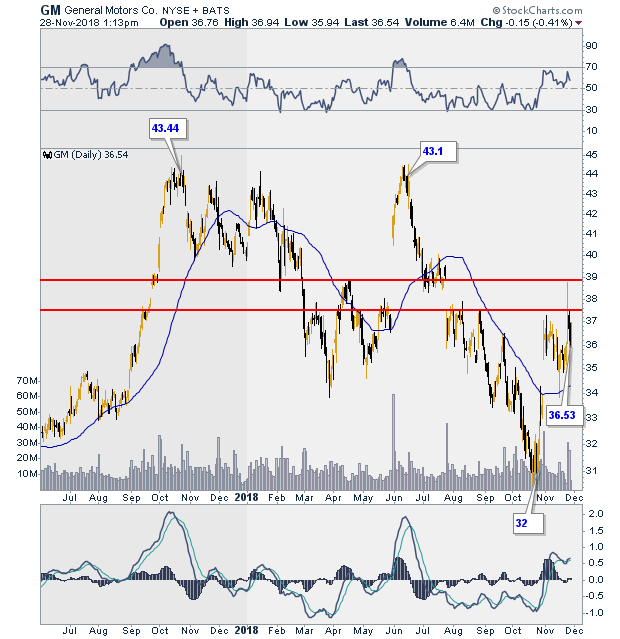

| On October 23, 2017, GM touched a high of 43.44. (See Figure 2) A year later, the chart shows a failed test of that high. On June 12, 2018, it reached a higher 44.47 and then turned down. The decline thereafter was steep and unrelenting. |

|

| Figure 2. GM Daily Chart. |

| Graphic provided by: StockCharts.com. |

| |

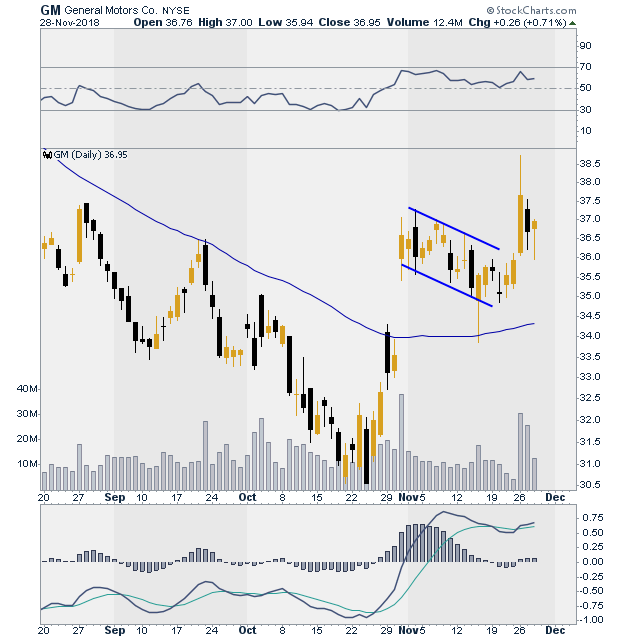

| GM has since rebounded from the lows it reached on October 27, 2018, at 30.57. It subsequently has formed a V shaped bottom, rallying to touch highs of 38.75 on November 26, 2018. The rise in GM's price halted after a gap up on October 31, 2018, with price then forming a downward sloping channel (see Figure 3). GM broke out of the channel on November 26, 2018, on very heavy volume with price retreating from the day's high to close nearer the middle of the day's price range, which was evidence that some of the heavy volume of the day masked sellers getting out of the stocks. |

|

| Figure 3. GM's recent trading action with a gap up and downward sloping trend channel. |

| Graphic provided by: StockCharts.com. |

| |

| Volume has since declined daily as GM has not been able to rise above its November 26, 2018 high. I read GM's chart as still bearish. A close above 38.85 would have me reassessing my opinion on a short term trade in this stock. Resistance remains at the area delineated by the two parallel red lines (see Figure 2) that was a prior gap down. If price is able to close above this area, it would be time to reassess the short term trend of this position. |

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

| E-mail address: | stellaosoba@gmail.com |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog