HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Stella Osoba, CMT

On June 29, 2018, General Electric (GE) got dropped from the Dow Jones Industrial Average (DOW). It was replaced by Walgreens Boots Alliance (WBA), a multinational holding company with several distinctive brands offering prescription and non-prescription drugs as well as health related services and other general goods.

Position: N/A

Stella Osoba, CMT

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

A Look At The DOW's Newest Member

07/26/18 03:54:59 PMby Stella Osoba, CMT

On June 29, 2018, General Electric (GE) got dropped from the Dow Jones Industrial Average (DOW). It was replaced by Walgreens Boots Alliance (WBA), a multinational holding company with several distinctive brands offering prescription and non-prescription drugs as well as health related services and other general goods.

Position: N/A

| The DOW is a price-weighted index, meaning that the share price of the individual companies making up the 30 member index matter. It was therefore decided that as GE's share price had fallen so low that it represented less than one-half of one percentage point weighting in the index, its continuing presence in the index was no longer meaningful. WBA's share price was much higher at the time — on June 26, it was trading around $66 a share. It was decided by the index committee at S&P Dow Jones Indices that the addition of WBA would be more meaningful for the index. |

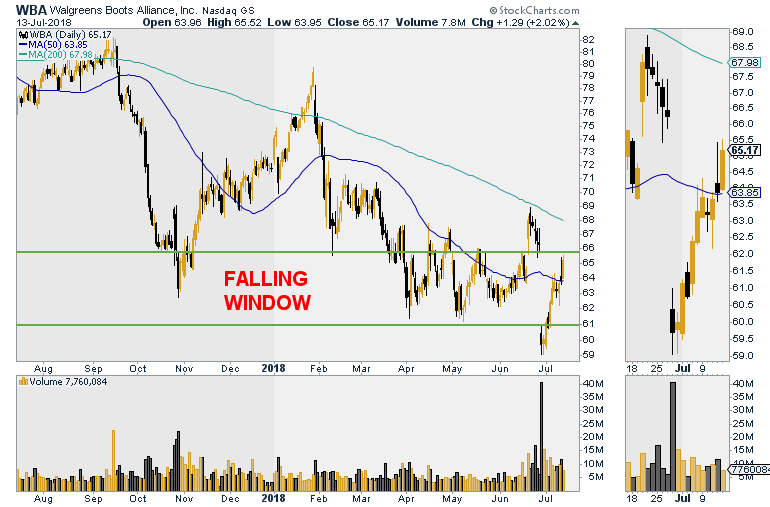

| This, therefore, seems like as good a time as any to look at the chart of WBA and see if there are any clues that the recent addition of this company to the granddaddy of indices tell us about its price performance. A look at the chart below shows that WBA had actually been in a down trend by June 2018. After reaching a high of 91 in August 2015, WBA has traded either sideways or down. WBA was testing lows of 61, which it touched on April 3, 2018 and May 8, 2018. Price then rose and made a higher low into June. A rising window or gap up on June 19 implied that the trend might have tried to reverse to up. The reaction starting on June 21 was normal but then the announcement came out that WBA was being added to the DOW and the stock didn't take the news well. WBA closed the day lower and on June 28, a couple of days later, it opened down in a large falling window. This had the effect of taking the stock to new recent lows. |

|

| Figure 1. Daily chart of WBA. |

| Graphic provided by: StockCharts.com. |

| |

| The whole area of the falling window now becomes resistance. If we look at recent price action we see that price has risen into the body of the falling window, but the highs on the last two trading days ended at the upper level of the falling window. While the gap now appears to have closed, if price is not able to rise above the upper area of the gap, then it is still in effect. |

| One thing that is interesting to note is that while GE was booted from the DOW because its share price had fallen to lows that made its continued membership in the index irrelevant, GE continues to be a much larger cooperation than WBA at a current market capitalization for GE of $120.64 billion, while WBA has a market capitalization of $64.68 billion. Perhaps had the DOW been calculated as a market capitalization rather than a price weighted index, GE, an original member of the DOW might not have needed to have been replaced. |

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

| E-mail address: | stellaosoba@gmail.com |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog