HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Stella Osoba, CMT

The last few months have seen increased volatility in the stock market. When caught up in the stress that several hundred points in daily swings can bring, it is tempting to wade deeper into the tall grass amid all the uncertainty and lose sight of the forest for the trees. So let's take a step back and attempt to answer the question which is the title of the piece. Where next for the Dow Jones Industrial Average?

Position: N/A

Stella Osoba, CMT

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

Where Next for the Dow?

05/11/18 04:11:24 PMby Stella Osoba, CMT

The last few months have seen increased volatility in the stock market. When caught up in the stress that several hundred points in daily swings can bring, it is tempting to wade deeper into the tall grass amid all the uncertainty and lose sight of the forest for the trees. So let's take a step back and attempt to answer the question which is the title of the piece. Where next for the Dow Jones Industrial Average?

Position: N/A

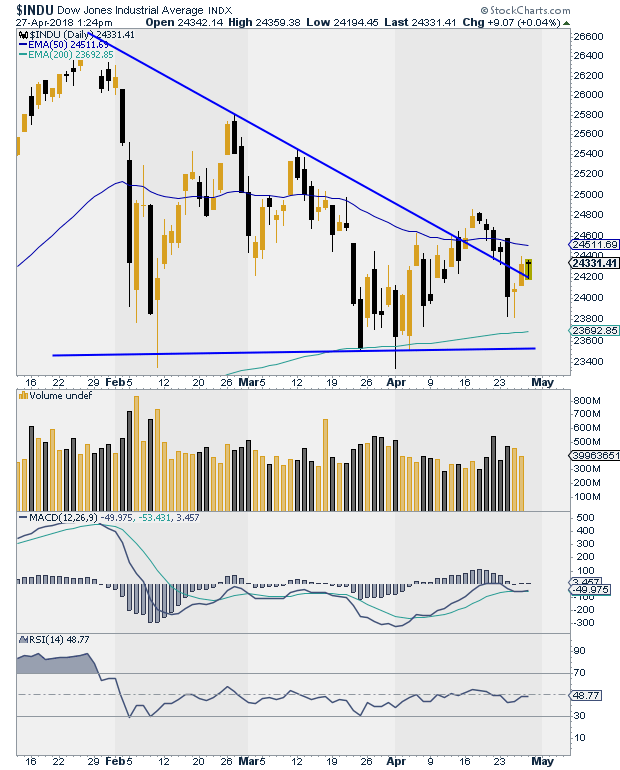

| The uptrend from the breakout in 2016 took the Dow from 18,847 in November 2016, to 26,616 in January 2018. This impressive run up ended so suddenly and sharply that many unsuspecting traders got caught up in the resulting carnage. The first leg down was a breathless drop from a high of 26,608 to a low of 23,360. In 10 trading days, two months worth of gains had been wiped out. |

| What often happens after such sharp and swift reactions catch traders by surprise is the willingness to believe that what has just occurred cannot really be happening or to ascribe some more benign explanation to the result. How often have we heard that this is a much needed correction? That once this correction is over, the market is destined for higher highs. There was a prediction I read somewhere that the DOW was set to touch 100,000. It is predictions like these that can cause you to put caution aside and hold on, with the hope that if you do, perhaps the market will make you whole again if you are sitting on losses. But this way of thinking is dangerous. We know that taking losses is hard, but the discipline required to be able to do this is essential to successful trading. |

|

| Figure 1. Daily chart for DJIA. |

| Graphic provided by: StockCharts.com. |

| |

| The DOW has recently broken above its downtrend line (See Figure 1) and is currently using the trend line as support. It is possible to draw a descending triangle on the chart. Often descending triangles will resolve to the downside, which could mean more pain for the bulls. Now is not the time to buy on the dips unless you know what you are doing. Do not have any expectations for this market. Now is the time to stand aside and wait. Allow the market to resolve itself, to show you what it is doing. Too often we are tempted to anticipate what it will do. But when the swings are this deep, it is wise to trade cautiously if at all. |

| A break below 23,810 or the previous low might indicate further downside price action in store. However, a break above the previous high of 24,876 might indicate some more upside price action ahead. But stay cautious. The extremely long bearish candles that have formed in the last few months should be seen as ominous. They represent selling pressure, which means that people are getting out of the market. For an uptrend to continue, there needs to be more willing buyers than sellers. That is not what the chart seems to be indicating at present. |

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

| E-mail address: | stellaosoba@gmail.com |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog