HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Stella Osoba, CMT

One of the ways we give back all our gains is by not recognizing when a successful trade is over. Learning to step back and do nothing after exiting a successful trade can be hard, but is an essential step to achieving trading mastery.

Position: N/A

Stella Osoba, CMT

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

It's Over When It's Over

05/03/18 03:06:29 PMby Stella Osoba, CMT

One of the ways we give back all our gains is by not recognizing when a successful trade is over. Learning to step back and do nothing after exiting a successful trade can be hard, but is an essential step to achieving trading mastery.

Position: N/A

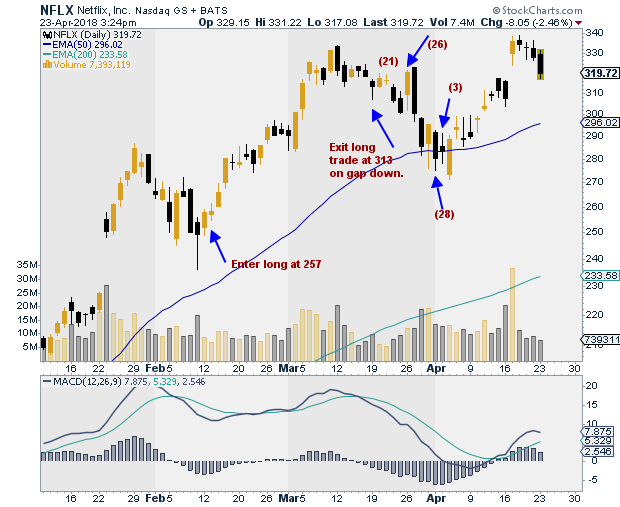

| Successful trading is all about discipline, self-trust and patience. Just as entering a trade correctly is essential for successful trading, so is exiting the trade and staying out until we are mentally ready to take another trade. Sometimes, we make mistakes by trying to force trends on past trades because we have not mentally divorced ourselves from the trade we just exited. For example, imagine we had entered a long trade in Netflix, Inc.(NFLX) on the bullish candle after the hammer when the price closed at 257.95 (See Figure 1). We held the position until a gap down convinced us of a trend change. The price was at 313.48. A 55.53 point increase would have made for a profitable trade. But then self-doubt interferes. |

|

| Figure 1. Daily chart for NFLX. |

| Graphic provided by: StockCharts.com. |

| |

| We ask ourselves, were we just reacting to fear, or was the trend really about to change? Maybe there is a bullish report from an analyst who increases the stock's price target, or maybe there was other positive news coming out of the company. Anyway, we watch the chart, as the day following our exit, the stock trades slightly higher. This begins to make us doubt the wisdom of exiting the position completely. We think that perhaps we should have left a small position open. |

| With self-doubt gnawing at us, we convince ourselves to reenter the trade the following day (21), even though the doji suggests the market is uncertain about direction. When price gaps down the following day (22), we no longer make any pretense at trying to analyze price. Maybe we are wrong, we think, after all we have by now convinced ourselves that we were wrong before when we exited too early. |

| The strong bullish candle on March 26, 2018, convinces us that our self-doubt was warranted. So we add to our position. The next day, the bearish engulfing candle which should have convinced us that we are wrong tells us the opposite. Studies have shown that we feel the pain of losses twice as much as the pleasure of gains. We torment ourselves with the losses we are seeing, but we do not allow ourselves to bail, remembering how we felt earlier when we exited. How much worse will it be now if we exit the trade and lock in losses, we ask ourselves. After two days of bearish candles, the bullish candle on the 50-day moving average with the long lower tail points to some buying coming in. Relieved, we hope that the stock has found support and will rebound to prove us right. The next day (28), this does not happen, we watch as our losses grow. The bearish candle with the lower close now convinces us that we were wrong to have gone in to the trade the second time. We bail the following day (3) only to watch helplessly from the sidelines as the following day the stock rebounds as we had hoped it would. |

| This scenario is very common for new traders. What happened is that after exiting a successful trade we did not see our next entry as a completely new trade, divorced from the previous one. Instead we rationalized our exit as a failure to be rectified, which we tried to do. But instead of allowing the market to tell us what it was going to do, we became attached to results and hope began to creep into our decision making. It would have been better to exit the position, and to have the discipline not to re-enter until we had stepped far enough away to be able to reassess the security with a cold rational mind, unencumbered with the emotions from the trade we had just exited. Cultivating the skills of discipline, self-trust and patience would have helped enormously. |

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

| E-mail address: | stellaosoba@gmail.com |

Click here for more information about our publications!

Comments

Date: 05/04/18Rank: 5Comment:

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog