HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Stella Osoba, CMT

We all know markets are fluid. They are constantly moving and we can never be sure what they will do next, so it is tempting for us to constantly change our minds as well, effectively moving the goal post further and further away.

Position: N/A

Stella Osoba, CMT

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

Pulling The Trigger Can Be Difficult

01/15/18 05:00:13 PMby Stella Osoba, CMT

We all know markets are fluid. They are constantly moving and we can never be sure what they will do next, so it is tempting for us to constantly change our minds as well, effectively moving the goal post further and further away.

Position: N/A

| Have you ever looked at a chart and told yourself that when price forms a long lower tail, you will enter the trade, then when this happens, you say, when it closes higher than the last high you will enter? When that happens you say, when it moves above the 50-day moving average, you will enter, when that happens, you say when it reaches another milestone you will enter. By continuously moving the goal post further and further away, you have effectively talked yourself out of entering what could have been a perfectly good long trade. |

| We can never be sure about the next likely direction of a trade. When we use technical analysis, we are playing a game of probabilities. If price moves up at a prior low after a downtrend and forms a lower tail, it is possible that this is evidence that the next likely move will be up. The fact that price halted at support, plus the lower tail is evidence of buying coming in. This does not mean that price cannot move lower, but only that the balance of probabilities suggest that it might move higher. As traders, we have to determine our level of risk and also develop our trading rules. It is always easy to second guess ourselves, but having rules, referring to those rules when in doubt and sticking by those rules we will help ourselves enormously in this trading game. |

|

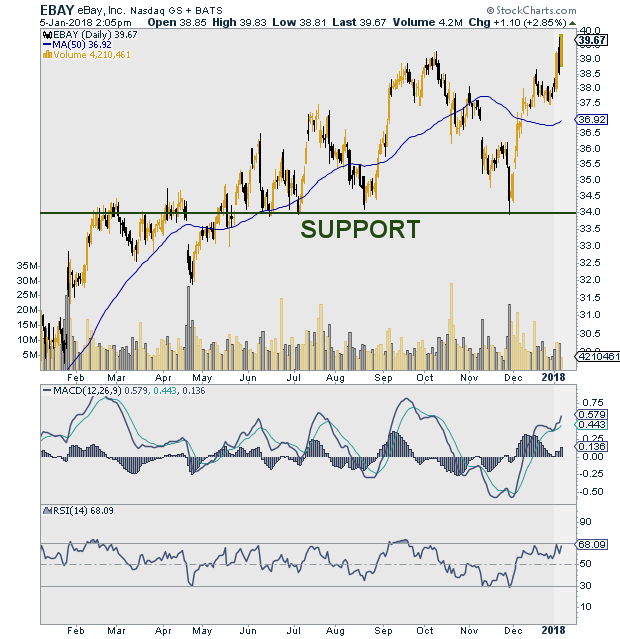

| Figure 1. Daily chart for EBAY. |

| Graphic provided by: StockCharts.com. |

| |

| Using the price chart of eBay (EBAY) as an example, if we look at Figure 1, we can see that recent support is at around 34. Price declines halted three previous times at this level. |

|

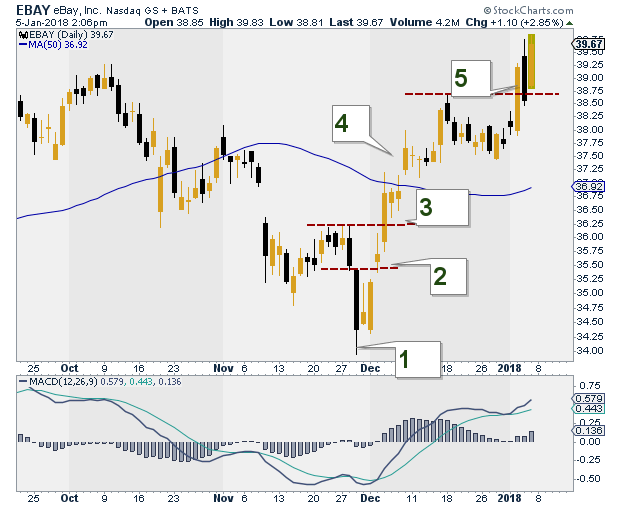

| |

| If we had been watching price, waiting for a signal to go long, depending on our trading rules, it could have come on November 29, 2017 when price formed a bearish candle with its lower tail touching support. We could have entered a long position (1 in Figure 2). If, however, we had decided to wait for more evidence that the trend was reversing to the upside, we could have entered at 2 (marked in Figure 2) when price gapped up to close above the high of the bearish candle at 1. If we needed still more evidence, we could have waited for price to close above most recent highs, at 3. If the chart still did not look bullish enough, we could have waited for a close above the 50-day moving average at 4 or a close above the most recent high at 5. |

| The problem here is that moving the goal post effectively keeps you on the sidelines while a perfectly good long trade is moving higher. In order to prevent ourselves from second guessing, it would be wise to have our rules written down and then stick to them. So if our rules say enter on a test of support, that is what we do. No questions asked, no second guessing. We create rules to take some of the emotion out of trading in an environment that is fluid. Creating rules tells us to trust the process, not our emotions. Sure, sometimes even when we follow our rules, the trade will not work out. But trading is all about our willingness to take risk and our knowledge that staying out of trades due to fear and uncertainty will hinder our progress towards mastery of this most lucrative of all games. |

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

| E-mail address: | stellaosoba@gmail.com |

Click here for more information about our publications!

Comments

Date: 01/19/18Rank: 5Comment:

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor