HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Stella Osoba, CMT

I usually will not write about IPO's because there is simply not enough technical information available to do a halfway decent analysis. So why am I writing about LongFin Corp. (LFIN)? Because sometimes a stock acts so spectacularly that a special mention is warranted.

Position: N/A

Stella Osoba, CMT

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

Manias And The Madness Of Crowds

01/04/18 04:28:49 PMby Stella Osoba, CMT

I usually will not write about IPO's because there is simply not enough technical information available to do a halfway decent analysis. So why am I writing about LongFin Corp. (LFIN)? Because sometimes a stock acts so spectacularly that a special mention is warranted.

Position: N/A

| LFIN debuted on December 13, 2017. It's opening price was 6.65. By December 18, 2017, it's share price had shot up to a high of 142.82. Any early investors who had held shares prior to the open, or had the nerves to buy on the open could no doubt have netted a windfall had they sold four trading days later. The stock closed at 72.38 on December 18, retreating significantly from its high, but the closing price still represented a gain of 1088% from its opening price. |

| Did anyone mention tulips? LFIN is a small fintech company that describes itself as delivering foreign exchange and financing solutions to import and export companies as well as SMEs across the globe powered by artificial intelligence. |

|

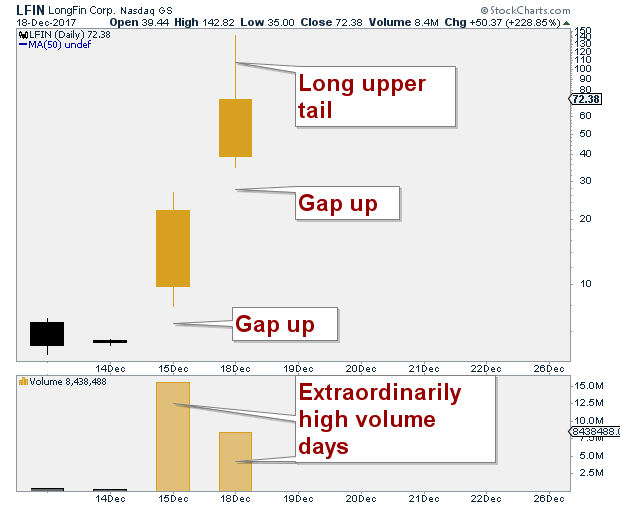

| Figure 1. Daily chart for LFIN. |

| Graphic provided by: StockCharts.com. |

| |

| The reason for the stratospheric price increase appears to be the announcement made on December 15, 2017 that it had acquired a company called ziddu.com, which it describes as a blockchain empowered global micro lending solutions provider. |

| LFIN has almost no trading history upon which to base a proper analysis of its price behavior. The little that there is, is provided in the chart above which I think speaks for itself. Nevertheless, a few comments are warranted. The stock opened on December 13, and closed lower on very low volume. The following day, the stock traded narrowly, between 5.51 and 5.22, on even lower volume showing a general lack of interest in the stock. However, when the company announced its acquisition of Ziddu, the stock gapped up on exceedingly high volume the following day. This price behavior was repeated the next day, December 18, which saw another gap up on high volume. The long upper tail on the bullish candle might suggest sanity returning in pockets of the market as some of those with a windfall lost no time in exchanging their shares for cash. |

| It is somewhat painful to think that there were buyers of the stock at the stratospheric highs reached on December 18. But indeed, there were. Those buyers are looking at almost instant losses, so the question is how long will it take the stock to return to the highs of December 18, so that they can get out, and will the stock hold onto any of its recent gains over the longer term? The answer to that question is anyone's guess. It was John Maynard Keynes who has been attributed with the statement that markets can remain irrational far longer than one can remain solvent. So to anyone thinking of getting swept up in the bitcoin mania, through companies such as LFIN, there is one word that comes to mind. Beware! |

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

| E-mail address: | stellaosoba@gmail.com |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor