HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

Four stocks have effectively powered the Nasdaq Composite higher since this rally began. They have struggled of late. Is the rally finally over?

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

MOMENTUM

FANG Stocks are Faltering - Should we be worried?

01/29/16 04:14:56 PMby Matt Blackman

Four stocks have effectively powered the Nasdaq Composite higher since this rally began. They have struggled of late. Is the rally finally over?

Position: N/A

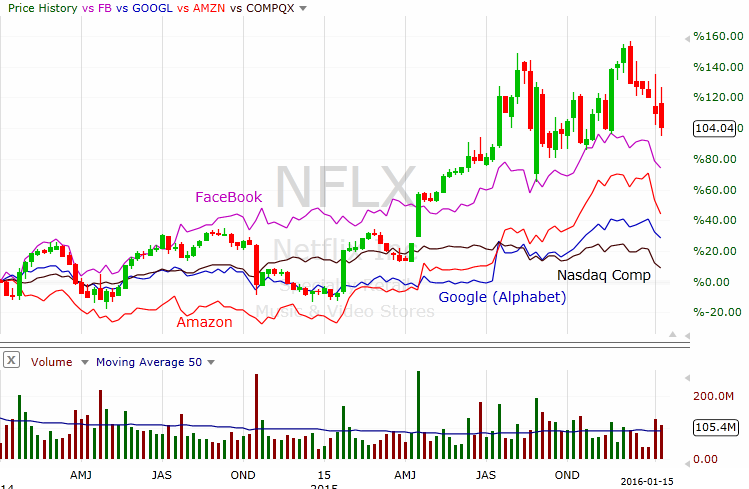

| In every rally, there are a group of market leading stocks that pull stocks higher. And since May 2012 when Facebook, the last FANG (Facebook, Alphabet, Netflix and Amazon) stock IPOed, the combined stock price appreciation of this group has dwarfed that of the Nasdaq Composite and every other index. Alphabet, the least stellar performer had gained more than 130% compared to the group's star, Netflix which had gained more than 1000% by the beginning of 2016. This compared to gain of roughly 70% for the Nasdaq Composite Index over the same period. |

|

| Figure 1. Weekly chart of the FANG stocks (Facebook, Amazon, NetFlix and Google (Alphabet)) versus the Nasdaq Composite over the last two years. |

| Graphic provided by: Freestockcharts.com. |

| |

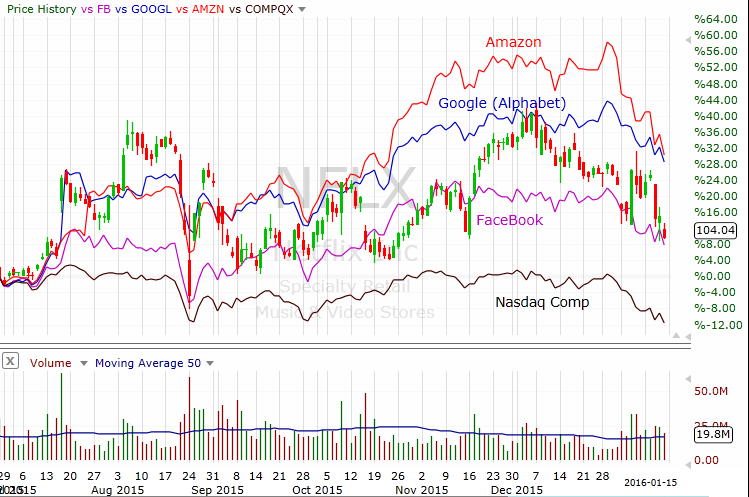

| But in the last six months, the performance of all these stars has deteriorated significantly. Netflix, although still higher, has been trapped in a trading range as has Facebook, while Amazon and Alphabet are up 30 to 40%. Meanwhile, the Nasdaq Composite has lost 4% (see Figure 2). |

|

| Figure 2. A daily chart of the same stocks showing how they have performed over the last six months. |

| Graphic provided by: Freestockcharts.com. |

| |

| This year has been anything but bullish for stock markets around the globe. The January Barometer, introduced by Yale Hirsch, founder of the Stock Trader's Almanac, tracks the performance of the S&P 500 on the premise that as goes January, so goes the rest of the year. Since 1950 it has only registered 8 major errors and boasts an admirable accuracy of 87.7%, according to the book's editor, Jeffrey Hirsch. |

| But perhaps more concerning for the bulls is the fact that stocks that have consistently lead this rally since 2009 are no longer ramping higher, and when market leading stocks stop leading, it's time to take notice. A new group of stocks could well emerge to pull the market higher but there are no guarantees. And until that happens, caution is definitely warranted. |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

| Company: | TradeSystemGuru.com |

| Address: | Box 2589 |

| Garibaldi Highlands, BC Canada | |

| Phone # for sales: | 604-898-9069 |

| Fax: | 604-898-9069 |

| Website: | www.tradesystemguru.com |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog