HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

Imagine that you're on a train seated at a table for five - just you and four of the world's best stock traders.

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

MOMENTUM

Book Review: Momentum Trader's Ticket to Ride

10/14/15 04:31:21 PMby Matt Blackman

Imagine that you're on a train seated at a table for five - just you and four of the world's best stock traders.

Position: N/A

| Now imagine that you all must stay seated at the table for the next few hours but can ask whatever questions you like. All answers given are detailed, to the point and best of all you'll get a transcript of the conversation when it was over. If this sound too good, you're right, it is. But a new book comes close to transforming this dream into reality. Entitled "Momentum Masters -- A Roundtable Interview with Super Traders" and edited by Bob Weissman, the book includes extensive interviews with four power traders: Mark Minervini, David Ryan, Dan Zanger and Mark Ritchie II. Each is asked questions on such topics as how they pick stocks, how they use technical and fundamental analysis to choose winners, how they use market direction and their entry criteria just for starters. All together, there are more than 100 questions with detailed answers from each trader. Here are a few examples. "How do you feel about HFT (high frequency trading)?" No surprise that none of traders like it, what is perhaps unexpected is how they feel this practice has changed markets. For example, HFT has led to increased chop that when combined with the increasing use of artificial intelligence computer algorithms have changed the rules and how markets work. The good news is that all have found that chart patterns still work, although each trader has his own favorite indicators. For example, Minervini looks for a stock's relative strength compared to the market while Zanger mainly uses chart patterns, price and volume. In Chapter 2, the traders are asked, "How about a price cut-off -- do you buy low-priced stocks? If yes, do you treat them differently than you do high-priced names?" Zanger's answer is instructive. "I find most cheap stocks are cheap for a reason, as they lack many of the characteristics I'm looking for in a stock." But he then shares his Idera Pharmaceutical (IDRA) trade that was the only cheap stock success story that he could remember since the Internet bubble days. |

|

| Figure 1. Chart of Idera Pharmaceuticals (IDRA) showing Zangerís average buy and sell price in trades that netted him a 120% gain in this inexpensive stock in 2013-14. |

| Graphic provided by: StockCharts.com. |

| |

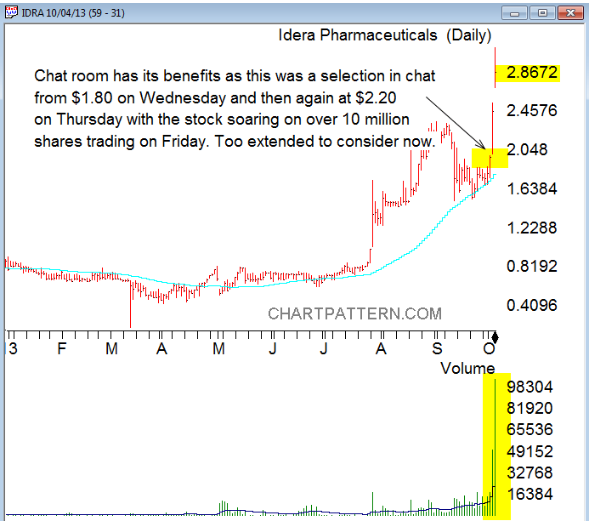

| So why did Dan Zanger buy Idera? I did some homework and found the chart in Figure 2 from his Chartpattern.com newsletter that provided the answer. The stock was in an uptrend and then gapped up out of what looks like a small inverse Head & Shoulders pattern on above average volume October 3, 2013 triggering Zanger's buy signal. This breakout was followed with an even bigger rise the next day on higher volume. His average purchase price was $2.20. |

|

| Figure 2. Daily chart showing what caused Zanger to buy Idera Pharmaceuticals in October 2013 from the Zanger Report newsletter. |

| Graphic provided by: www.Chartpattern.com. |

| |

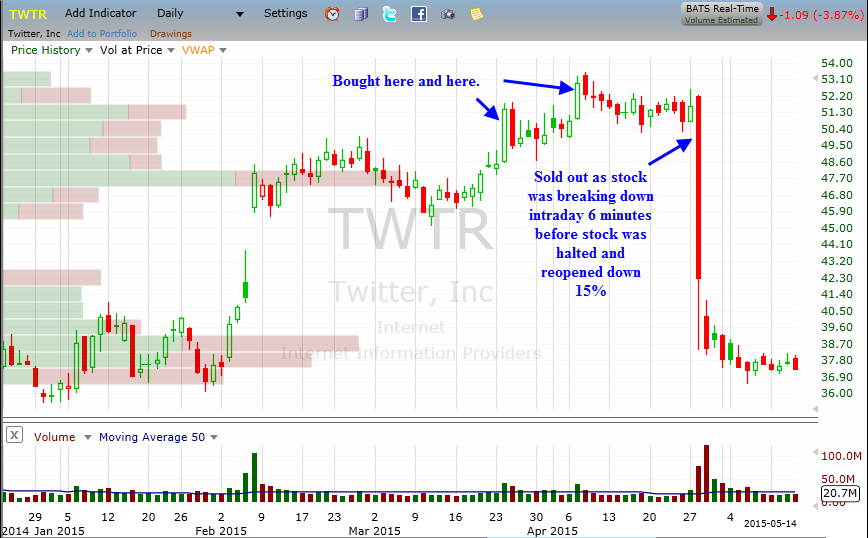

| Not every trade in the book is a winner. In chapter nine Mark Minervini responds to the second part of the question, "Can you walk us through a winning and losing trade?" After building a position in Twitter (TWTR) in March and April 2015 leading up to earnings release April 28, earnings were leaked early during the day. Following his trading plan, Minervini sold most of his position early in the day and exited his last position just six minutes before the stock was halted (see Figure 2). The stock gapped down 15% when it was re-opened. Mark lost less than 1% on the trade. "The reason this loss was so sweet is because I was going to hold into earnings, so the leak actually saved me from what would have been a large gap down the next morning." This trade highlights the risks of holding a stock into earnings -- sometimes they work and sometimes they go horribly wrong. |

|

| |

| If I had to pick one favorite question, it would be this one in Chapter 11. "What are your top five trading rules?" |

| Surprisingly each trader proffered five different answers. Some of my favorites from each trader are: "Never average down." Minervini "Never let a good trade turn into a loss." Ryan "Never chase a stock that is up more than 3 - 5% above its pivot or breakout area." Zanger "Guard your emotions with equal value to the way you guard your capital." Richie II If I had one complaint about the book it would be this: With just 190 pages, it left me wanting more. Momentum Masters is published by Access Publishing Group, LLC and is available at Amazon or by going to MomoMasters.com. |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

| Company: | TradeSystemGuru.com |

| Address: | Box 2589 |

| Garibaldi Highlands, BC Canada | |

| Phone # for sales: | 604-898-9069 |

| Fax: | 604-898-9069 |

| Website: | www.tradesystemguru.com |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor