HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Stella Osoba, CMT

Options are often thought of as being risky and they often are, especially when you do not have a clear understanding of how they work. There are times, however, when a thorough understanding of an option strategy can help to minimize downside risk while allowing you to participate in potential upside gains.

Position: N/A

Stella Osoba, CMT

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

PRINT THIS ARTICLE

OPTIONS TRADING

Protecting Profits With Strangles

05/01/15 05:00:05 PMby Stella Osoba, CMT

Options are often thought of as being risky and they often are, especially when you do not have a clear understanding of how they work. There are times, however, when a thorough understanding of an option strategy can help to minimize downside risk while allowing you to participate in potential upside gains.

Position: N/A

| A strangle is an option strategy consisting of purchasing both a put and a call on the same underlying, with differing terms. You can use this strategy if you already own a call and the underlying has advanced or you own a put and the underlying has declined. In either case your option trade should be profitable before you use this strategy. |

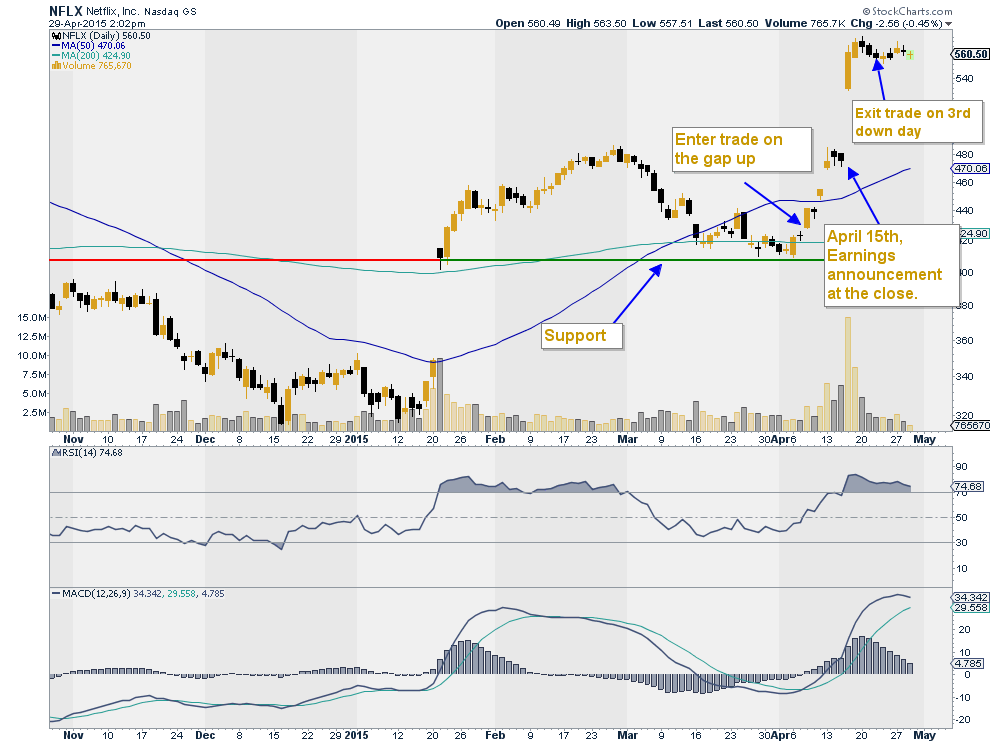

| To illustrate how a strangle could work, I will use Netflix (NFLX). NFLX has been in the news recently, its massive gap up in price after its earnings announcement on April 15, 2015 may have taken some by surprise, but a look at its chart in Figure 1 shows that NFLX typically is a volatile stock, prone to massive gaps in either direction. Because of its price behavior during earnings announcements, NFLX is an ideal candidate for a strangle option strategy. (Note, something to bear in mind when evaluating this strategy is that using expensive options such as NFLX's may make this example unsuitable for some.) |

| You can use a strangle to protect downside risk or upside risk. This example will be done with calls. From late February 2015, NFLX was in a short-term downtrend. On March 27, 2015 it touched support and for the next week hovered around support, without breaking it. On April 7, 2015 price bounced off support. The candlestick on the following day was a doji. Both the relative strength index (RSI) and the moving average convergence/divergence (MACD) were giving positive signals. On April 8, 2015 price gapped up. If you had used this as your confirmation, you could have entered the trade by buying a call option. Over the next three days, price appreciates. However, you are aware that an earnings announcement is due and you really don't want to be in a directional trade before earnings. There is no way to know how the stock will react after the earnings announcement; it could rise or it could plunge. What should you do? |

|

| Figure 1. Daily Chart Of Netflix (NFLX). The stock is volatile and prone to gaps in either direction. Because of this, NFLX is an ideal candidate for a strangle option strategy. |

| Graphic provided by: StockCharts.com. |

| |

| You could get out and preserve your profits, or you could buy a strangle. This will allow you to stay in the trade while protecting the bulk of your profits. The way it works is as follows. You already own a call, say you had bought the September 440 call. You now have a profit because the price of the underlying has appreciated. You buy the September 450 put. You would now own a strangle. The put serves as downside protection should the stock plummet after the earnings announcement, and you will continue to enjoy any upside appreciation should the stock continue to appreciate. For further reading on this topic a good source is "Options as a Strategic Investment" by Lawrence G. McMillan, 5th Edition. |

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

| E-mail address: | stellaosoba@gmail.com |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog