HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Stella Osoba, CMT

The sunk cost fallacy is a behavior that is potentially harmful to your investment success. Is there any way to overcome it?

Position: N/A

Stella Osoba, CMT

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

PRINT THIS ARTICLE

PSYCHOLOGY

Sunk Cost Fallacy

04/21/15 04:04:37 PMby Stella Osoba, CMT

The sunk cost fallacy is a behavior that is potentially harmful to your investment success. Is there any way to overcome it?

Position: N/A

| The sunk cost fallacy is the tendency to stay with an investment that is not working simply because you are already invested in it and also because you do not want to admit to making a mistake. The psychological reasoning that leads to sunk cost fallacy is a logical flaw in our reasoning which is very common and shows up in many areas of our lives. For example, it is sunk costs that leads individuals who have incurred tremendous expense going to graduate school, to stick with careers they are not happy in. It is sunk costs that leads many people to stay in unhappy marriages; it is sunk costs that leads people to stay in investments that are not working out and sometimes even to throw good money after bad. The reasoning could go something like this, "I've already spent money in this position and if I pull out now, the money will be lost." |

| When you are in a losing position, it is often best to ignore the sunk costs of losses when evaluating current opportunities, because you have already incurred the losses. If the position you are in is doing badly or not behaving as it should, it is usually best to be out of the position, to free up your resources so that you have the opportunity when it presents itself, to enter a better position. Do not be tempted to invest additional resources in a losing position when better investments are available. Use current information to make your investment decisions. What the stock is doing currently is where your focus should be, not what you hoped it would do when you entered the position. Accept that sunk costs are costs that have already been acquired, and for investing purposes they should often be ignored. |

|

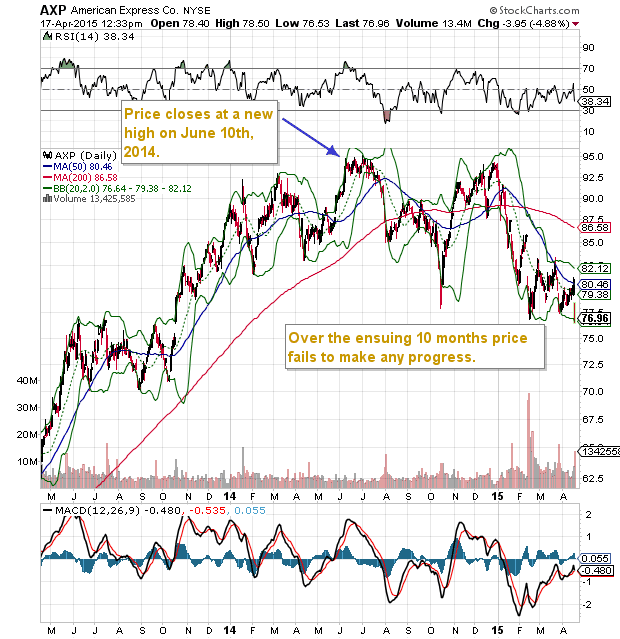

| Figure 1. The Sunk Cost Fallacy In Action. Staying in a losing position can be costly in terms of time and money. |

| Graphic provided by: StockCharts.com. |

| |

| Suppose you had been observing the stock price of American Express Co. (AXP). On June 10, 2014 when price made a new high (see Figure 1), it was higher than its two prior highs, so you interpreted this to be a bullish sign and entered the position at $94 the following day. However, over the next month and a half the stock failed to make any progress. It entered into a sideways trend and then toppled over in mid-July. You figure that you might as well hold your positions because you are staring at unrealized losses and if you liquidate, then the losses will be real. So unwilling to accept that the stock is not doing what you had expected it to do, you continue to hold the position and 10 months later no progress has been made. On April 16, 2015, the stock price for AXP was at $80. Even if the price came back to your original entry price of $94, by staying in the position you have given up the opportunity of investing your funds in more promising situations for a period of over 10 months. You have thereby allowed the sunk cost fallacy to dictate your investment decision. |

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

| E-mail address: | stellaosoba@gmail.com |

Click here for more information about our publications!

Comments

Date: 04/22/15Rank: 4Comment:

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog