HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Chaitali Mohile

The stock of Intel Corp. has plunged a few points. Is it a serious correction or a pullback?

Position: N/A

Chaitali Mohile

Active trader in the Indian stock markets since 2003 and a full-time writer. Trading is largely based upon technical analysis.

PRINT THIS ARTICLE

TECHNICAL INDICATORS

Intel Corp. - Is It A Corrective Rally?

03/30/15 02:21:43 PMby Chaitali Mohile

The stock of Intel Corp. has plunged a few points. Is it a serious correction or a pullback?

Position: N/A

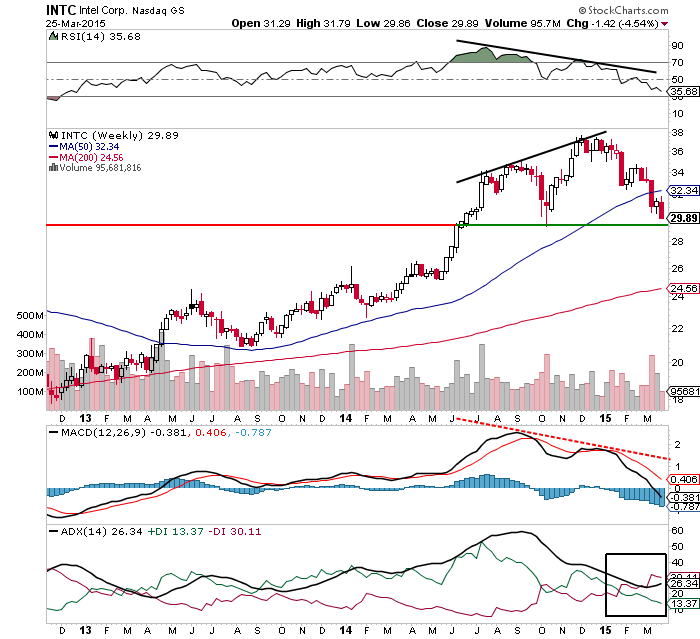

| Intel Corp (INTC) was in a steady uptrend for almost two years. As the average directional index (ADX)(14) turned overheated above 50 levels, the price rally started losing its strength. Due to the trend reversal indication the rally jittered while forming higher highs in Figure 1. The small doji candlesticks and the small upper-lower shadows formed by other candlesticks reflect upcoming bearish strength in INTC. The weakness was also indicated by the relative strength index (RSI)(14). The negative divergence formed by the RSI highlighted a second reversal indication. |

|

| Figure 1. Weekly Chart Of Intel Corp. (INTC). Here you see that the ADX(14) was overheated, the RSI(14) was overbought, and the MACD(12,26,9) was positive. |

| Graphic provided by: StockCharts.com. |

| |

| Eventually, INTC reversed, initiating a new downside rally. The stock has psychological support at $29. The ADX(14) was overheated at 60 levels, the RSI(14) was overbought around 90 levels, and the moving average convergence/divergence (MACD)(12,26,9) was positive in Figure 1. These resulted in short-term downside price movement of INTC. This bearish rally looks more like a technical correction than any other serious correction. |

| Recently, the 50-day moving average (MA) support was converted to resistance. Although, the ascending short-term moving average ruling over the 200-day moving average (MA) is a strong bullish indication, the stock is likely to remain volatile under the newly formed resistance. Therefore, INTC is likely to get trapped between the narrow range of 50-day MA resistance and $29 support. |

|

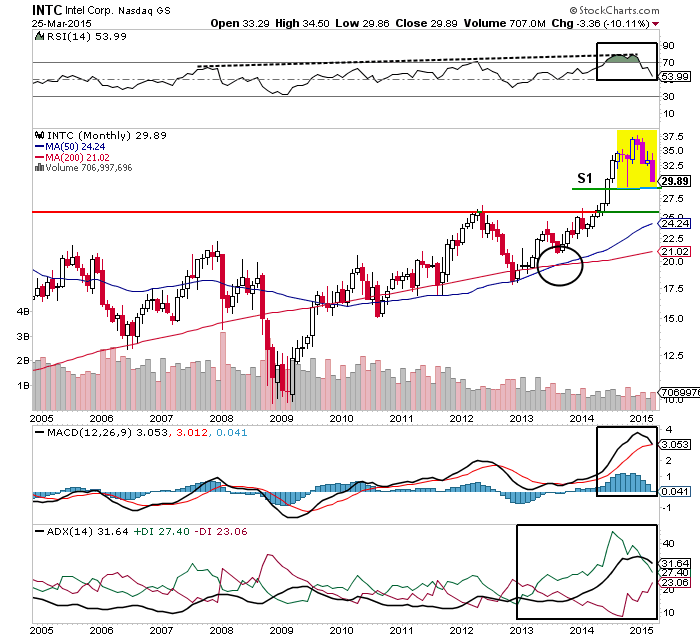

| Figure 2. Monthly Chart Of INTC. Here you see various support & resistance lines in the price chart. The big picture shows more downside for INTC. |

| Graphic provided by: StockCharts.com. |

| |

| The monthly time frame chart in Figure 2 shows various supports of INTC. S1 is the first support at $29 (approximately), the support-resistance line is the next support, and the moving average is the final support. An overbought RSI(14) and the highly positive MACD(12,26,9) influenced the developing uptrend indicated by the ADX(14). The MACD is ready to undergo a bearish crossover in positive territory and the RSI has already hit the center line (50 level). As a result, the ADX is also reversing from the $31 level, and the selling pressure indicated by the negative directional index (-DI) is increasing. These bearish signals would easily ignore the only positive indication of the bullish moving average crossover on the price chart (black circle) in Figure 2. |

| The big picture shows more downside for INTC. The stock is likely to breach its first support (S1 at $29 level) and hit the second support, which is the support-resistance line. Although INTC is undergoing short-term technical correction, it is likely to plunge further. |

Active trader in the Indian stock markets since 2003 and a full-time writer. Trading is largely based upon technical analysis.

| Company: | Independent |

| Address: | C1/3 Parth Indraprasth Towers. Vastrapur |

| Ahmedabad, Guj 380015 | |

| E-mail address: | chaitalimohile@yahoo.co.in |

Traders' Resource Links | |

| Independent has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor