HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Stella Osoba, CMT

Sometimes people will say that the reason that they will no longer use protective sell stops is because when they have used them in the past, their stops will invariably get touched, taking them out of the trade, just before the stock reverses. It is likely that this happens, not because the market somehow knows the price at which you set your stop and then deliberately aims to take you out of the trade, but the more likely reason, is that your stop might not have been set correctly in the first place.

Position: N/A

Stella Osoba, CMT

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

Using Protective Stops To Help With Entries

02/27/15 01:03:21 PMby Stella Osoba, CMT

Sometimes people will say that the reason that they will no longer use protective sell stops is because when they have used them in the past, their stops will invariably get touched, taking them out of the trade, just before the stock reverses. It is likely that this happens, not because the market somehow knows the price at which you set your stop and then deliberately aims to take you out of the trade, but the more likely reason, is that your stop might not have been set correctly in the first place.

Position: N/A

| Stop orders are useful tools if used correctly. They can help with entering into a new position, protecting profits, or limiting losses. A stop specifies the price at which an order is to be executed. A buy stop is placed over the market price while a sell stop is placed under the market price. Once this price is hit, the stop order becomes a market order. |

| There are a number of different types of stops including protective stops, progressive or trailing stops, time stops, and money stops. Our focus here is on protective stops. Protective stops help in the management of risk by removing some of the emotion from the decision making process. Protective stops have been described as being like fire extinguishers. They are designed to get you out when the trade is not working. So it is necessary to develop a method to effectively determine where your stops should be in a consistent and systematic way. You therefore have to determine before entry, the point below (above) which the stock should not go. This is the point at which you will know you were wrong about the trade. You then place your stop a safe distance below (above) this point. You want to give the trade room to move, but you also want to make sure that you can get out without too much damage. |

| The way to let protective stops help with entries is to first determine where the most logical place for a protective stop should be. It is not guess work and neither should it depend on how much you can afford to lose on a position. If the best place to set your protective stop is too far away from your entry, then it might be a clue not to take the trade. |

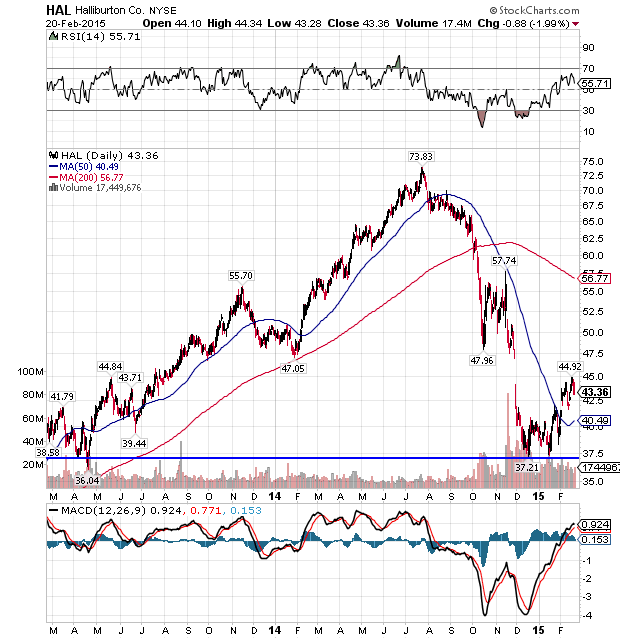

| In Figure 1, Halliburton Co (HAL) appears to have bottomed after making a low in December 2014 and again in January 2015. The stock is now rising. The best place to put a protective stop would be below the lows in December and January or below $37.20. But if you enter the trade at $43, you might decide that risking over $6 per share is more than you are willing to lose so you might want to raise your stop maybe to $38 or even $40. But arbitrary stops, set in this manner have a far greater chance of being hit. It would therefore be better not to take the trade but wait for another reaction to a level you are more comfortable with and which allows you to set your protective stops in a consistent and technically systematic way. Then your protective stops will only be hit when there is technical damage to the chart, which is what you want. |

|

| Figure 1. Where To Place Your Stops? The best place to put a protective stop would be below the lows in December and January. |

| Graphic provided by: StockCharts.com. |

| |

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

| E-mail address: | stellaosoba@gmail.com |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog