HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Stella Osoba, CMT

So you have done everything right. You have followed your rules, waited for the signal, entered the trade on confirmation of that signal and what happens? The setup fails. What do you do?

Position: N/A

Stella Osoba, CMT

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

When Setups Fail

02/19/15 05:22:06 PMby Stella Osoba, CMT

So you have done everything right. You have followed your rules, waited for the signal, entered the trade on confirmation of that signal and what happens? The setup fails. What do you do?

Position: N/A

| Because technical analysis is a game of probabilities, setups will fail. It is inevitable. The market will act in ways that often cannot be predicted. Successful trading means that at the time you enter any trade, you have set out what you will do in the event the market does not act as you anticipate that it will. Therefore, before putting on a trade you must know the following: * How you will know that you are wrong? * What you will do if you are wrong? |

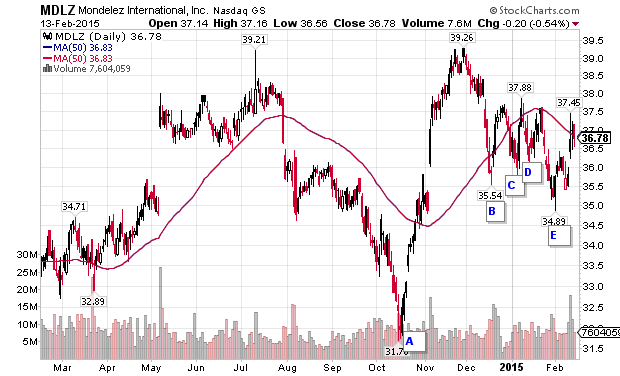

| For example, you have been watching Mondelez International, Inc. (MDLZ) for a suitable entry point for a long position. You watch as it comes off a low in October 2014 (A on Figure 1). It makes a high in November 2014 at $39 and then another high before falling to $35.54 (See B on Figure 1). Price then rebounds. You watch this price action and note that price has failed to make a lower low. You decide to enter at the next reaction if the low then is higher than the prior low. The low is on January 6 at $35.79 (See C in Figure 1). Price action the following day confirms this is the low. So you enter the position on January 8, 2015 at $37.10. You realize the following day that you had entered on the day of the high because price falls on January 9. Price falls over the next week bottoming on January 14 (See D on Figure 1). It however makes a higher low at $36.07. You watch the charts concerned. This is not quite what you hoped would happen. What should you do? |

|

| Figure 1: The Importance Of A Trading Plan. If you had entered a long position at $37.10 on January 8, 2015 at C, your stop should have got you out at $35.50 which would be on the lows at B. |

| Graphic provided by: StockCharts.com. |

| |

| At this point, there is not much damage to your position. You followed your rules and entered the position in compliance with them. You should allow the trade to unfold without getting anxious. The following week, price rebounds and rises. But on January 22, it meets resistance at the 50 day MA. The following trading day, price gaps down and closes lower. It does the same thing the following day, slicing through its 200-day MA. Now you are really concerned. |

| If you had followed rules 1 and 2 above, as well as following your trading rules you would have decided before putting on the trade the exact price level that price action would have to reach to let you know that you are wrong and the trade is not working. You would also have made a decision of what you would do if and when price action gets to that level. For instance, using the example here, since you entered on the idea of price making higher lows, you could have determined that anything which invalidated that idea would get you out of the trade. Therefore, placing a mental or actual stop under price at B would have gotten you out of the position before the reaction low at E, causing limited damage to your account, both financial and psychological. |

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

| E-mail address: | stellaosoba@gmail.com |

Click here for more information about our publications!

Comments

|

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog