HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Stella Osoba, CMT

The fear of regret is a cognitive bias that involves both judgment and emotion. We feel pain for having made a decision that results in a loss. Sometimes, the anticipation of that pain is so strong that it causes us to act in ways which might otherwise seem irrational.

Position: N/A

Stella Osoba, CMT

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

PRINT THIS ARTICLE

PSYCHOLOGY

Fear of Regret

02/12/15 03:00:08 PMby Stella Osoba, CMT

The fear of regret is a cognitive bias that involves both judgment and emotion. We feel pain for having made a decision that results in a loss. Sometimes, the anticipation of that pain is so strong that it causes us to act in ways which might otherwise seem irrational.

Position: N/A

| Fear of regret, also known as regret theory, manifests itself in several ways which can be detrimental to our success as traders and investors. This short piece can only hope to scratch the surface of an interesting and often insidious bias. |

| The emotion of regret is painful and we seek to avoid pain, so we act in ways that anticipate the pain we might experience as a result of our errors of judgment and then we mitigate these errors by some action or inaction thereby compounding our mistakes and acting irrationally. For instance, fear of regret can cause you to hold on to losing stocks too long as a way to defer having to face the pain of regret at having made a mistake in purchasing the losing stock in the first place. Conversely, fear of regret can cause you to want to sell profitable positions too soon as you do not want to hold and run the risk of seeing the price reverse to the downside and wipe out all your gains, for then you would kick yourself for not taking profits when you could. Fear of regret therefore pushes you into doing precisely the opposite of what you should be doing to achieve success in the markets. |

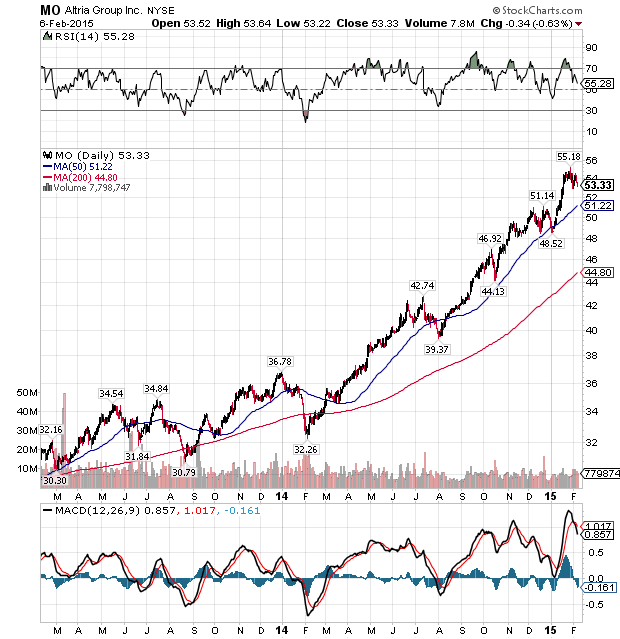

| According to Robert Shiller, "there is a human tendency to feel the pain of regret at having made errors, even small errors, not putting such errors into a larger perspective." So, for instance, when a person has suffered through a string of small losses, they instinctively feel the need to retreat from the market. For example, (for illustrative purposes only) see Figure 1. Let's suppose your trading rules are these: * Buy when the stock moves above its 50-day moving average (MA) * Sell when it goes below its 50 day MA. On July 9, 2013 Altria Group Inc. (MO) crosses its 50-day MA on the upside. So you enter the position at $34. However, on July 23rd, it falls below its 50-day MA. Your rules say you should get out of the position, so you exit at $32. On September 11th, it rises above its 50-day MA and you reenter the position at $33. On October 1st, it again dips below its 50-day MA. You get out of the position again at $32.60. You reenter the position on the gap up on October 10th at $33. But you exit again on January 14, 2014 at $35 when again the stock dips below its 50-day MA. Even though what you have done so far is excellent trading in terms of having the discipline to scrupulously follow your rules, fear of regret can lead you to magnify the pain of constantly getting whipsawed out of the position. And so when on March 4, 2014, your rules say you should get back into the position, you are reluctant to because you fear the possibility of another whipsaw. You anticipate the pain of regret you will experience if you have to take another loss. You don't get back in and this time price surges to above $40 before it dips back under its 50-day MA. |

|

| Figure 1. The Fear Of Regret. Here you see an example of how you may have to take several small losses before we hit the big payoff. |

| Graphic provided by: StockCharts.com. |

| |

| As the example in Figure 1 illustrates, it is often at times like these when the best course of action might be to wade back into the market and take an aggressive position. To be successful we need to cultivate one of the behaviors of venture capitalists who are willing to take many small losses for the big payoff. Having a healthy fear of losses is fine, unless that fear prevents us from making the very decisions we need to be able to make in order to achieve financial success as an investor. |

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

| E-mail address: | stellaosoba@gmail.com |

Click here for more information about our publications!

Comments

Date: 04/02/15Rank: 4Comment: Consistent with many things I read

To be successful we need to cultivate one of the behaviors of venture capitalists who are willing to take many small losses for the big payoff.

Application is a bit more difficult.

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor