HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

Up by more than 91% since February 2014, shares of Kroger Co. are flashing numerous warning signs that a correction is approaching soon.

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

CYCLES

Kroger Co: 20-Week Cycle High Approaching

01/27/15 05:29:59 PMby Donald W. Pendergast, Jr.

Up by more than 91% since February 2014, shares of Kroger Co. are flashing numerous warning signs that a correction is approaching soon.

Position: N/A

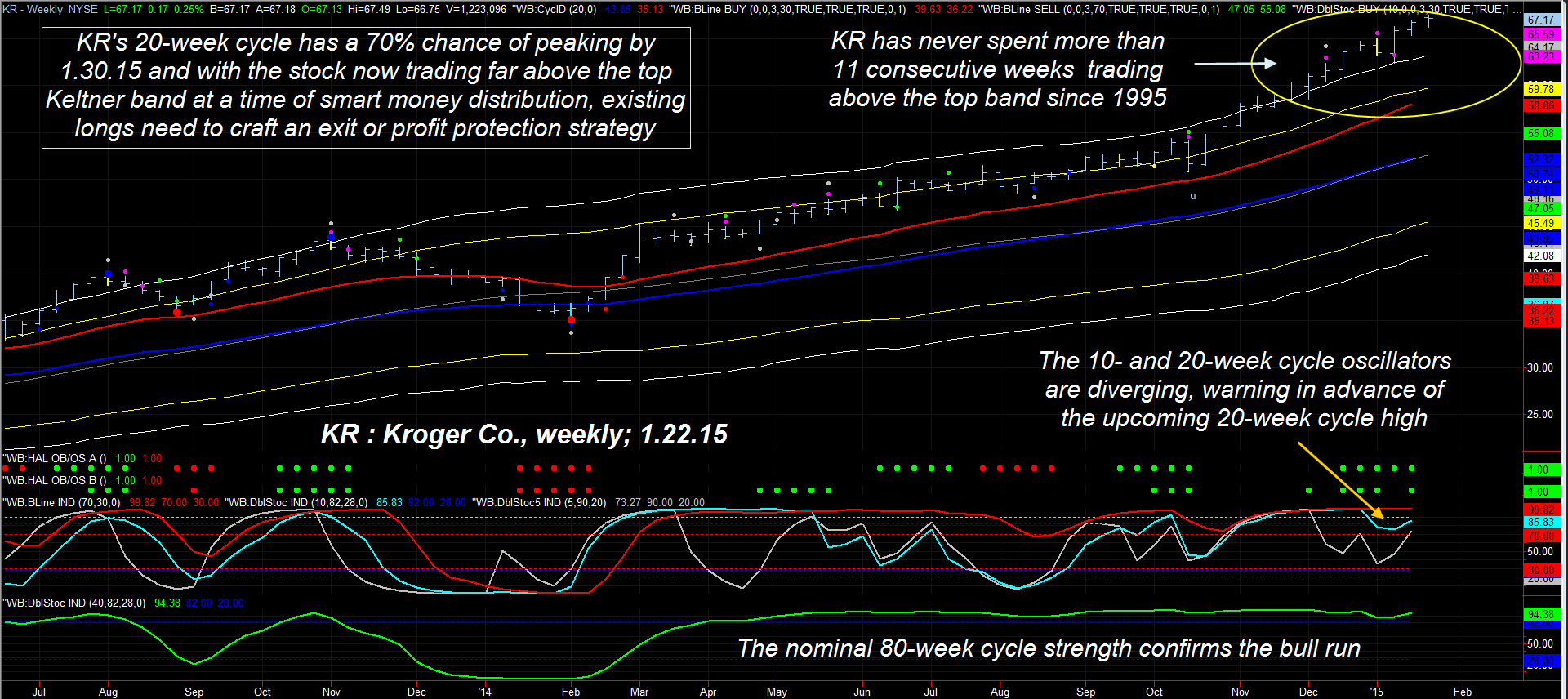

| Before, during, and after the so-called "great recession" of 2008-2012, one thing remained a constant — people still need to buy groceries. For Cincinnati-based Kroger Co. (KR), there simply was no recession at all as the company kept expanding into new markets even though its arch rival Wal-Mart Stores (WMT) proved to be a formidable competitor. The company's share price has nearly doubled in the past year and its daily and weekly charts all look super bullish — at first glance — but savvy technicians and the "smart money" movers and shakers can already see that this current bull run in KR is running on borrowed time. Here's a look at the reasons why this is so, using KR's weekly cycles chart (Figure 1). |

|

| Figure 1. Weekly Cycles. Kroger Co. (KR) is up by more than 90% since early 2014, but is fast approaching a correction in the first quarter of 2015. |

| Graphic provided by: TradeStation. |

| Graphic provided by: ProfitTrader7 from www.walterbressert.com. |

| |

| On February 7, 2014 KR bottomed simultaneously on its 10-, 20-, 40-, and 80-week price cycles; as is most often the case in a quadruple cycle agreement like this, a powerful multi-quarter rally was birthed; this rally has so far been good for open gains of better than 90% in only 50 weeks, making KR one of the best 52-week performers in the S&P 500 index (.SPX, SPY). But this gravy train ride in this grocery kingpin's stock appears to be running on fumes now: 1. KR has never made more than 11 consecutive weekly closes above the extreme upper Keltner band at any time since January 1995; the stock is currently on track to make its tenth sequential weekly close above the band (on January 23, 2015). 2. Daily and weekly money flow histograms (not shown) confirm that the smart money (mutual funds, hedge, and pension funds) has been distributing their shares of KR to the "dumb money" since October 2014. 3. The cycle timing algorithm within the ProfitTrader 7 software (TradeStation version) now confirms that the dominant 20-week cycle in KR has a 70% chance of topping by January 30, 2015 and only a 30% chance of topping thereafter. 4. The 10- and 20-week cycle oscillators are both confirming bearish price/momentum divergences. 5. The HAL OB (overbought) indicator (green dots) is also calling for a 20-week cycle high soon. 6. At the very bottom of the chart, the 80-bar cycle oscillator is still running close to its upper limit, confirming the uber-bullish move of the past 12 months; if/when it closes below its upper OB line, look for this massive rally to have completed. |

|

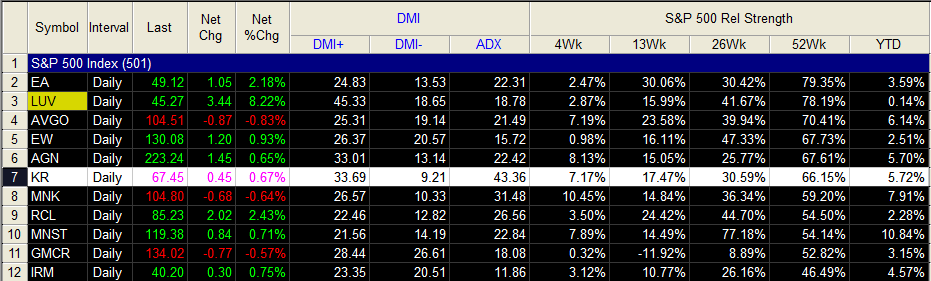

| Figure 2. Relative Performance. KR remains one of the strongest stocks in the S&P 500 index (.SPX. SPY) over the past year. |

| Graphic provided by: TradeStation. |

| Graphic provided by: TradeStation 9.1 RadarScreen. |

| |

| The bottom line here is that KR is due for one of the following, and in short order: A. A cycle high followed by a multimonth trading range. B. A cycle high followed by a proportional correction of 24-38% of the entire run higher since early 2014. C. A cycle high followed by a full-blown trend reversal, one good for a 50-79% correction of the 2014 rally. No one knows which scenario will play out, but these price dynamics are in perfect agreement in calling for a 20-week cycle high in KR during the first quarter of 2015. If you are long KR now, be sure to already have an exit or profit protection strategy ready to deploy at short notice. The .SPX is still trading within a few percent of its all-time highs and could go either way (in a big way) during 2015, so be sure to lock in the open gains you may currently be blessed with. Trade wisely until we meet here again. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog