HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Stella Osoba, CMT

When we want to judge the likelihood of something occurring, it is often the case that we will attempt to recall instances of its occurrence from memory. If retrieval is easy and many instances can be readily retrieved then we are more likely to judge the thing as likely to occur. This is the availability heuristic.

Position: N/A

Stella Osoba, CMT

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

PRINT THIS ARTICLE

PSYCHOLOGY

The Availability Heuristic

01/22/15 02:43:52 PMby Stella Osoba, CMT

When we want to judge the likelihood of something occurring, it is often the case that we will attempt to recall instances of its occurrence from memory. If retrieval is easy and many instances can be readily retrieved then we are more likely to judge the thing as likely to occur. This is the availability heuristic.

Position: N/A

| This heuristic like other heuristics of judgment is insidious because it will often substitute one question for another in our minds. For instance, you wish to determine whether a company is a good stock to buy, instead the question you answer is how easy it is to come up with stories praising the company. When the stock price of a popular company is rising and making new highs, there will be many available stories on why it is such a great company. Recalling those stories will be effortless, therefore it will be easy to come to the conclusion that a company's stock is a good buy when its hype is greatest. |

| The story of the company and the story of the stock price are two different things. For the technician, a good stock has nothing to do with the performance of the company and everything to do with the performance of its stock. Reactions in stock prices happen for all sorts of reasons and can happen for reasons which have nothing to do with the underlying health of the company. |

| Positive feedback loops often happen when increasing media spotlight gets thrown on a stock, which causes further price increases which causes more media attention which causes more price increases and so on. Don't be the one who gets in when those in the know are leaving the party. Remember that the more expensive a stock, the more risky it is likely to be. And the more risky a stock, the more homework you should do before you jump on board. A risky stock might be an excellent buy. Just make sure you buy for the right reasons and ensure that you avoid the availability heuristic. When you ask yourself a question about the stock, pay attention to ensure that you are in fact doing the challenging work of answering the right question and not the easier one that your brain often wants to substitute. Unless we have cultivated the habit of learned self awareness, this can often go unnoticed. |

|

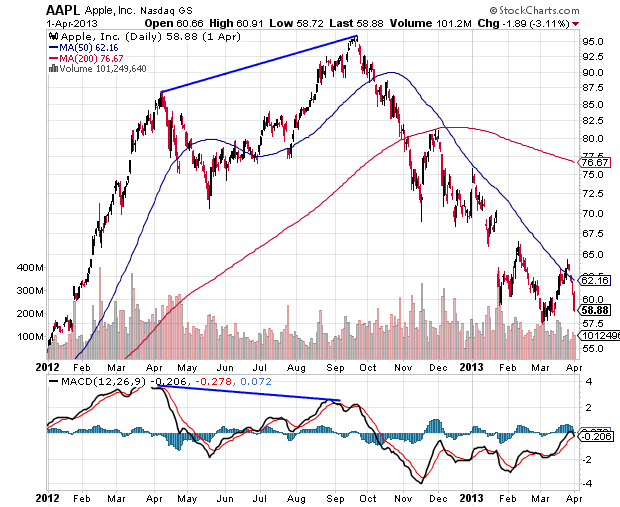

| Figure 1. Divergence Between Price And Indicator. Although Apple, Inc stock (AAPL) was making new highs in August/September 2012, there was a significant divergence between price and the moving average convergence/divergence (MACD) indicator. |

| Graphic provided by: StockCharts.com. |

| |

| For example, in Figure 1, when AAPL was making new highs in August/September 2012, many news outlets carried stories about the rise of the stock price. But the more vigilant observer noticed the significant divergence between the price peaks and indicators like the moving average convergence/divergence (MACD). Such divergences are a signal for caution. Price was making new highs while the MACD was making lower highs which meant it was refusing to confirm the price highs. Spotting this negative divergence would have kept one from getting into the stock at the wrong time. But remember, a negative divergence is only a signal to pay close attention, not a signal to take action. Look for confirmation in price action itself before taking action. Such confirmation could be in the way of price breaking a trend line or price falling below a moving average, or some other such confirmation which should always come from price action itself and not its indicators. |

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

| E-mail address: | stellaosoba@gmail.com |

Click here for more information about our publications!

Comments

Date: 01/29/15Rank: 5Comment:

|

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog