HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Stella Osoba, CMT

Representativeness heuristic is one of the many mental shortcuts that we often use to distill information and arrive at answers when faced with conditions of uncertainty. We judge something as more likely to happen because it is representative of its class. But that something is representative of a particular class, does not make it more likely to happen.

Position: N/A

Stella Osoba, CMT

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

PRINT THIS ARTICLE

PSYCHOLOGY

Representativeness Heuristic

01/15/15 04:59:50 PMby Stella Osoba, CMT

Representativeness heuristic is one of the many mental shortcuts that we often use to distill information and arrive at answers when faced with conditions of uncertainty. We judge something as more likely to happen because it is representative of its class. But that something is representative of a particular class, does not make it more likely to happen.

Position: N/A

| The representativeness heuristic has a particular application in selecting financial investments. It is often the case that people will judge a company based on fundamental information such as the quality of its earnings, earnings growth, quality of leadership and management, competitive advantage, etc. and then extrapolate from this information a projection about the performance of the short- to medium-term share price of the company. |

| If we can construct a plausible scenario about a company including its earnings, etc., this does not make it more probable that the company's stock will outperform. When we are judging different stocks, it is often the case that we are predisposed to believe, due to the representative bias that the more coherent and plausible the story is, the more probable the scenario. The stories we construct may make an event sound more plausible, but just because an event is plausible, does not make it more probable, even though this cognitive bias means that our minds are wired to think this way. |

| In training our minds to correctly judge stocks based on technical data, we need to remember that plausibility and probability are not interchangeable even when our mental biases want us to think this way. While we are predisposed to like coherent stories, our brains are not wired to automatically look at statistics and probabilities in reaching decisions. Technical analysis is useful because it allows us to pay less attention to the story of the stock and more to its actual performance. |

|

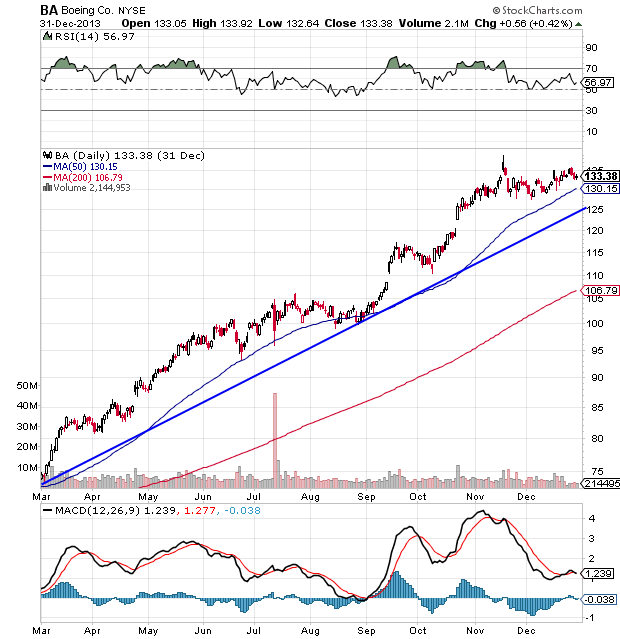

| Figure 1. Why The Uptrend? If you got into Boeing Co. stock (BA) at the beginning of 2013 as the stock broke out of a range bound market, you would have been able to ride the stock during its uptrend. |

| Graphic provided by: StockCharts.com. |

| |

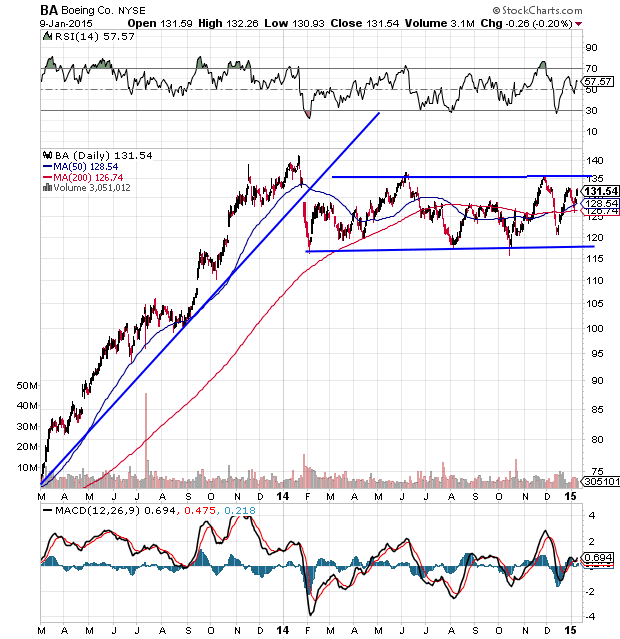

| For instance, if we were able to construct a cohesive story about BA (Figure 1) through its fundamental data, to explain why its stock was in an uptrend in 2013, we might look more favorably towards the stock and believe that the up trend will continue until at least the fundamental reasons we have constructed for its performance change. But knowledge that a stock that is trending will eventually be mean reverting can alert us to constantly look for evidence that the trend is ending, not in the fundamental data but in the charts. And knowing that trends do not last forever will protect us from the often all consuming temptation of entering a trend too late when the story of the company is likely to be most impressive (Figure 2). |

|

| Figure 2. Uptrends Don't Last Forever. But one year later, the uptrend had ended and BA spent the whole of 2014 trapped in a range bound channel. |

| Graphic provided by: StockCharts.com. |

| |

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

| E-mail address: | stellaosoba@gmail.com |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor