HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

Now that the Dow 30 industrials have cleared 18,000, how much higher can it run?

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

CYCLES

20-Week Cycle Still Bullish In Diamonds?

01/07/15 03:32:26 PMby Donald W. Pendergast, Jr.

Now that the Dow 30 industrials have cleared 18,000, how much higher can it run?

Position: N/A

| The epic bull market that launched in the wake of an equally epic bear market (November 2007 to March 2009) has seen the Dow 30 industrials (DIA, .DJX) rise by 180% over the past 70 months; though the numerous 'quantitative easing' (QE) interventions by the central bankers are no doubt responsible for the majority of the stupendous percentage gains seen thus far, it was inevitable — from a purely price cycle viewpoint — that a multiyear rally was due after the carnage caused by the housing bubble/ mortgage/derivatives meltdowns in the latter part of the 2000s. Here's a closer look at the monthly cycle dynamics for DIA, along with some ideas as to what may happen as 2015 gets underway. |

|

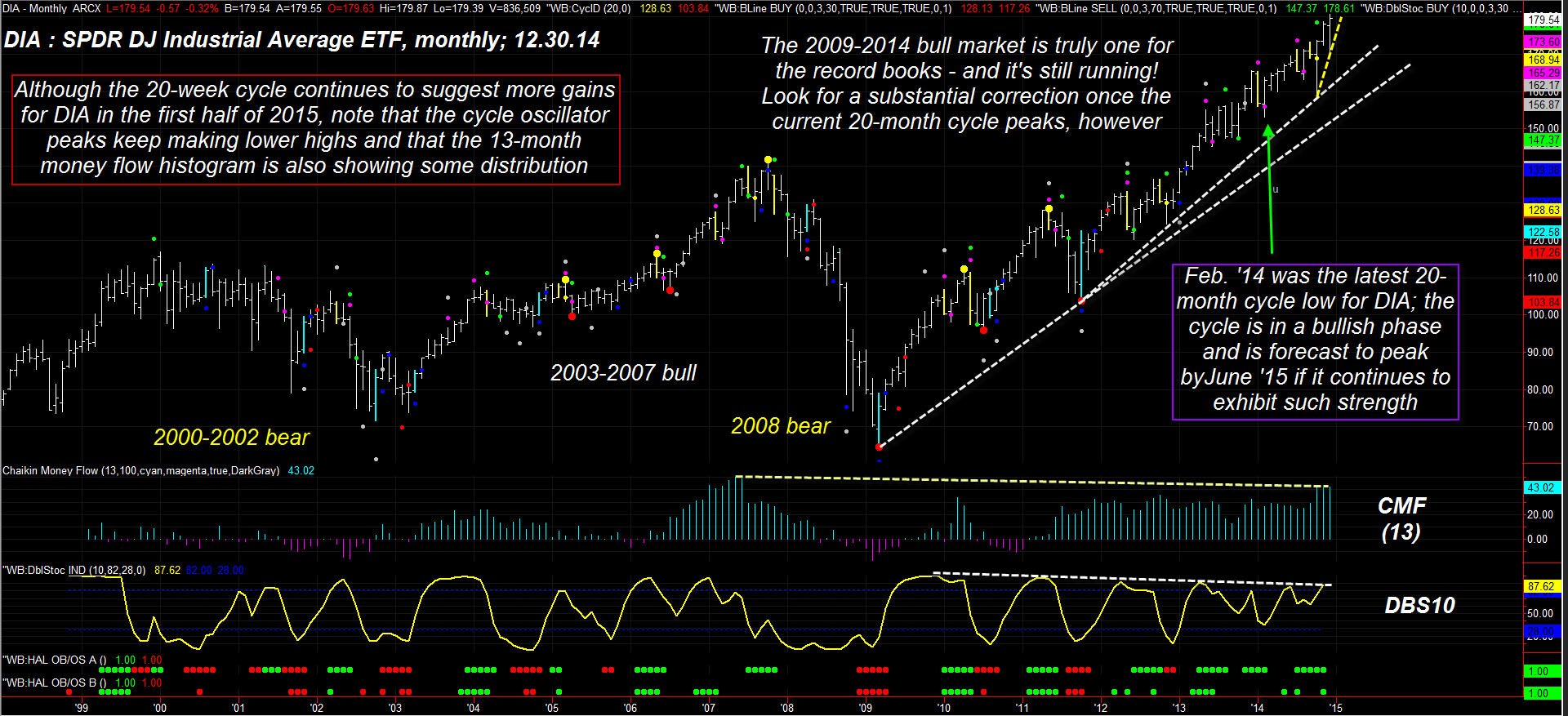

| Figure 1. Price Cycles in the Diamonds. The SPDR Dow Jones Industiral Average ETF Trust (DIA) is in the midst of its most powerful bull run in a generation (or two); cyclic and money flow indicators are warning of a steady, albeit minor loss in upside momentum, despite the accelerating trend lines. |

| Graphic provided by: TradeStation. |

| Graphic provided by: ProfitTrader7 from www.walterbressert.com. |

| |

| The dominant price cycle in the monthly chart of the SPDR Dow Jones Industrial Average ETF Trust (DIA) in Figure 1 is currently running at 20 bars from trough to trough; the most recent cycle low was made in February 2014 and although the sharp 'V' reversal seen in September/October 2014 might seem to be the dominant cycle low, in truth it was more of a random market event caused by the Ebola scare, with the rally from the low being so rapid that the February 2014 low remains the starting point for the 20-bar cycle. That said, this cycle is only 10 bars (months) old and is definitely of the 'bull' rather than 'bear' variety; here are the essentials to be aware of as 2015 gets underway: 1. The algorithm within the ProfitTrader 7 software is suggesting that DIA's cycle has a 70% probability of peaking before June 30, 2015 and a 30% probability of topping even later. This cycle top window is based on the assumption that the 20-bar cycle remains in effect; cycle traders know that an average 20-bar cycle can easily contract to 15 bars or even expand to cover 25 bars, depending on a variety of factors. 2. Note the three trend lines and that DIA's uptrend is in a near-term acceleration mode, thus validating such a bullish cycle projection. 3. In contrast, witness the steadily declining peaks of the yellow cycle oscillator (DBS10) since May 2011; this confirms a gradual loss of upside momentum as each subsequent cyclic up thrust becomes less able to push prices as hard as the previous one. 4. The 13-month Chaikin money flow histogram (CMF)(13), although still very robust, is at a lower level than that seen at its previous high of June 2007. This confirms that the "smart money" crowd is becoming more cautious as this record bull run continues to grind higher. |

|

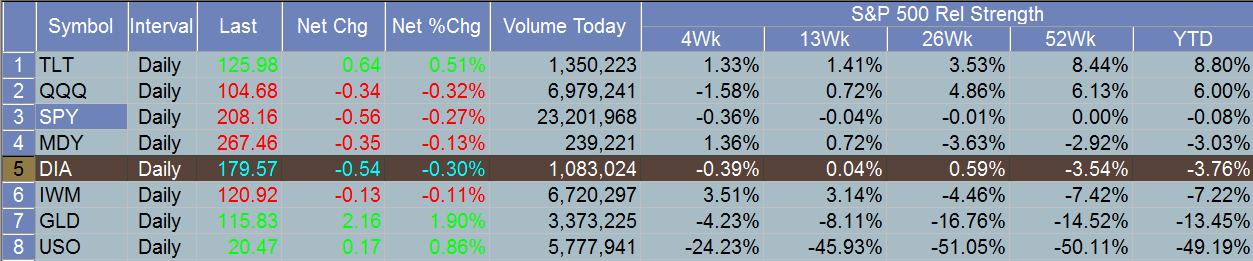

| Figure 2. Relative Strength. The DIA's comparative relative strength ranking is somewhere in the middle range of the eight major ETFs depicted here. |

| Graphic provided by: TradeStation. |

| Graphic provided by: TradeStation 9.1 RadarScreen. |

| |

| Wise traders and investors will continue to monitor the cycles in DIA and be watching for significant breaks of any of the three trend lines shown on the monthly chart. Making precise predictions of turning dates/prices in DIA of any other market is a fool's game, but it always pays to have some sort of proven early warning system to help guide you and your trade management regimen. Using price cycle, money flow, momentum and trend line analysis can make that job much, much easier. Trade wisely until we meet again here in the New Year and may God be especially good to all the readers and their families in 2015 and beyond. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

|

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog