HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

This stock is probably not on your radar screen yet. Maybe it should be.

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

MOMENTUM

Edward Life Sciences: Pumping Into The Stratosphere?

12/09/14 03:34:12 PMby Matt Blackman

This stock is probably not on your radar screen yet. Maybe it should be.

Position: N/A

| Edward Life Sciences (EW), a provider of heart valve products and hemodynamic monitoring systems, has been performing well since the beginning of 2014. Since early January the stock price has doubled and momentum is showing no signs of abating anytime soon. As we see in Figure 1, the stock has moved in stair-step fashion exhibiting gaps as it's moved through major resistance levels. And since the beginning of the year it has been a powerful relative performer, consistently outperforming the S&P 500 (see middle sub-graph). |

|

| Figure 1. Stair-Step Move. On this daily chart, you see the strong technicals and fundamentals with the latest Edward Life Sciences earnings per share growth above 100% and annual revenue growth above 10%. |

| Graphic provided by: TC2000.com. |

| |

| Fundamentally, the company looks sound with impressive annual earnings and revenue growth as we see in Figure 1, and posting stronger than expected Q3 numbers in its latest report of October 23, 2014. Yet the company is still not expensive given its strong momentum with a P/E under 20 times earnings. |

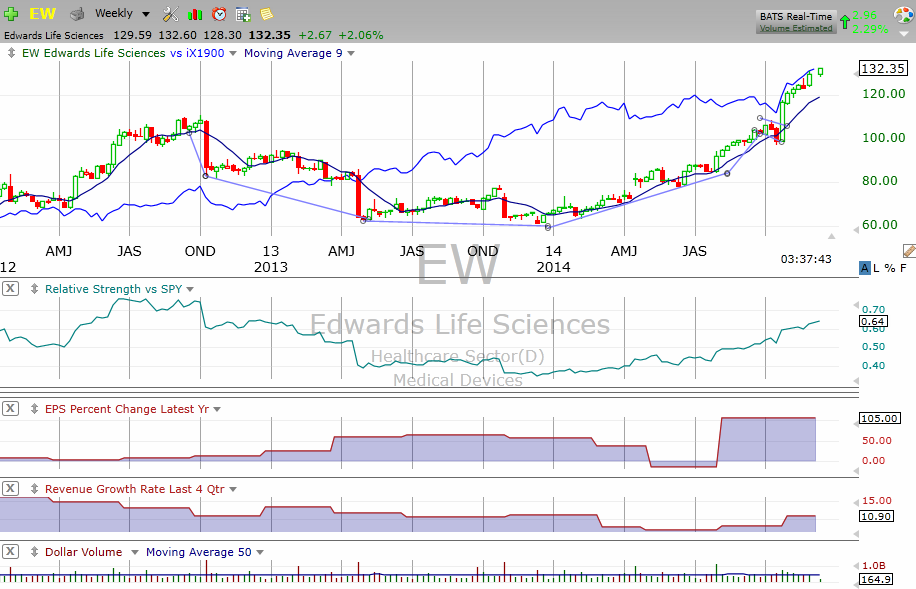

| As we see in Figure 2, it briefly underperformed the medical devices industry in which it resides but since 2014 has outperformed other stocks in the group. Also note the interesting cup with handle chart pattern it posted with a brief handle appearing and the lip of the cup around $108. It broke out of handle support in late October and hasn't looked back putting in a series of 52 week highs in the process (which is how I discovered the stock). |

|

| Figure 2. Relative Performance. On this weekly chart you see the Edward Life Sciences (EW) over the last 28 months together with its industry (medical devices) in blue, accelerating strength relative to the SPY and some key fundamentals. |

| Graphic provided by: TC2000.com. |

| |

| The only thing (other than some negative company news) that could hold this stock back would be overall weakness in the market. But if the Santa rally arrives on time into year-end, this stock has the potential to make it to $150 and beyond by the mid to end of January 2015. |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

| Company: | TradeSystemGuru.com |

| Address: | Box 2589 |

| Garibaldi Highlands, BC Canada | |

| Phone # for sales: | 604-898-9069 |

| Fax: | 604-898-9069 |

| Website: | www.tradesystemguru.com |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

|

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog