HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

It's been flying passengers since 2007 but on November 14, 2014 the company, founded by entrepreneur Sir Richard Branson, began trading on the NASDAQ.

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

RSI

Virgin America Airlines Shares Take To The Air

11/20/14 05:53:28 PMby Matt Blackman

It's been flying passengers since 2007 but on November 14, 2014 the company, founded by entrepreneur Sir Richard Branson, began trading on the NASDAQ.

Position: N/A

| Virgin America (VA) began trading on the Nasdaq November 14, 2014 offering the public 13,337,587 shares of common stock at an IPO price of $23/share. The company, based in San Francisco, began flying passengers in August 2007. According to the company's website, it flies to and from a number of destinations in the US and Mexico including Boston, Cancun, Chicago, Dallas, Fort Lauderdale, Las Vegas, Los Angeles and New York. The IPO was popular with investors, which opened at $27.00 and ended its first trading day at $28.85. By the close of its second trading day, the stock had gained another 13.3% to close at $32.68 (Figure 1). |

|

| Figure 1. First Two Days. Here you see a 15-minute chart of Virgin America (VA) showing the strong performance of the stock in its first two days of trading. |

| Graphic provided by: TC2000.com. |

| |

| Virgin America reported its preliminary operating figures for October 2014 on November 12 which showed that passenger traffic decreased 1.1% versus the same month the year before and that its load factor of 82% was up 1.3% from October 2013. However, the number of onboard passengers dropped 3.1%, according to a report in Comtex. |

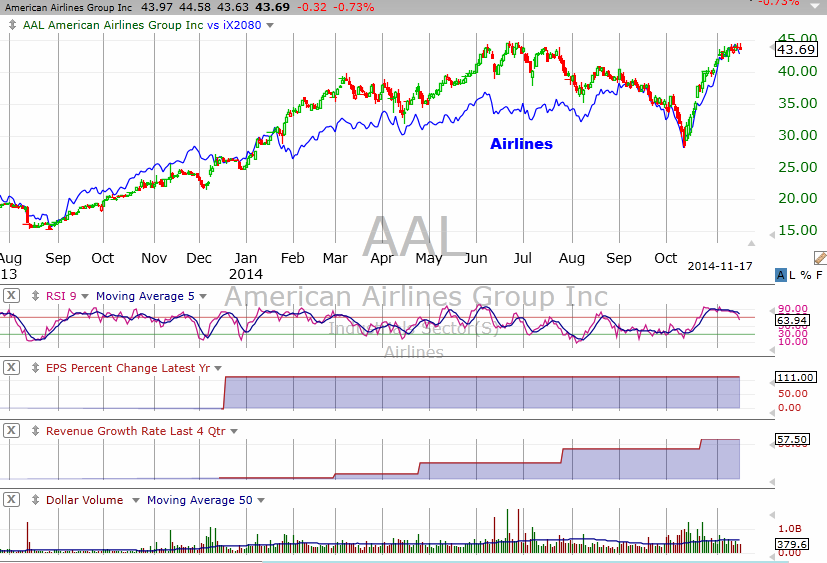

| As you see in the chart of American Airlines Group, Inc. (AAL) in Figure 2, the industry has been relatively strong bolstered by falling fuel prices. Note the rising earnings per share and revenue growth in sub-graphs 3 and 4 on the chart. |

|

| Figure 2. Industry Performance. On this daily chart of American Airlines and the airline industry (blue) you see the growth in earnings per share and quarterly revenues. |

| Graphic provided by: TC2000.com. |

| |

| The question now is, how high is too high for this stock? It's already jumped more than 40% from its IPO price in just two days and that was on mixed passenger traffic. As we see from the RSI in Figure 1, with a reading of 92.31 the stock is oversold. Investors and traders will be looking for an opportunity to buy in on any weakness, especially given Sir Richard's ability to compete against rivals. But until we get a clearer picture of its valuation and revenue growth potential, it will be a difficult company to price for the fundamental analysts and investors in the crowd. |

| Until then, it will be a short-term traders' game! |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

| Company: | TradeSystemGuru.com |

| Address: | Box 2589 |

| Garibaldi Highlands, BC Canada | |

| Phone # for sales: | 604-898-9069 |

| Fax: | 604-898-9069 |

| Website: | www.tradesystemguru.com |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog