HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

Shares of Apple, Inc. have been in a major rally since June 2013, but may now be near an important turning point.

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

FIBONACCI

AAPL: Close To Pattern Completion?

09/25/14 05:23:27 PMby Donald W. Pendergast, Jr.

Shares of Apple, Inc. have been in a major rally since June 2013, but may now be near an important turning point.

Position: N/A

| Up as much as 86.85% between late June 2013 and early September 2014, shares of Apple, Inc. (AAPL) are the focus of everyone from retail investors to multi-million dollar hedge fund managers, with all of them seeking ways to get a piece of the "Apple pie" before opportunity slips away and the stock goes into another normal corrective phase. Presently, AAPL is at or very near to completion of a key AB=CD Fibonacci swing pattern, one that swing and trend traders need to be aware of; there is also a potential for one further bullish drive higher in APPL, and we'll look at both scenarios on its weekly chart now (Figure 1). |

|

| Figure 1. Apple Inc. (AAPL) is pausing just shy of the 127% Fibonacci swing CD projection level at $104.40; existing longs should protect open gains and or begin scaling out, waiting for a pullback toward the low $90.00 range to re-enter. |

| Graphic provided by: TradeStation. |

| Graphic provided by: Elite Trader Indicators by Fibozachi.com. |

| |

| No two patterns repeat in exactly the same way in the stock market; in APPL's case, the historic run-up to the September 2013 high of 100.72 occurred as part of an investment mania of sorts that had driven the stock far beyond its intrinsic value (rate of earnings growth increase); after the last investor bought at 100.72 on September 21, 2013, APPL proceeded to plummet by 45.38% over the next seven months, with only a couple of tradable weekly bounces to be seen on the way toward its multicycle low of 55.01. As bad as the selloff was, the stock was still in great shape fundamentally, and the "smart money" wasted little time in loading up the truck in anticipation of a new bullish phase ahead. Money flow had stabilized and begun to improve by the time a double bottom was in place (June 2013 at point A) and the first bullish drive was underway, lasting until December 2013 (point B). The stock had cleared its 89-week simple moving average (SMA) and then dipped below it as swing BC was completed in January 2014 at 70.51. To experienced traders, this 38% pullback to point C after such a strong rally by swing AB was the "let's buy now" signal, and it also set up the possibility of a strong move higher for a forthcoming swing CD. Basic Fibonacci math allows for calculating possible swing termination points ahead of time (Fibonacci-based projections being leading rather than lagging indicators), as follows: 1. AB = CD @ 97.16 2 1.27AB = CD @ 104.40 3. 1.62AB = CD @ 113.58 4. 2.00AB = CD @ 123.81 Obviously, the 100% target has already been exceeded, but notice how APPL has been held back by the 127% projection level at 104.40; the stock has failed to make a weekly close above this area and is now churning before deciding on a swing direction. While this is in no way a short-selling signal, it is a heads up for existing swing/trend traders to protect their long positions and/or take some open gains off the table. That the SpectraTrader oscillator (bottom of chart) is now near its historical overbought zone is another warning for APPL longs to protect open gains. Conversely, the 34-week Chaikin Money Flow histogram (CMF)(34) is at its highest reading since October 2010 and keeps grinding higher; this suggests that the "smart money" are not yet actively dumping their APPL shares — yet. Furthermore, the 89-week simple moving average (SMA) keeps moving higher; this is a lagging indicator as are all moving averages, so it will always be rising even as — and for weeks after — the ultimate high is made. |

|

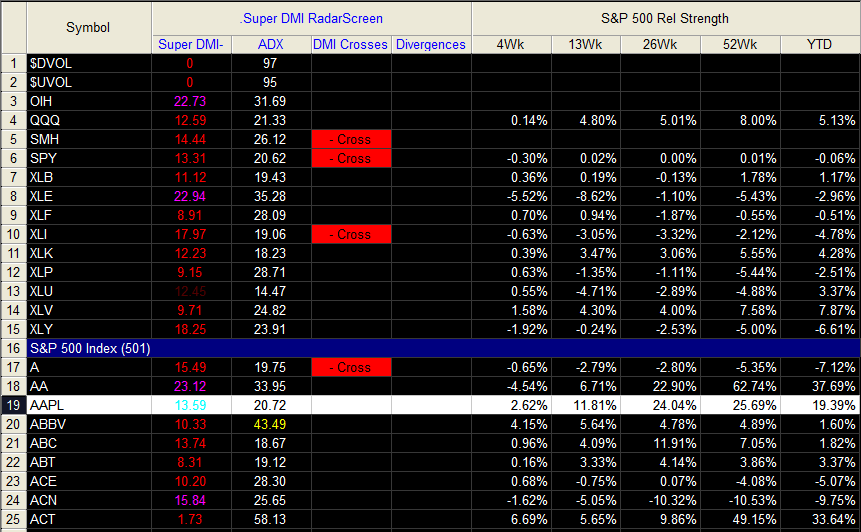

| Figure 2. AAPL continues to outperform the S&P 500 index (SPY, .SPX) over the past four- and 13-week periods. |

| Graphic provided by: TradeStation. |

| Graphic provided by: TradeStation RadarScreen. |

| |

| There is also a potential to see a bullish 'three drives' pattern develop, particularly if APPL goes into corrective mode for a month or two and then begins to rally back up past 104.40; this sets up a high probability surge to complete the pattern near the Fib 162% projection at 113.50 sometime in the first quarter of 2015. However, if a near-term correction takes APPL below 86.50, the three drives scenario becomes essentially void, and the possibility of a major ABC corrective pattern becomes the favored scenario. Keep close watch on the 104.40 level in APPL; once exceeded on a weekly close, a move toward 113.58 becomes likely, but only after a correction toward the lower $90.00 range is completed. But if 86.50 is breached to the downside, a larger correction may be in the wind. Trade wisely until we meet here again. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog