HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

Sometimes one of the leaders in a market starts showing signs of trouble. What does that imply going forward?

Position: N/A

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

AutoZone At The Tipping Point

09/18/14 06:36:41 PMby Billy Williams

Sometimes one of the leaders in a market starts showing signs of trouble. What does that imply going forward?

Position: N/A

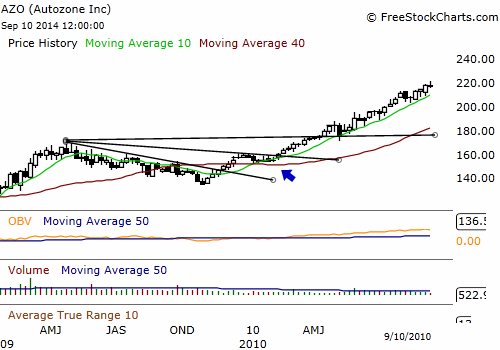

| The market's march upward has hardly missed a beat despite warnings that a crash is coming. The forecasters may be right eventually but now the smart play is to hunt for longs in the strongest segments of the market. Autozone, Inc. (AZO) is a reliable stock leader but it is showing signs of trouble that may signal that a short is in this stock's future. AZO has been a stock trader's dream for the better part of the last four years where it traded erratically prior to bottoming in November of 2009 and offered up three opportunities to go long in its stock. This was confirmed in the beginning of 2010 as the weekly chart's 10-week moving average crossed up through its 40-week moving average and signaled a "death cross" that marked a change in the trend. This moving average confirmation signaled a change in the trend as the bulls took control and a rally took place from this point. |

|

| Figure 1. AZO pulled back for a time but then resumed its long-term trend. As it began its rise, it offered several opportunities to go long. |

| Graphic provided by: www.freestockcharts.com. |

| |

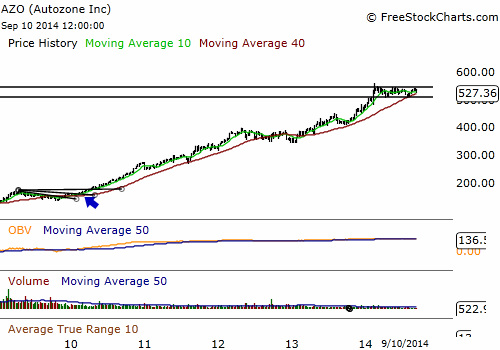

| Even it you had entered late as AZO traded above its previous price high of $169, the stock went on to trade as high as $561 before settling into a trading range. Its in this new period of price contraction that AZO finds itself today after trading between support at $511 and resistance at $546. For the last nine months, AZO has been in this range and formed a flat base pattern which has also acted as a base pattern for a potential rally. But there are signs of weakness in the stock's technical action that give doubt as to whether the stock can successfully mount such a rally. Though both support and resistance have held up to this point, the stock has failed to touch resistance in the three attempts at a rally up to resistance. In fact, each successive rally has formed a marginally lower price high with each attempt. With price refusing to tighten up toward the resistance point, a breakout seems unlikely unless there is a huge spike in volume which leads to another problem. |

|

| Figure 2. AZO has established its position as a stock leader. It outperformed the market by tripling in price in just a few years. |

| Graphic provided by: www.freestockcharts.com. |

| |

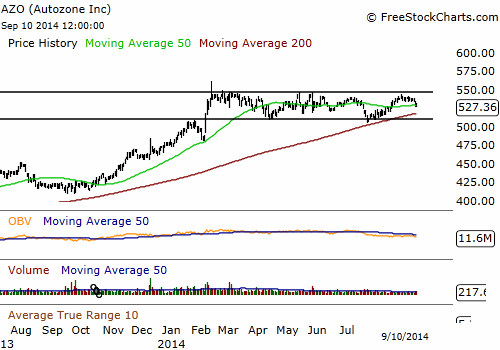

| Volume has dropped off in the last few weeks, which is not unusual for a high-performing stock trading up near its all-time high but it also means institutional sponsorship is falling. The OBV indicator shows that distribution is taking place near the stock's highs when you would want to see the stock being steadily accumulated. Without sufficient volume entering the stock's daily price action, AZO may lack the fuel to help it leave orbit and trade higher. The bottom line is that AZO is at a tipping point where it could go either way. |

|

| Figure 3. In the last nine months, AZO has entered a period of price contraction. Trading near its all-time high, AZO is set to go higher if it can break above its resistance point. |

| Graphic provided by: www.freestockcharts.com. |

| |

| The smart money says to trade it on the side of the bulls since it's well above its 50-day simple moving average (SMA) and 200-day SMA. However, if price falls below support then shorting the stock or buying puts may be in order. That said, if a short position presents itself, you need to wait for the stock to bounce back and then ride the resumption of the downward trend. Shorts tend to move fast so their profit potential is huge but their initial move is volatile and can be all over the place, stopping you out before you get a fair shot at a new downward trend. Almost without exception, however, an initial thrust through support is followed by a bounce back to minor resistance (at the $511 mark in this example) followed by another downward move. This is the meat of the new trend as it plunges lower. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog