HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

Dorchester Minerals (DMLP) is the energy market's best kept secret and it's gathering steam. Don't get left behind.

Position: Buy

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

FLAGS AND PENNANTS

Dorchester Minerals - Tomorrow's Next Big Headline Winner

09/11/14 04:14:21 PMby Billy Williams

Dorchester Minerals (DMLP) is the energy market's best kept secret and it's gathering steam. Don't get left behind.

Position: Buy

| Turn on any financial news network you'll pick up on a pattern of talking about the latest and greatest stock and how now is the time to buy. The problem is that if they're talking about it, then the big move is over and the Johnny-come-lately's are coming in on the tail-end of a price trend that is running out of juice and about to flatline. Apple Computer, Microsoft, even Enron from days-of-scandal gone by were all touted as the next greatest stock that would likely trade even higher. Then, gravity sunk its teeth into the price movement and pulled it back down. The time to look at trading a stock is not when everyone is talking about it or when all the finanical newspapers are writing about it. The time to look for tomorrow's big winner is when the company is still getting its footing and getting ready to enter a bull run. There is one stock in a hot industry that is in high-demand but offers a degree of safety that hardly any other stock in its peer group can match. It's diversified, throws off solid cash flow, and is in a strong trend that is offering a chance to enter into a bull run that has only begun. |

|

| Figure 1. Dorcester Minerals (DMLP) has been hit and miss since the 2008 crash but has recently exploded higher to the point where it is within shooting distance to take out the stock's all-time price high at $36.49. |

| Graphic provided by: www.freestockcharts.com. |

| |

| Dorchester Minerals, L.P. (DMLP) is engaged in the acquisition, ownership, and administration of producing and nonproducing crude oil and natural gas royalty, net profits, and leasehold interests in the United States. DMLP is the energy market's best kept secret. Price has been on a steady trend after busting out of a base pattern that formed during May 2013 and the beginning of 2014. Price found resistance in January 2014 but after a brief pullback, came back to breakout above the $26.28 resistance level. After that, the stock took off and never looked back. |

|

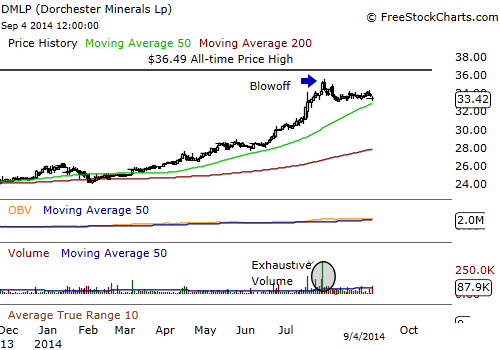

| Figure 2. Since the beginning of 2014, DMLP has rallied and racked up an almost 50% gain before volume spiked and exhausted the stock's advance. Now, the stock looks to be forming a flag pattern just below the all-time price high. Going long on a confirmed pattern trade could put the stock in a strong position to enter a new bull run for a strong return. |

| Graphic provided by: www.freestockcharts.com. |

| |

| On the tail-end of an impressive quarter-to-quarter earnings report, the stock exploded higher and formed a steady series of higher highs and higher lows with hardly a pause in its march to higher ground. Gaining almost 50% since coming off a low in February 2014, DMLP peaked at a recent high of $35.55 after experiencing a blow-off of exhaustive volume. The spike in volume at the peak of the stock's run at this price level suggests that the stock's advance is done for now. But, price appears to be forming a flag pattern, a continuation pattern that reflects a pause in a stock's advance and indicates a good entry point if the trend resumes. Only time will tell. |

| For now, price is ahead of the 50- and 200-day simple moving averages (SMA) and the pullback gives the stock's price action time to get back in balance and avoid extending itself. An extreme extension could cause a snap-back in price and derail the bull run that the stock has worked hard to achieve so far. Time will tell if the trend resumes and if price forms a low-risk setup, like a flag pattern or something similar. At that time, it would be worth your while to consider opening a long position in DMLP. If DMLP's stock holds near its recent high, then it is within shooting distance of the all-time high of $36.49. This pause in price movement near this price level could help DMLP gather steam to break above this resistance point for the first time in years. Such a move could signal a major bull run in a stock whose industry appears to only be getting stronger and could end up being tomorrow's next headline. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog