HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

Oil & gas stocks are on the rise but one stock is breaking higher and getting ready to enter a new bull run.

Position: Buy

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

BOLLINGER BANDS

Delek Logistics Partners In Focus

08/27/14 03:44:59 PMby Billy Williams

Oil & gas stocks are on the rise but one stock is breaking higher and getting ready to enter a new bull run.

Position: Buy

| When searching for stocks with runaway potential there are four factors to consider: accelerated earnings, explosive price moves, new price highs, and high relative strength. These four factors represent the critical success keys to selecting stocks with the highest potential to outperform the market. One stock currently has all four. Delek Logistics Partners (DKL) went public in late 2012 after which it quickly found a following, as energy stocks were being gobbled up by Main Street and Wall Street at the time. Since then, the public's appetite for oil & gas companies has only grown more ravenous and this has helped DKL find upside momentum. |

|

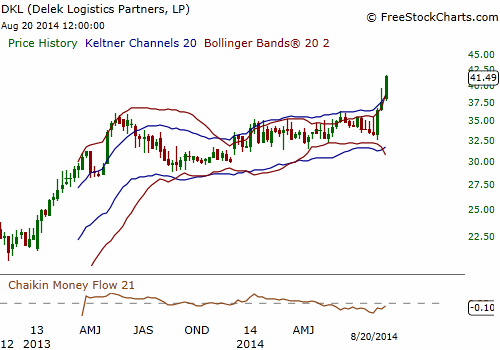

| Figure 1. WEEKLY CHART. DKL was trending higher until May of 2013 when it began to decline and became range bound. A squeeze pattern formed during this time but now it looks like volatility is exploding to the upside. |

| Graphic provided by: www.freestockcharts.com. |

| |

| It's no secret that the energy markets are hot right now and traders who are looking for stocks to outperform the rest of the market can find a fertile field there to select stocks on the rise. The big multi-nationals like Chevron and Shell are big players on a global scale but the real movement is in the smaller cap stocks. These are fast and nimble players that have solid management and impressive price action that is being fueled by explosive earnings. DKL is one stock that I am focusing on as it has recently launched into higher territory and is attracting a following by the major institutions on Wall Street. With a market cap of just over one billion, the stock's institutional sponsorship has expanded to just over 66% giving it much needed price support. In addition, its quarter-over-quarter earnings is a mind-blowing 234.6% which has caused its price to explode recently and break above the $36 resistance point (Figure 1). This bullish breakout on volume that is over 500% of its 50-day average has propelled the stock to an all-time high with a clear shot to go further. |

|

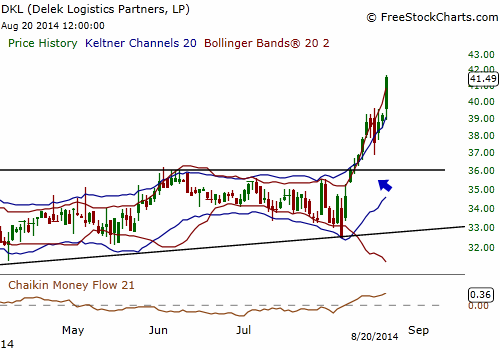

| Figure 2. DAILY CHART. A squeeze setup formed on the daily chart and price broke out above resistance at $36. An entry signal was fired. The combination of bullish factors could signal a bull run that could last for months, if not years. |

| Graphic provided by: www.freestockcharts.com. |

| |

| All the stars are aligning for DKL to runaway from the pack by an impressive margin, but there is more compelling technical action to show that the bull run has legs that could last months, or even years. The stock had a strong run from 2012 to May of 2013 but then stalled and price entered a period of contraction. On its weekly price chart, the Bollinger Bands constricted and began to trade within the Keltner Channels. This is a squeeze setup where volatility falls and price movement is lackluster. Typically, volatility reverts to its mean which means that price is going to snap back at some point and explode. |

| This is signaled when the Bollinger Bands begin to expand again and trade outside the Keltner Channels. This occurred on the weekly and daily chart (Figure 2) leading up to the recent breakout. The confluence of factors could mean that the current bull run could last a long, long time. The recent entry signal was at the breakout point around the $36 level where price broke above resistance and the squeeze fired off a buy signal at the same time. If you missed it, then the only thing to do now is to wait for a secondary entry in the form of a pullback. Wait for price to pullback and then enter on the high of the price bar with the lowest intraday low. Set your stops 7% away from the entry point and risk no more than 1% of your total equity. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

|

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog