HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

Despite suffering a 35% decline in profits and an 11% slide in Q2 2014 revenues, shares of Intuitive Surgical (ISRG) have gapped higher by more than 10%.

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

GAPS

Intuitive Surgical: Bullish Gap Even As Earnings Decline

07/25/14 12:52:04 PMby Donald W. Pendergast, Jr.

Despite suffering a 35% decline in profits and an 11% slide in Q2 2014 revenues, shares of Intuitive Surgical (ISRG) have gapped higher by more than 10%.

Position: N/A

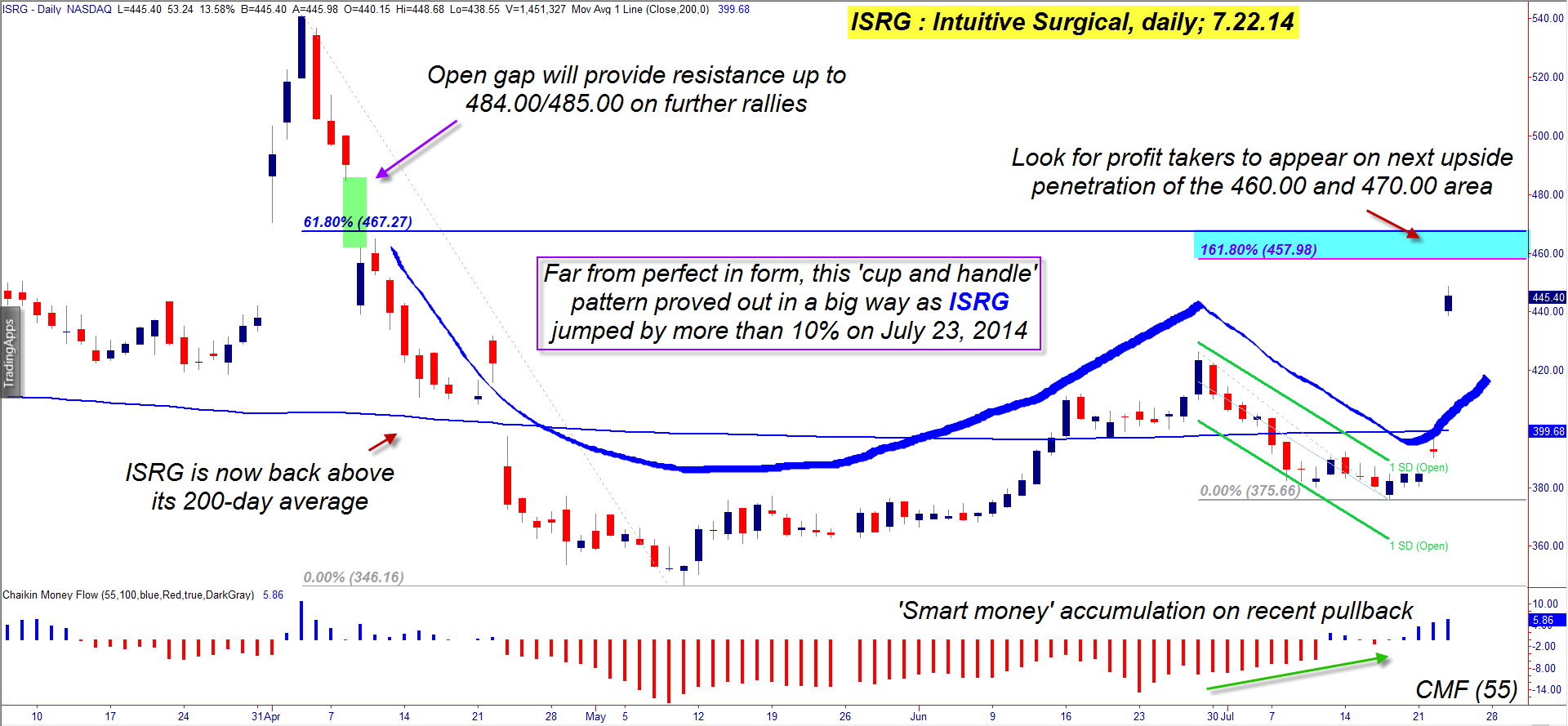

| Generally speaking, a stock's price trend is supposed to mirror its earnings trend, particularly over the long term. However, there are times when logic seems to be ignored and a stock will move sharply higher or lower in complete defiance of its most recent quarterly earnings release. Such is the case with shares of Intuitive Surgical (ISRG); after the close of trading on July 22, 2014 the company announced the following wonderful news: 1. Q2 profits were down by 35% 2. Q2 revenues had declined by 11% Bad news like this should cause a stock to have at least some kind of a negative reaction, especially at the open of the following trading session, right? Not in this case; ISRG bolted higher by 10% at Wednesday's open (July 23, 2014), blasting back above its 200-day average on big volume. Fundamentals matter, but a given stock can do just about anything on a day-to-day basis until the underlying financial strength/weakness of a stock forces a reality check for the share price. Here's a closer look at ISRG on its daily chart (Figure 1). |

|

| Figure 1. Intuitive Surgical (ISRG): A cup & handle pattern with smart money accumulation during the "handle" phase can often be a good predictor of a subsequent bullish breakout. However, no one could have accurately anticipated just how strong this stock's breakout would be. |

| Graphic provided by: TradeStation. |

| |

| ISRG is one of those large-cap NASDAQ 100/S&P 500 (.NDX, .SPX) issues that can make rapid, almost violent price moves, especially around earnings release dates; after peaking on April 3, 2014 at 541.23, it only took five weeks for the stock to plunge 36%, finally finding buyers at 346.46. As it turned out, that major low would eventually be identified as the bottom of a major cup & handle (C&H) formation, one that indirectly helped set the stage for the stock's next big rally — one that is occurring right now. C&H patterns aren't an everyday occurrence, but when you can identify one that has reasonably good proportions, like the one you see here — it normally will signal a low-risk long trade entry once the pattern completes. In this example, the termination of the "handle" portion of the pattern (the breakout from the linear regression channel) might have been a good place to begin scaling in to ISRG; the huge bullish gap confirms that logic, and the big question now for the bulls is how to best capitalize on the potential for even more gains in this stock over the next few weeks (months). Note that the "smart money" (institutional traders) had been accumulating the stock during the pullback within the channel, based on the steady rise in the 55-day Chaikin Money Flow histogram (CMF)(55), so there was a bit of an upside bias already baked into the cake prior to today's price surge. |

|

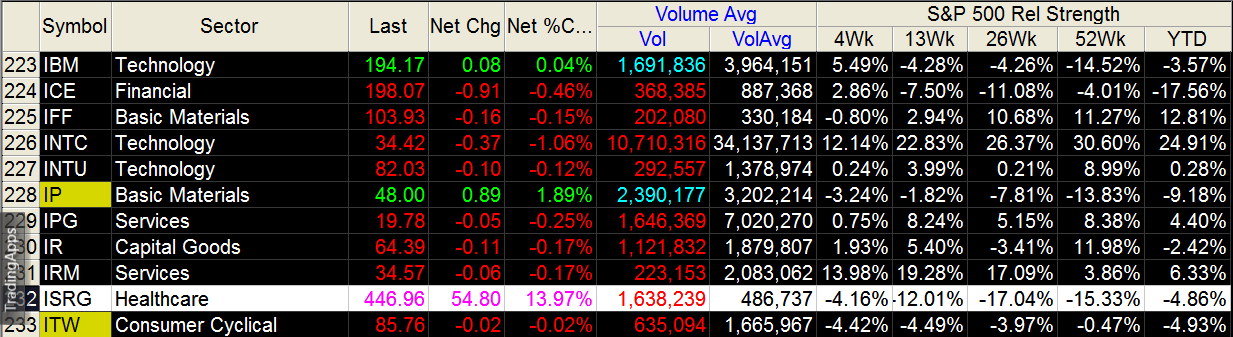

| Figure 2. ISRG's comparative relative strength has been much weaker than the S&P 500 index over the past year; the stock now has a good head start on recouping its recent losses, however, and may start to outperform once again. |

| Graphic provided by: TradeStation. |

| Graphic provided by: TradeStation RadarScreen. |

| |

| A covered call would make a lot of sense here — especially a deep-in-the-money one. However, the bid/ask spread on ISRG options is pathetically wide, making them a poor choice for serious traders; here's a swing trading idea that might instead be used, and it's one that hopes to enter long after a minor pullback from Wednesday's surge higher: 1. Wait to see if the stock pulls back, dipping toward the upper range of the bullish gap; if you see buyers rush back in anywhere near 440.00, that's where you want to consider getting on board, using a 60- or 120-minute trading time frame. 2. Once in the trade, run a three-bar trailing stop of the lows (hourly or two-hour price bar), with an absolute stop loss no lower than 436.00. Then simply hold the trade until stopped out or until the stock manages to reach the next major resistance level, which is between 459.00 and 469.00 (blue zone on chart). That price zone is a formidable barrier, and is based on two distinct Fibonacci levels and the large bearish gap from April 9, 2014; it looks like the best place to take partial, if not all of your gains should ISRG make a fast continuation move to that price range. Keep your account risk at a maximum of about 1% and remember to trade wisely until we meet here again. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Date: 07/29/14Rank: 5Comment:

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog