HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

After enjoying a massive run-up since late 2012, shares of SanDisk (SNDK) now appear to be on the fast track to the lower 80.00 range.

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

REVERSAL

SanDisk: Bearish Trend Reversal

07/22/14 05:18:05 PMby Donald W. Pendergast, Jr.

After enjoying a massive run-up since late 2012, shares of SanDisk (SNDK) now appear to be on the fast track to the lower 80.00 range.

Position: N/A

| SanDisk (SNDK) has been trending well in its daily and weekly time frame charts since coming out of its major 2008 lows; the stock managed to gain 167% between late November 2012 and mid-July 2014 and until a few days ago looked nearly unstoppable as it edged ever higher. But as things would have it, SNDK has suddenly staged its largest weekly point drop (although not on a percentage basis)in more than 14 years and looks primed for even more losses in the weeks ahead. Here's a closer look at SNDK's weekly chart now (Figure 1). |

|

| Figure 1. SanDisk's (SNDK) major bullish run since late '202 has ended with a bang; the stock now faces a high probability decline to at least the 80.00 to 83.00 area before hitting significant support levels. |

| Graphic provided by: TradeStation. |

| |

| Any newer trader needing a visual depiction of the power of a bullish continuation move need look no further than the weekly chart of SNDK; learning to spot strong trends that subsequently go into well-defined consolidation patterns — and then waiting patiently for high probability breakout moves in the direction of the previous trend — can yield positive and profitable results in a trader's account equity. Here are the key dynamics at work on SNDK's weekly graph, all of which confirm that a significant, bearish trend reversal is already underway: 1. Swing CD is roughly 127% the length of swing AB; many trend reversals seem to occur when a trend extends by 127% of the previous significant swing, although other Fibonacci ratios are also important to watch, too. 2. SNDK experienced a powerful 'throw over' of its long running linear regression channel just before it reversed sharply lower. This is a classic Elliott fifth wave termination pattern, one being confirmed before our eyes; this is the stage of a bull market when the "smart money" drives the price up in a final thrust that draws the latecomers in, allowing the big money boys to finally sell out their remaining long positions before they start shorting in full force. 3. Last week's sell off in SNDK is the largest weekly point decline for the stock since April 2000 when the NASDAQ had just begun its epic crash, one that didn't end until late 2002/early 2003. Ah, the bad old days — maybe they are here again after such massive run-ups in so many stocks since early 2009. 4. SNDK also crashed through several support levels on its daily chart (not shown) last week; a daily close beneath 91.80 sets off yet another (secondary) sell signal; the next meaningful support level occurs near 83.00, not far above the current price of the lower regression channel line. So, by several weekly and daily measures of significant reversal price action, SNDK's newest plunge really is confirming that a bearish trend reversal has taken hold. By no means should any daily/weekly based trader even consider putting on new long positions until they see how the stock handles a decline into support between 80.00-83.00. If you're long the stock since late April 2014, you should already be flat SNDK now. |

|

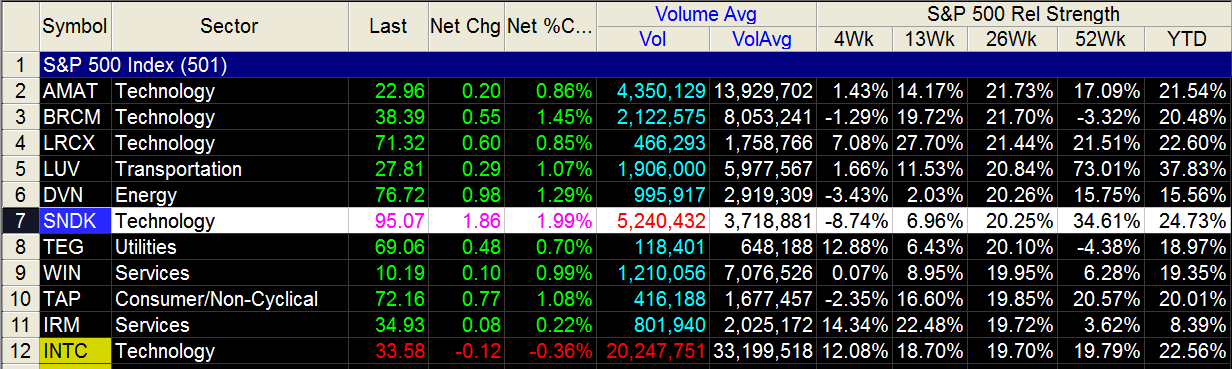

| Figure 2. SNDK is still outperforming the S&P 500 index (.SPX) across three of its longer time periods, but is now underperforming over the past four weeks. |

| Graphic provided by: TradeStation. |

| Graphic provided by: TradeStation RadarScreen. |

| |

| Speculative bears may want to check out this moderate risk long put play for SNDK: 1. On a daily close below 91.80, consider buying the January 2015 SNDK $95.00 put; the bid/ask spread is good and the daily volume is nearly 150 contracts. Open interest is a strong 2,130 contracts. 2. Once long the put, use 100.00 as the stop loss and use 83.00 as your initial profit target; this is a high probability support area, so if you get close to that price, consider taking most if not all of your profits on this trade. By no means allow the put to lose more than half of its value before selling it. Keep your account risk on this trade at 2% or less and remember to trade wisely until we meet here again. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog