HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

It's been a volatile journey for this stock but traders who have been able to hang on have been generously rewarded as it hits a new all-time high.

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

CUP WITH HANDLE

NetFlix Has Broken Through Major Resistance... Again

07/10/14 05:11:12 PMby Matt Blackman

It's been a volatile journey for this stock but traders who have been able to hang on have been generously rewarded as it hits a new all-time high.

Position: N/A

| It's been a roller coaster ride for Netflix (NFLX) over the last two years. The stock peaked during the second week of July 2011 just above $300/share only to roll over and drop to just under $53 little more than a year later during the first week of August 2012. It then mounted another rally to peak just above $458 on March 7, 2014 before dropping once more to a low of $299.50 on March 28, 2014. But then, like it had before, it mounted another challenge that posted a bullish head & shoulders (H&S) pattern at the bottom of a more bullish cup & handle pattern before breaking prior resistance around $455 and in the process put in a new all-time high of $475.87 on July 2, 2014. By July 3, 2014 the stock looked to be building a bull flag (see Figure 1). |

|

| Figure 1. Daily chart of TV streaming company NetFlix Inc. showing the recently completed cup & handle pattern and forming bull flag with strong revenue and earnings per share growth in the last year. |

| Graphic provided by: TC2000.com. |

| |

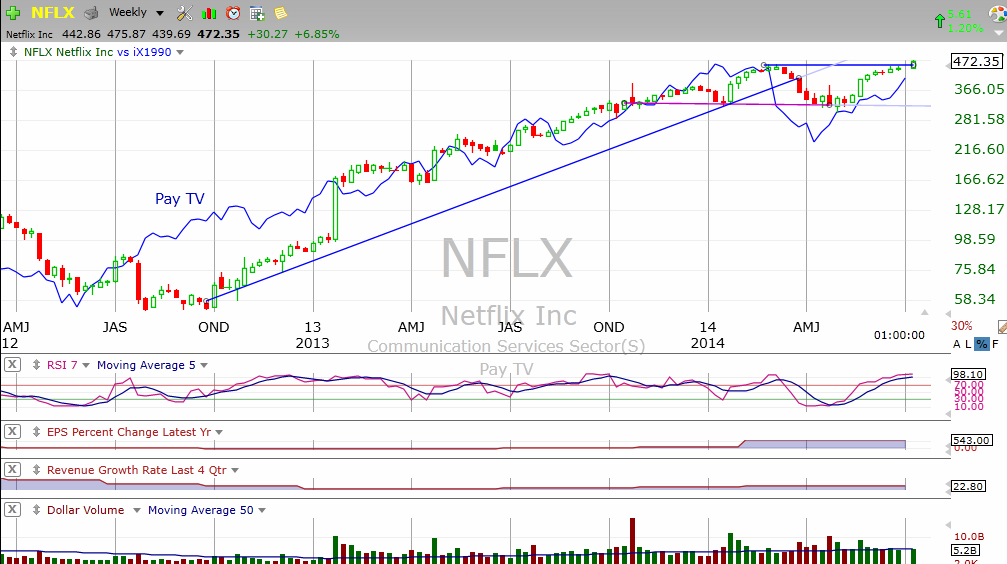

| NFLX has experienced some hiccups along the way which at least in part explain its volatile stock chart, but as of the latest data, the fundamentals look strong with 22.8% revenue growth in the last four quarters and an impressive 1830% growth in earnings per share in the latest quarter. But recent strength has swelled its P/E ratio to a rich 175 times earnings so the stock has clearly gotten ahead of itself on a valuation basis. |

|

| Figure 2. Weekly chart of NetFlix shown together with the Pay TV industry (blue) showing both in strong uptrends. |

| Graphic provided by: TC2000.com. |

| |

| Now we will have to wait to see if the stock can hold this new high and mount another rally. NFLX is scheduled to release earnings July 21, 2014 and given the recent high, it is probably safer to wait till after earnings are released to buy if you don't already have a position. But the risk of waiting could mean missing out on upside action if the market and the stock continue to fight the wall of worry higher. |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

| Company: | TradeSystemGuru.com |

| Address: | Box 2589 |

| Garibaldi Highlands, BC Canada | |

| Phone # for sales: | 604-898-9069 |

| Fax: | 604-898-9069 |

| Website: | www.tradesystemguru.com |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor