HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

Three key factors are driving SHPG higher but one giant technical indicator is indicating the best is yet to come!

Position: Hold

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

TECHNICAL INDICATORS

SHPG Powers Up

06/26/14 03:56:46 PMby Billy Williams

Three key factors are driving SHPG higher but one giant technical indicator is indicating the best is yet to come!

Position: Hold

| Wall Street thrives on big deals and mergers which throw investors into a frenzy like dropping blood into an ocean of sharks. Attractive mergers and acquisitions can multiply the value of the company's stock by combining forces to become a fiercer competitor in its market. Wall Street lives and thrives on such deals at every level of its negotiations from arranging the financing to selling the shares which can jump-start a stock's momentum. For the companies involved, it enhances their ability to acquire more companies to increase their bottom line so it's rare when a company backs away from an offer by a competitor as is the case with Shire PLC (SHPG). But a closer look shows a stock that has more upside potential left to itself but may end up finding a better suitor to buy it or maybe a better offer from the current bidder. Based out of Ireland, SHPG is a bio-pharmaceutical company that is projected to hit around $5.8 billion this next year out of its current pipeline of drugs. In previous years, the company has had an impressive rollout of drugs combined with strong marketing to launch those drugs and carve out an impressive niche in the marketplace crowded with big players such as Johnson & Johnson (J&J). |

|

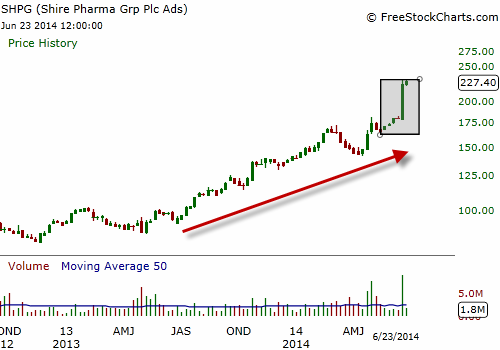

| Figure 1. The long-term trend is firmly under the control of the bulls. Shire Pharma (SHPG) has been making a steady series of higher highs and higher lows in its price action. When should you enter a long position, where should you enter a long position, and why should you enter a long position? |

| Graphic provided by: www.freestockcharts.com. |

| |

| Long-term price action reveals the strength of the company's fundamentals and strategy with a steady succession of higher highs and higher lows (Figure 1). With the exception of being taken down in the 2008 housing market collapse, SHPG managed to recover and regain lost ground caused by the crisis. Afterward, SHPG stayed flat from 2011 to 2013 before managing to enter into a period of expansion again and trader higher. Almost without interruption, the stock has been firmly in the bulls' camp where traders took the stock's price to an all-time high and steadily continued higher from there. It was only during the first quarter of this year that SHPG pulled back substantially. Typically, stocks correct by retracing 20% or greater from their all-time high but SHPG missed it by a few points. This can likely mean that the stock's price action has a lot of relative strength and that buyers are still hot on the stock. |

|

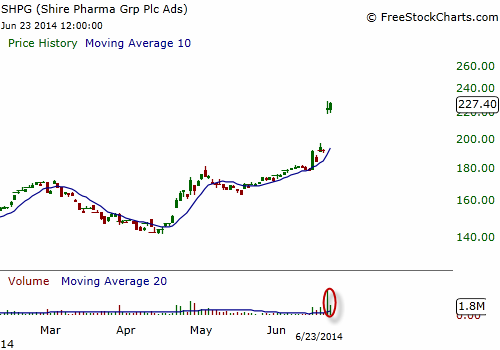

| Figure 2. SHPG has risen just over 40% in six weeks with the latest price spike occurring in a huge 35 price gap a couple of days ago. If SHPG can rise another 16 points in two weeks, then a major bullish indicator is triggered which makes SHPG a contender for a runaway move. |

| Graphic provided by: www.freestockcharts.com. |

| |

| Strong earnings, high relative strength, and a stock that is firmly under control by the bulls can form the basis for the CEO to reject another company's offer to buy it. AbbVie(ABBV) offered $46 billion for SHPG which was rejected by the company's board and CEO. Their view is that the company is worth more than what ABBV was offering. An announcement by SHPG's CEO proclaimed that his company's earnings were likely to double from where they are currently by 2020 to the tune of $10 billion a year. Traders and investors alike responded by driving the stock even higher as SHPG exploded by over 35 points on June 20, 2014. ABBV is rethinking its offer but traders are looking at the price action and deciding what to do next. |

| First, the huge price gap needs to be given time to consolidate. During this time, it will either decline to close the gap below or buyers will rush in, driving SHPG higher and offering new entry opportunities. The really compelling technical criteria is on the weekly chart (Figure 2). SHPG has rallied from a price low of $163 from mid-May to just over $229 recently. If price gains another 16 points by the end of week, then the stock will have a 50% rally within an eight-week time period setting the stage for a runaway move. If price hits that level, then the stock is a candidate for a long-entry once it trades past a previous high already set in motion or once it pulls back at that point and offers a previous high as a pivot point to buy off of. Time will tell, so stay sharp. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor