HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

PSX has been Warren Buffett's darling for the last two years but can it continue? There are signs that the bulls are ready to take this stock higher.

Position: Buy

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

STOCKS

The Future Of PSX

06/20/14 04:31:31 PMby Billy Williams

PSX has been Warren Buffett's darling for the last two years but can it continue? There are signs that the bulls are ready to take this stock higher.

Position: Buy

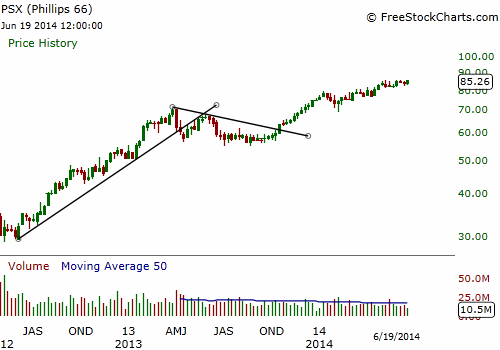

| Phillips Specialty Products (PSX) was a spin-off launched by Conoco Phillips a little over two years ago where the parent company hoped to divest itself of operations that would be able to compete more aggressively on its own while making it possible for it to follow suit. The move was a surprise to most investors and many had doubts to the logic behind the move. However, Warren Buffett once again picked a winning stock. But, Buffett looked to get out of PSX near the end of 2013 leaving many to wonder whether the stock had a future. For traders, PSX appears to be offering a lot of profit opportunities. When PSX was offered to investors, its price action was sluggish and projected weakness. The stock was ill-received and fell in price in the opening days. News of Buffett's involvement in the stock seemed to bolster its price. The stock found support and as investor enthusiasm turned positive on PSX's future, price began to trade higher (Figure 1). Within a month, PSX began to make higher highs and higher lows in its price action revealing that the bulls had taken control of the stock's price movement. PSX went on to double in price in less than a year before entering a correction period. It was at this point that PSX began to enter a contraction phase and formed a trading range. |

|

| Figure 1. PSX started off weak but then went on to double in price in less than a year. In the weekly chart, you can see where the bulls ran the stock up before it entered a correction. But PSX found support and managed to trade higher. |

| Graphic provided by: www.freestockcharts.com. |

| |

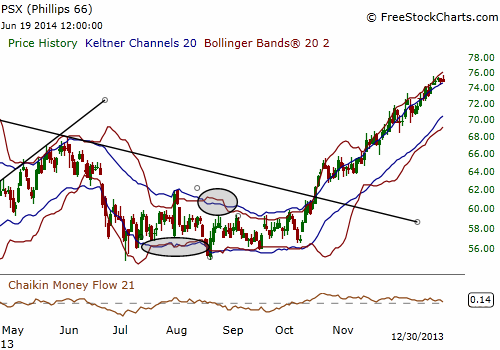

| From March of 2013 to October of that same year, PSX traded from just over $70 a share to its support level at $55 a share. The stock seemed to be going nowhere and left the trading public in doubt as to whether to sit tight or take profits. The price trend seemed to have dried up and left many traders wondering if they should seek greener pastures elsewhere. But, in the summer of 2013, something interesting took place (Figure 2). |

|

| Figure 2. The summer of 2013 showed that PSX entered a squeeze setup that was signaled as the Bollinger Bands traded through the Keltner Channels as PSX broke above its downward trendline the following October. |

| Graphic provided by: www.freestockcharts.com. |

| |

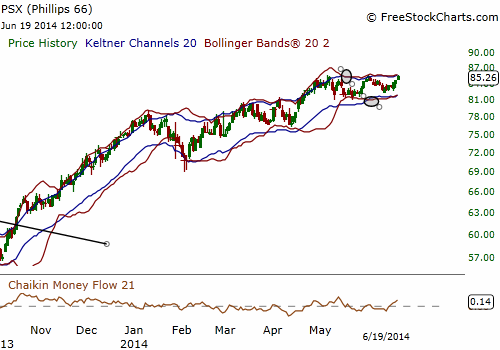

| From June to July 2013, PSX entered into a squeeze setup where the Bollinger Bands traded within the Keltner Channels, revealing a period of low volatility. Low volatility is followed by high volatility and vice versa, which was what happened when price traded up through the upper trendline. This occurred at the same time the Bollinger Bands traded up through the Keltner Channels and signaled that a long entry was called for. On October 17, 2013, an entry was signaled at the $61-$62 price level where you would have seen price trade as high as $79 before taking a pause (Figure 3). The bulls still had firm control of the stock and took PSX to as high as $85 a share recently but can they take PSX higher? |

|

| Figure 3. PSX has traded as high as $85 in recent weeks but has formed another squeeze setup. The stock looks ready to go higher if it trades above resistance as the squeeze setup triggers an entry above the $86 level. |

| Graphic provided by: www.freestockcharts.com. |

| |

| The bullish trend is firmly in place but volatility has fallen somewhat which is a positive. It's a good thing because PSX has signaled another squeeze setup which reveals that it could trade higher if the signal is given. Look to go long at $86-$87 as price trades up through resistance but only if it's followed by the Bollinger Bands expanding outside of the Keltner Channels. And, be sure to use at least a 7% stop loss to limit any unexpected moves against you. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor