HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

Shares of Avon Products have been in a bear market for more than a year now, but signs of a reversal are appearing.

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

CHANNEL LINES

AVP: A Change Of Channel

06/13/14 03:48:50 PMby Donald W. Pendergast, Jr.

Shares of Avon Products have been in a bear market for more than a year now, but signs of a reversal are appearing.

Position: N/A

| Many large cap stocks have had great runs higher since the summer of 2013, but for shares of Avon products (AVP) things have been going from bad to worse — as evidenced by its 45% decline since May 2013. But toward the end phase of every major decline there usually appear valuable clues of an impending trend reversal, and that's likely the case for AVP now. Here's a closer look, using its daily chart (Figure 1). |

|

| Figure 1. Avon Products (AVP): A major shift in the long term money flow histograms is one of the first clues that a significant trend reversal may be approaching. |

| Graphic provided by: TradeStation. |

| |

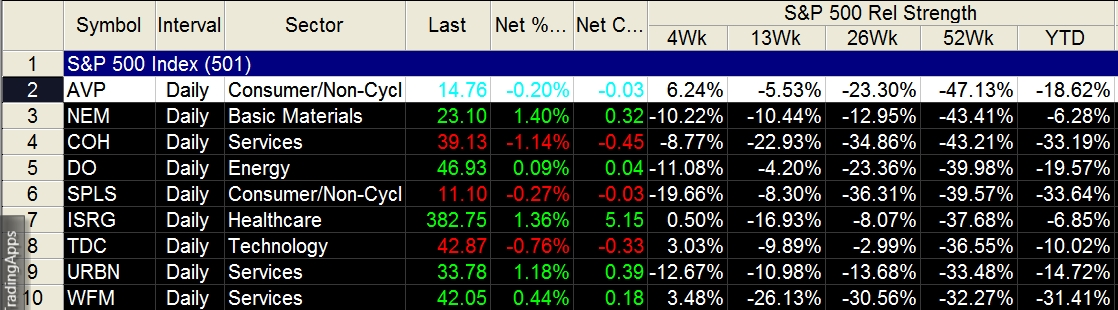

| Of all the 500 stocks in the S&P 500 index (.SPX), AVP has the dubious distinction of owning the title of "worst 52-week relative strength performance vs. the .SPX." One glance at its chart leaves little doubt here; of special note is that its huge October '13 bearish gap was responsible for finally closing the equally huge bullish gap seen in the stock back in February of the same year. Once that gap was closed, the downtrend settled into the larger linear regression channel, continuing to disgorge all of the gains seen during late '12 into mid-'13. It's an unusual chart pattern, one bookended by major gaps in either direction. Presently, however, AVP has some hopeful stirrings about it, even though it's still mired in the major down channel: 1. The 89-day Chaikin Money flow (CMF)(89) is showing us that the 'smart money' crowd has definitely begun to acquire a taste for AVP since early April '14 — just look at how rapidly the histogram has reversed from bearish to bullish. 2. As the money flow trend has improved, note that a modestly bullish (but narrow) trend channel has printed, one that may prove to be AVP's pathway toward a sustained bullish reversal soon. To accomplish this feat, AVP must first close above the topline of the larger channel and then make a successful support test of the same channel line — preferably while remaining within the confines of the new bullish channel. If or when this occurs it will be a successful 'change of channel' for the stock, one where the programming will hopefully be of a more bullish nature. |

|

| Figure 2. AVP boasts the poorest 52-week relative strength performance of all the stocks within the S&P 500 index (.SPX). |

| Graphic provided by: TradeStation. |

| Graphic provided by: TradeStation RadarScreen. |

| |

| Playing this likely reversal in AVP might involve putting on a near-term covered call like this one: A. For every 100 shares of AVP you own, sell one July '14 $14.00 call option. These calls have good open interest and decent daily volume. B. For the life of the trade (until July 19, 2014), simply use a 21-day exponential moving average (EMA) as your trailing stop loss for the entire position. A close below it and you are out of both sides of the trade, but otherwise just hold the position through July option expiration. This is a reversal-style trade and account risk should be kept at about 1%; also be aware that the major stock indexes are looking vulnerable to a summer slump so be sure you are properly managing/protecting all of your long positions in the market. Trade wisely until we meet here again. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor