HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

In every market, there are almost always new strong stock performers rising through the ranks. Here are two worth watching.

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

MOMENTUM

Two New Fliers To Watch

06/10/14 03:43:37 PMby Matt Blackman

In every market, there are almost always new strong stock performers rising through the ranks. Here are two worth watching.

Position: N/A

| One scan I perform regularly is called "New Fliers" that looks for stocks with relatively small market caps, with a low number of shares in the float and low institutional ownership that are also experiencing momentum growth. These are the stocks that could eventually be the next Google, Netflix or Tesla. Last week, eleven stocks came up in the search, but two were clear winners, exhibiting a powerful combination of revenue growth and impressive stock performance. |

|

| Figure 1 – Daily chart of China XD Plastics (CXDC) showing the parabolic growth in the stock prices over the last two months. |

| Graphic provided by: TC2000.com. |

| |

| The stock with the best daily performance was China XD Plastics Company Ltd.(CXDC), a specialty chemical company that manufactures polymer automotive plastics. It reported Q1-2014 revenues of $223.6 million with gross profits of $46.6 million, up 59.6% from Q1-2013. As you see from Figure 1, not only have revenues been growing nicely, so have earnings with the latest data showing an earnings per share (EPS) growth rate of 76% with the stock price more than doubling since April. CXDC began trading on US markets December 2009 after which the stock fell off a cliff. It has clearly regained its former favor with investors. |

|

| Figure 2 – Weekly chart of China XD Plastics from when it began trading on US exchanges. |

| Graphic provided by: TC2000.com. |

| |

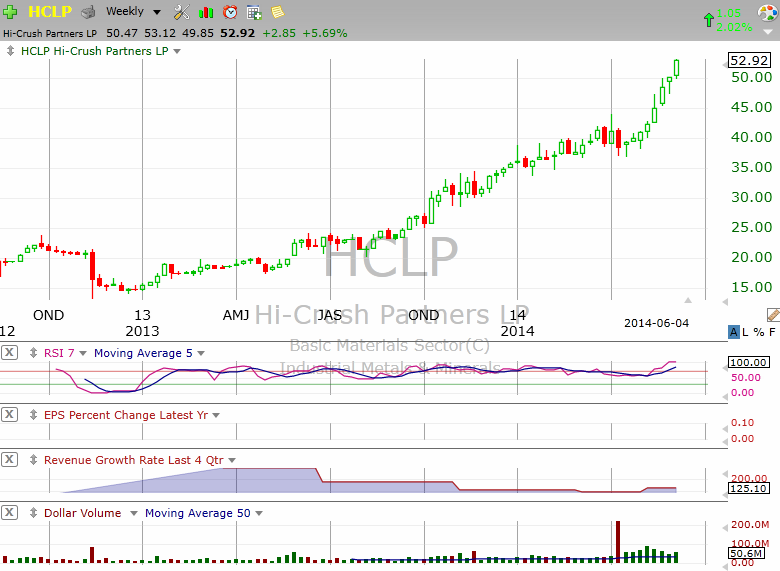

| Our next new flier is Hi-Crush Partners (HCLP), a basic mineral supplier for the extraction of natural gas and oil. According to its Q1-2014 financial report, the company reported net income of $14.3 million ($0.49 per share) on revenues of $55.8 million for the first quarter. Figure 2, the weekly chart of the stock from late 2012, shows the impressive growth rate of the stock from a low of around $15 to its recent high just below $53. |

|

| Figure 3 – Weekly chart of Hi-Crush Partners. |

| Graphic provided by: TC2000.com. |

| |

| Both stocks are well into overbought territory according to their RSI (seven-period) readings so now is probably not the best time to buy. But if both prove that they can weather their coming corrections and resume their up-trends, they could well be big winners in the coming weeks and months. |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

| Company: | TradeSystemGuru.com |

| Address: | Box 2589 |

| Garibaldi Highlands, BC Canada | |

| Phone # for sales: | 604-898-9069 |

| Fax: | 604-898-9069 |

| Website: | www.tradesystemguru.com |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

|

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog