HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

Golf stocks have been forced into the trees lately. Is this weakness due to an industry on a secular downswing or just the result of seasonal weakness?

Position: Sell

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

BULL/BEAR MARKET

Golf Stocks Mired In The Sand

05/30/14 05:54:17 PMby Matt Blackman

Golf stocks have been forced into the trees lately. Is this weakness due to an industry on a secular downswing or just the result of seasonal weakness?

Position: Sell

| As a big supplier of golf equipment, Dick's Sporting Goods (DKS) is a good proxy for the industry. Its stock came under major pressure in the third week of May 2014, dropping a whopping 18% on May 20, 2014 alone — much of that likely due to a downgrade from conviction buy to neutral by Goldman Sachs on May 21, 2014 with similar downgrades by a host of other brokers including Piper Jaffrey, Credit Suisse, SunTrust and JP Morgan the same day. But the big question for traders and investors is whether this is just temporary seasonal weakness or the signs of a more worrying secular trend for the industry? |

|

| Figure 1. Daily chart of Dick’s Sporting Goods (DKS) showing performance and the new 52 week low on May 21, 2014. |

| Graphic provided by: TC2000.com. |

| |

| The DKS case wasn't helped by the Bloomberg article May 23 entitled "Golf Market Stuck in Bunker As Thousands Leave The Sport" (see Suggested Reading below) that painted a grim picture of the golf industry and that about 400,000 golfers left the industry in 2013. The article stated, "U.S. golfers played 462 million rounds last year, according to Golf Datatech. That was the fewest number since 1995." |

|

| Figure 2. Daily chart of Callaway Golf Co (ELY) showing a peak at the end of March followed by a more than 20% drop over the next six weeks pushing the stock into official bear market territory. |

| Graphic provided by: TC2000.com. |

| |

| As you see in Figure 1, after peaking in early January, 2014 DKS has been trending lower. As of May 23, 2014 the stock was 26% off its peak and at a new 52-week low. As the chart also shows, earnings per share (EPS) and revenue growth have been consistently falling over the last nine months, which does not bode well for the stock price in the next quarter and beyond. |

|

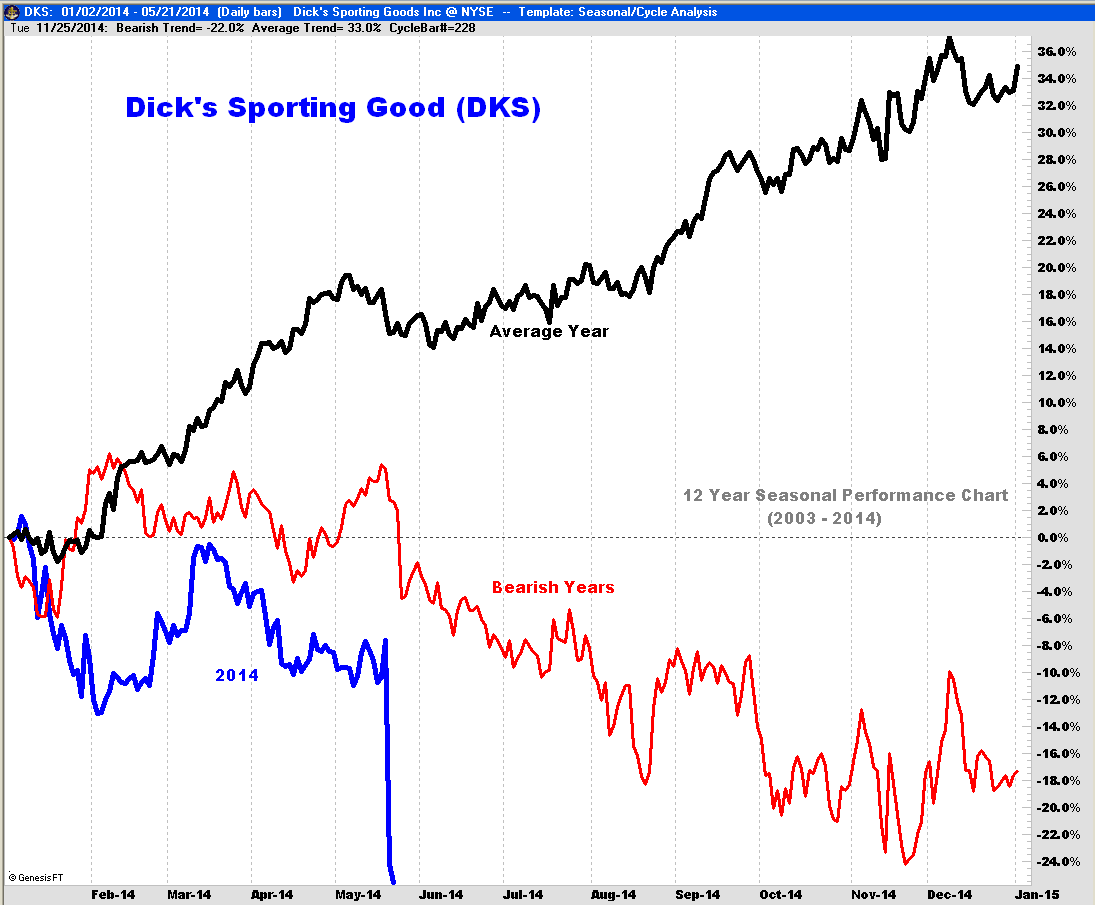

| Figure 3. Seasonal composite chart of Dick’s Sporting Goods between 2003 and 2014 showing how the current year stacks up against other years. |

| Graphic provided by: Trade Navigator www.genesisFT.com. |

| |

| Another major player in the golf space, Callaway Golf (ELY), also hit some headwinds in April and May (Figure 2) but unlike DKS is still showing EPS and revenue growth according to the latest data. To answer the question about whether this weakness is simply short-term or something to cause golf investors greater concern, we will refer to the seasonal chart of DKS (see Figure 3). As the chart shows, 2014 (blue line) has been a horrible year compared to its average seasonal pattern (black line). In fact to date, 2014 has been the worst year for the company since it began trading on the NYSE in 2003. Only one year – 2008 – had similar albeit less ugly stock performance by this time in the year. But by the end of the year, DKS had dropped more than 65%. |

| DKS is clearly running counter trend in 2014, down during the crucial January to May period, which normally accounts for an average 20% gain. So it appears that the headwinds the company and the golf industry are facing are not of the usual seasonal or cyclical sort and could be chalked up to more evidence of an aging demographic and struggling economy. Look for more of the same in the weeks and months ahead. Suggested Reading: Golf Market Stuck in Bunker |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

| Company: | TradeSystemGuru.com |

| Address: | Box 2589 |

| Garibaldi Highlands, BC Canada | |

| Phone # for sales: | 604-898-9069 |

| Fax: | 604-898-9069 |

| Website: | www.tradesystemguru.com |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog