HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

Certain channel breakout setups are more desirable than others; here's a quick tutorial to help you spot the higher probability opportunities.

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

CHANNEL LINES

CTL: Evaluation Of Channel Breakouts

05/21/14 04:23:27 PMby Donald W. Pendergast, Jr.

Certain channel breakout setups are more desirable than others; here's a quick tutorial to help you spot the higher probability opportunities.

Position: N/A

| The channel breakout systems popularized by Richard Donchian and Richard Dennis and his Turtle traders are still among the most popular trend following methodologies of all time; here's a brief look at a sequence of bullish channel breakouts in CenturyLink Inc. (CTL) along with some hints regarding the most opportune time to use a channel breakout entry. |

|

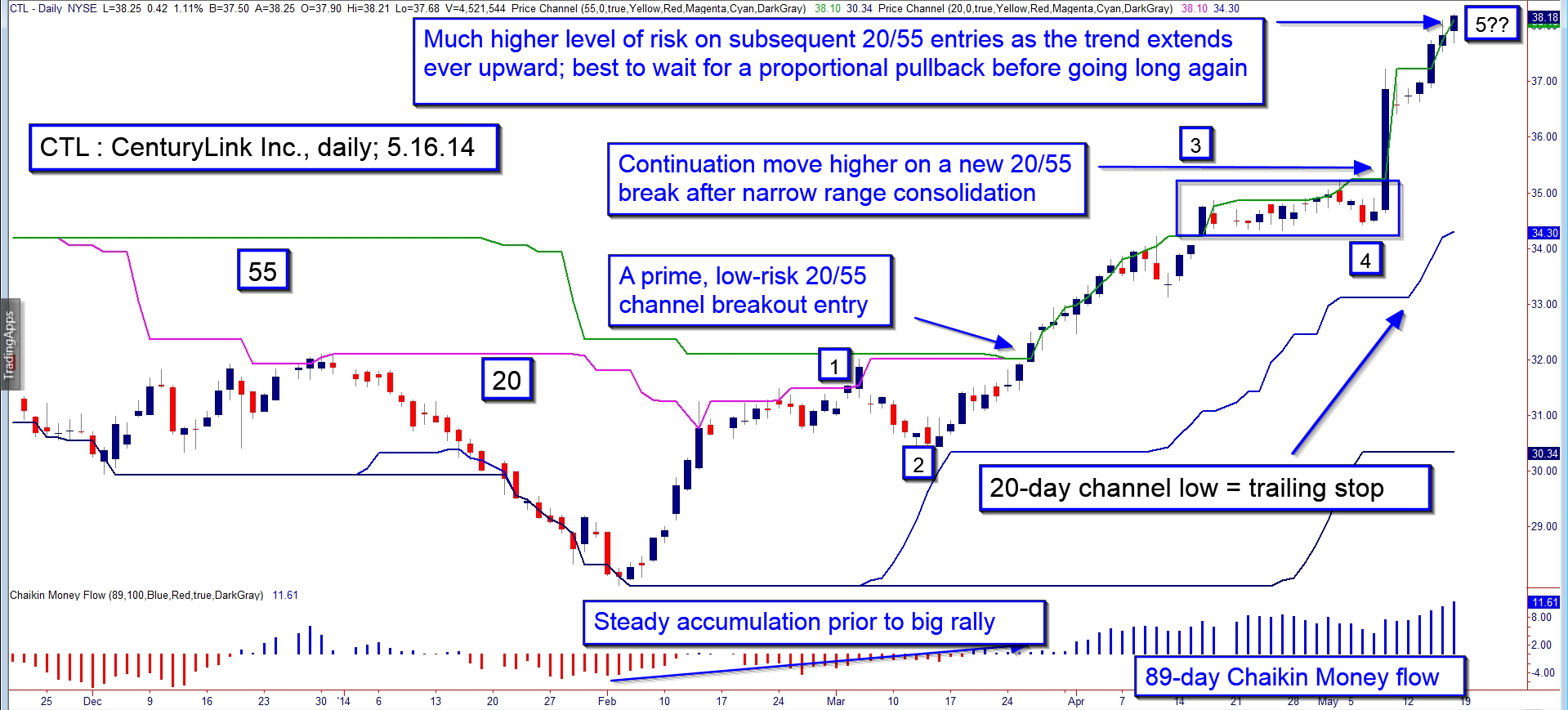

| Figure 1. CenturyLink Inc. (CTL) has had two successful 20/55-day bullish channel breakouts since late March 2014; the second one may now be entering its terminal phase as a beautiful five-wave Elliott pattern plays out. |

| Graphic provided by: TradeStation. |

| |

| Combining two different channel breakout lengths (such as a 20-day and 55/60-day) into a single buy/sell entry trigger can be a useful tactic for the following reasons: 1. You may have a higher probability of catching the start of a higher degree, bullish/bearish price cycle thrust than by relying on the 20-day channel break alone. 2. You will have a larger number of traders joining in on the same breakout, thus increasing the probability of a sustained move. In the daily chart of CTL in Figure 1 you see two great high probability 20/55 breakout entries on the long side: 1. On March 26, 2014 the break above 32.01 occurred as the long-term Chaikin money flow histogram was steadily moving higher from a negative to positive state (big institutional buying). The difference in the spread between the upper/lower 20-day channel lines was about 5%. 2. The second low-risk entry point was on May 8, 2014 on the break above 35.24; the long-term money flow trend was bullish (remaining well above its zero line) and the 20-day channel spread was about 6.5%. This breakout happened as a three week long, narrow-range consolidation pattern played out, setting up a bullish continuation move. Again, many traders are looking at the same 20/55 break higher, knowing that a continuation move is the line of least resistance; as such, you have trader bias, upward momentum, and strong institutional money flows all working in your favor on such a long entry. 3. CTL continues to make one 20/55 bullish channel break after another as the trend matures; right here, right now, this is a high risk, low reward long trade entry signal, and here's why: A. The spread between the 20-day channels is now close to 10%, which is always suggestive of high risk on these kind of channel setups. B. The complete bullish pattern since the February 4, 2014 cycle lows shows us a well defined 5-wave Elliott pattern (three drives higher and two corrective waves).meaning that going long here is even less attractive; in fact an existing long in CTL now might be wise to bring the trailing stop in closer than the 20-day trailing stop of the lows. |

|

| Figure 2. Nordstrom Inc. (JWN); some 20/55-channel breakouts are in a real hurry — such as this latest one in JWN, which also coincides with a quadruple top buy pattern. |

| Graphic provided by: TradeStation. |

| |

| Trend followers work hard on their personal trading psychology to avoid the trading bias traps of picking tops and bottoms and relying on popular overbought/oversold oscillators, and in general, that's why they are successful. However, by applying some of the common sense (as they say, this ain't rocket science, kids) tips demonstrated earlier, you can focus your trend following strategies on the stocks, exchange traded funds, and commodity markets that have a higher probability of sustained bullish/bearish follow-through. You can also apply these ideas to the forex markets but be aware that you won't have any meaningful money flow indicators to rely on. Trade wisely until we meet here again. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Date: 05/22/14Rank: 4Comment:

Date: 06/01/14Rank: 5Comment: Within a daily graphic, multiple time

perspectives are evaluated.

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor