HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

Up by 150% since November 2012, shares of Boston Scientific may now be giving advance warning of "smart money" distribution.

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

CHART ANALYSIS

Boston Scientific: Early Hint Of Distribution?

04/15/14 02:31:17 PMby Donald W. Pendergast, Jr.

Up by 150% since November 2012, shares of Boston Scientific may now be giving advance warning of "smart money" distribution.

Position: N/A

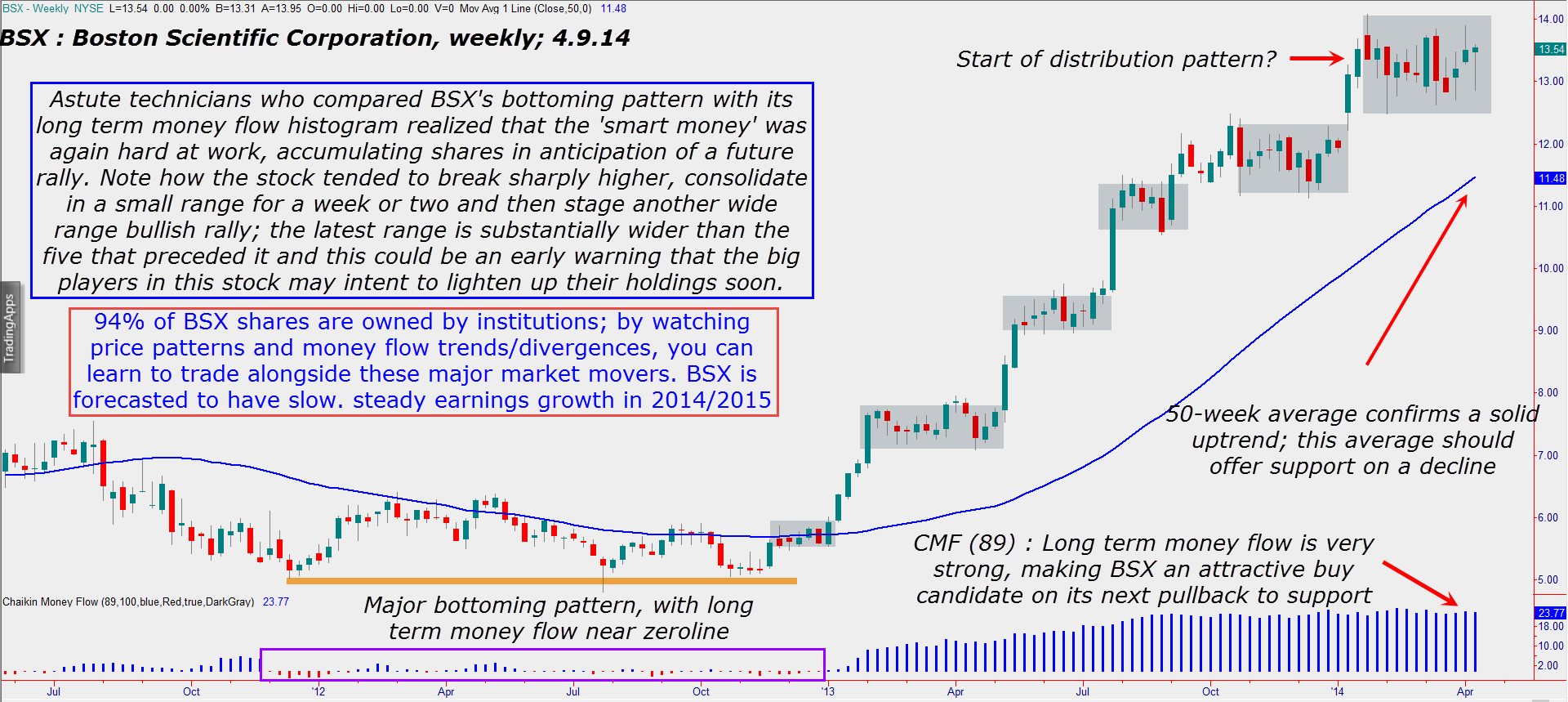

| High relative strength stocks — those that consistently outperform the S&P 500 index (.SPX) over various time windows — tend to attract plenty of attention and investment capital from major institutions. One of the best performers against the .SPX over the past year has been Boston Scientific (BSX). In the chart in Figure 1, we'll look at the telltale signs that helped confirm the so-called "smart money" interest in BSX at various stages of its latest market cycle. |

|

| Figure 1. Boston Scientific's (BSX) long-term money flow histogram is still positive, but that it has remained flat for the last seven months warrants caution for current longs in this stock. |

| Graphic provided by: TradeStation. |

| |

| After large-scale declines (market routs, bloodbaths, financial panics, etc.) in otherwise viable companies, major institutional players (mutual funds, hedge funds, pension funds) will start to sniff around for stocks that are overly hammered and which still sport company fundamentals that have a high probability of igniting a sustained markup/rally phase. What they will typically look for is the following: 1. A one- to three-year basing pattern after a major 75 to 95% decline from the last major rally high. 2. They also want to see evidence of increasing revenues and/or sales growth. 3. They also want to see an increasing number of analysts starting to cover the stock. 4. Additionally, they want to see proof that the earnings growth rates for the company are being revised upward — along with those of its peers in the same industry group. 5. They will also look at the long-term money flow trends or On Balance Volume (OBV) to provide evidence that the major low is likely already near or already in place. If most if not all of these factors are a "go" then the institutional players will start the process of accumulation; if enough of them do so then at some point the stock will stage a breakout rally that will clear the lower boundaries of the last stage of the basing channel. This is where the average retail trader typically jumps in, hoping for a quick momentum-play profit or perhaps to begin a longer term holding period. In BSX's weekly chart you see that the rally out of the base was logical and straightforward, leaving little doubt as to where the "line of least resistance" in the stock actually was. Once the blue 50-week average (SMA) was cleared, BSX managed to initiate no less than five subsequent rallies from consolidation areas between early 2013 and early 2014. The ranges of the consolidations have begun to widen as of late, however, warning that the big money boys may now have an eye out for opportune times to begin unloading their holdings of BSX, locking in gains now. Remember, it takes some time for a mutual fund to fully sell out of a big stock position, and they typically will use rallies toward the end of the markup phase to sell their shares to market latecomers. The long-term Chaikin Money Flow (CMF)(89) histogram is still very bullish at this point, but it has remained in a seven-month old sideways trend even as BSX has continued to rally; when you look at the size (height) of the recent trading range in the stock you realize that there is a tug-of-war going on between bulls and bears and that some amount of near-term distribution is already underway in the midst of the churning. |

|

| Figure 2. BSX has been outperforming the .SPX by a wide margin over the past 52 weeks. |

| Graphic provided by: TradeStation. |

| Graphic provided by: TradeStation Radar Screen. |

| |

| The bottom line here for BSX is simply this: 1. Those with substantial open gains in the stock should either be using protective puts or running a closer trailing stop, if not scaling out of the position altogether. 2. Given the height of the CMF (89) histogram, any pullback by BSX toward the blue 50-week average should be viewed as a low-risk buying opportunity, particularly for traders using a daily trading time frame. BSX is forecasted to have slow but steady earnings growth in 2014/2015 and that should also help bring the buyers out again on a pullback. Trade wisely until we meet here again. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog