HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

Up by more than 1,050% since March 2009, shares of ADS are now at risk of a large-scale reversal.

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

KELTNER CHANNELS

ADS: Major Reversal Warning?

03/07/14 03:33:51 PMby Donald W. Pendergast, Jr.

Up by more than 1,050% since March 2009, shares of ADS are now at risk of a large-scale reversal.

Position: N/A

| Some stocks tend to trend higher with minimal volatility, sometimes for years on end — until the big reversal arrives. Such appears to be the case in shares of Alliance Data Systems (ADS) as its latest weekly time frame push to new highs manifests rapidly fading upward momentum. Here's a closer look. |

|

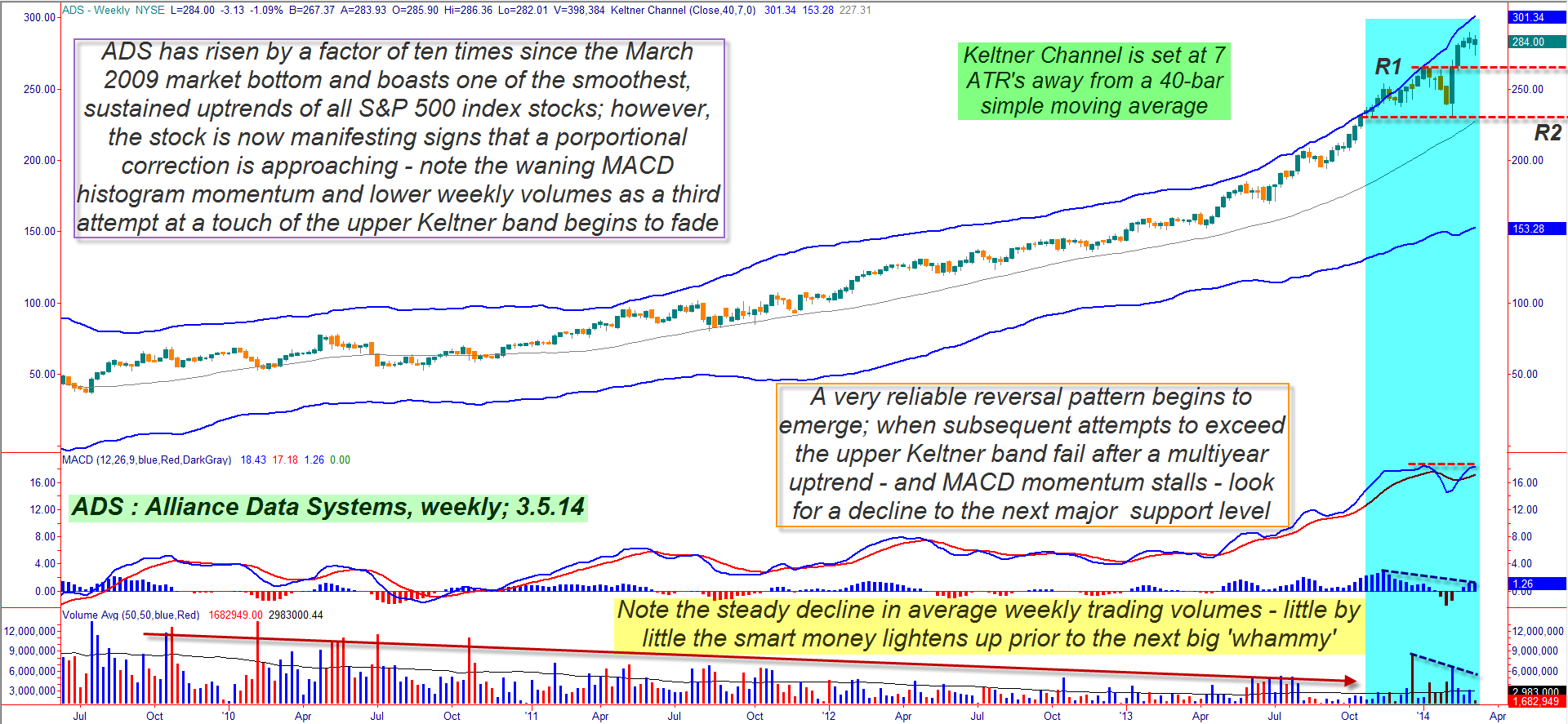

| Figure 1. Alliance Data Systems (ADS) has enjoyed a massive bullish run since March 2009, but the recent volatility in the stock at record price levels is hinting at a correction to come. |

| Graphic provided by: TradeStation. |

| |

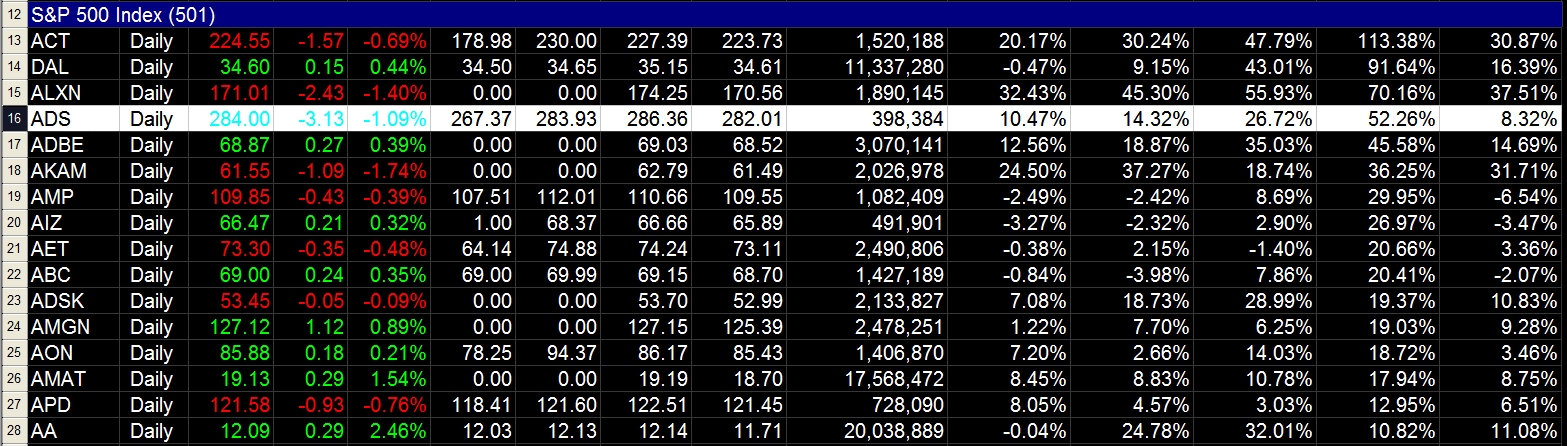

| Powerful, multiyear uptrends in large-cap stocks are a sheer wonder to behold, particularly when the trend has very few substantial corrections along the way; glance at the weekly ADS chart with 4 1/2 years of price data in Figure 1; there was a near 30% pullback in mid-2010, but since then, you'd be hard-pressed to locate a correction exceeding 10% at any time since July 2010. Note also how the stock has never once dipped below the mid-line of the Keltner Channel (a 40-bar simple moving average) since December 2010 and that the mid-line is still sloping ever higher. Truly, this is a "major" bull move, especially for a big-cap S&P 500 (.SPX, SPY) issue. Of course, institutional traders (mutual funds, big banks, hedge funds, billionaire investors who loot third world countries for fun and profit, etc.) prefer to deploy their enormous cash reserves into stocks that are outperforming the broad market averages in a big way (they look at the four- and 13-week comparative relative strength rankings of stocks against the .SPX, NDX, .RUT and so forth) to determine which stock market "horse" has the continued upward momentum to justify an investment position for the long haul, and ADS has more often than not been one of the true, consistent outperformers in the .SPX for the last four years. In fact, ADS is outperforming the .SPX over the past 52 weeks by nearly 53% and is also rising more than 10% faster than the index in just the last month alone. However, the stock has gotten more volatile since early 2014 when it had the biggest pullback since August 2011 (Eurozone-triggered stock market selloff). |

|

| Figure 2. ADS is outperforming the S&P 500 index (.SPX) by more than 52% over the past year. |

| Graphic provided by: TradeStation. |

| |

| Observe that the sell-off occurred right after ADS failed to make a successive close back above the upper Keltner channel line; traders interpreted this as a "failure swing" and a sharp three-week decline ensued. Well, here we go again — ADS bounced to new all times in the wake of that decline and now appears to be stalling out again — now even more shy of making a close above the upper Keltner line. Even worse for existing longs in ADS, the weekly MACD histogram shows us a pronounced negative price/momentum divergence even as the long-term average weekly volume trend continues to confirm that the "smart money" is selling out of this stock after such an incredible run. If you see a weekly close back below 274.05, you may have been given fair warning that an even more sizable correction is beginning to take shape; if the latecomers begin to panic en masse, the "smart money" will then start to aggressively short ADS, further intensifying the feelings of panic among less-savvy investors. The price targets to watch for potential support are near 265.00 and 230.00, respectively (R1 and R2); R2 has more chance of seeing a substantial bounce after a sharp correction, by the way — R1 may offer a minor bounce with which to help get positioned for an anticipated move down toward R2 as we head into spring 2014. Existing longs should be using protective puts and close stop losses (or even taking profits) in advance of such a corrective event in ADS. Trade wisely until we meet here again. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor