HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

Shares of Freeport-McMoran Copper and Gold have sold off hard since the start of 2014 and are down more than 18% in just over three weeks.

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

SUPPORT & RESISTANCE

Freeport McMoran: Closing In On Near Term Support?

01/27/14 04:58:02 PMby Donald W. Pendergast, Jr.

Shares of Freeport-McMoran Copper and Gold have sold off hard since the start of 2014 and are down more than 18% in just over three weeks.

Position: N/A

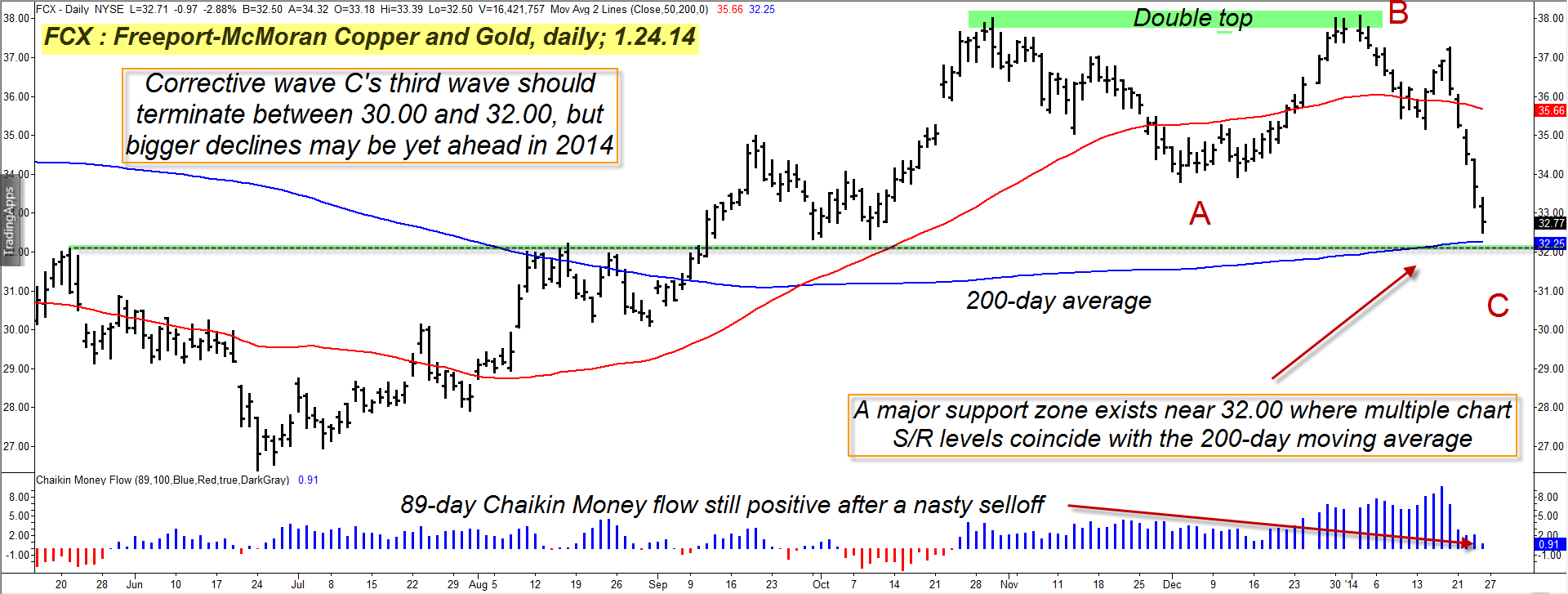

| Copper/gold mining giant Freeport McMoran (FCX) is noted for having volatile price movements in its share price, especially for a large cap S&P 500 index (.SPX) component issue; the stock is certainly in one of its more volatile phases right now, having declined substantially after forming a double top in the wake of a strong rally in the second half of 2013. Here's a look at FCX's current daily price chart dynamics now (Figure 1). |

|

| Figure 1. Freeport McMoran's (FCX) recent decline has been very swift and steep but the stock has key support levels near 30.00 and 32.00 that may allow the stock to stabilize and/or bounce. |

| Graphic provided by: TradeStation. |

| |

| FCX came roaring higher out of a significant multicycle low in June 2013, rising by more than 45% by the end of October 2013; that swing high was to become the first top of a major double top pattern — with the second top forming on the last trading day of 2013. The second top was slightly higher than the former, but very little extra ground was gained by the stock during the final thrust higher, with the share price rapidly collapsing as 2014 commenced. Note also the wide spacing between the two tops and the proportional correction that ensued in between; this is a near-textbook quality double top pattern and it wasn't surprising to see the sell-off that followed. What is surprising here is that the long-term money flow [based on the 89-day Chaikin Money flow histogram or (CMF)(89)] is still above its zero line at this point; this shows us that the "smart money" still has their eye on this stock and may soon step in to pick up more shares in anticipation of a relief rally back up toward a 38 to 50% retracement of the January 2014 decline. This chart also reveals that the June-October 2013 rally was some variation of a five-wave Elliott impulse pattern, given the ABC corrective wave structure that has formed over the past three months. If this current C wave is now in its longest and most powerful declining thrust (a third wave), we may see it stretch south to reach the 30.00 to 32.00 levels in the near future; there is powerful support near 32.00 which is formed from several chart S/R (support/resistance) swings and the all-important 200-day moving average (SMA). Odds are, there will be at least a minor bounce off the 200-day average within the next couple of sessions; if that bounce quickly fails however, expect FCX to get pulled down even lower to test key support near 30.00. That level could be where a nice short-covering rally may emerge, so anyone now short FCX should watch that price level carefully. |

|

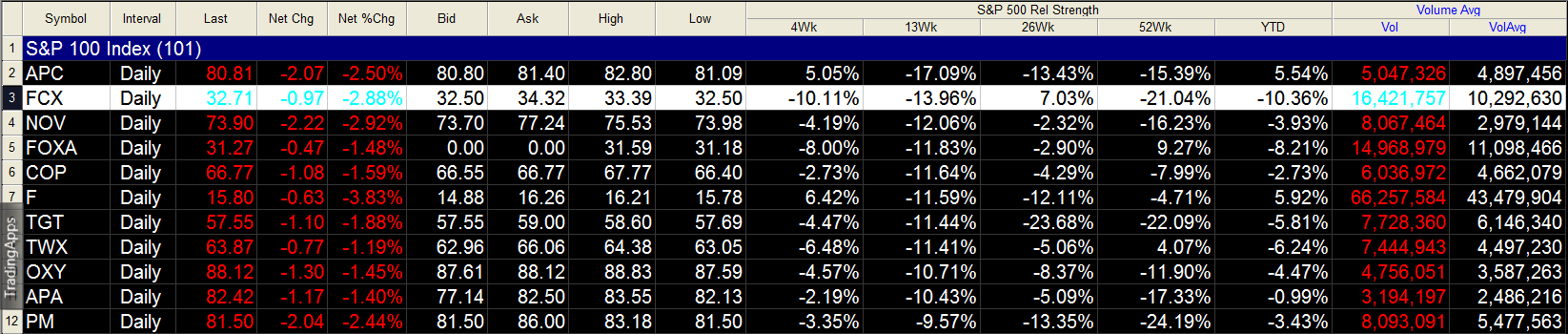

| Figure 2. FCX has been underperforming the .SPX over the last 4-, 13-, 26- and 52-week periods. |

| Graphic provided by: TradeStation. |

| Graphic provided by: TradeStation Radar Screen. |

| |

| Practically speaking, it's too late to get short FCX here now; the risks of a relief rally grow with each new decline of the C wave. The best plan here is to watch for a tradable bounce from 32.00 if you are a short-term intraday trader and to watch for a more sizable rally from the 30.00 level if you are a skilled swing trader. Look for tell-tale bullish reversal patterns from candlestick patterns (bullish harami, an outside bar bullish candle on big volume etc.) on 30- to 60-minute charts for intraday traders and similar patterns on daily charts for swing traders. If you decide to take a shot at a long entry from the 32.00 area on a 30/60 minute chart, be aggressive in securing any profits that may come your way. Swing traders going long on a valid reversal near 30.00 should use a 2 to 3-bar trailing stop of the daily lows, being sure to take at least half profits at strong resistance levels on the way back up. Account risks should be kept small (1% or less) on these kinds of reversal trades, especially when using intraday time frames. For what it's worth, the big sell-off in the major US stock indexes a few days ago appears to be the start of a long awaited (overdue?) correction (at several degrees of trend), so it might pay to wait for FCX to descend down to the lower support level before considering a long counter-trend entry. Trade wisely until we meet here again. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor