HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

When a major bull run in a large-cap stock ends, it sometimes happens with great speed and power.

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

REVERSAL

APC : Major Bearish Turn

12/26/13 04:01:36 PMby Donald W. Pendergast, Jr.

When a major bull run in a large-cap stock ends, it sometimes happens with great speed and power.

Position: N/A

| Shares of Anadarko Petroleum (APC) enjoyed a long and steady rally coming out of its June 2012 major multicycle low, rising by nearly 75% by the time its major high of 98.47 was reached on November 1, 2013. Since making that significant high however, the stock has plunged by 25%, taking out several key support areas along the way. Here's a look at a potential low-risk shorting opportunity in APC, one that may trigger a new bearish play as we head into the New Year. |

|

| Figure 1. Anadarko Petroleum's (APC)weekly chart presents an image of a sustained bullish trend transitioning into a bearish trend — a bearish trend that is strengthening. |

| Graphic provided by: Phantom Trader by KnowVera Research LLC. |

| |

| The trade setup that will be described here is unusual in that it appears to violate the "logic" of what I refer to as the "oscillator crowd" — those traders who believe every time an RSI or CCI goes way oversold that it becomes an automatic buying opportunity. To be fair, there are times when a stock or ETF that has been sold off is indeed a great, low-risk buying opportunity — especially when it occurs against the backdrop of a confirmed long-term bullish trend. However, when it's a shock sell-off that causes the oversold condition (as in the case of this weekly chart for APC) and that a single week of negative price action was able to erase the gains made from late November 2012 to late March 2013, well, you know this is more than a "buy the dips" kind of market scenario. In the case of APC, we find these bearish dynamics at work: 1. The weekly MACD is bearish and the spread is widening, confirming strong negative momentum. 2. The DMI (Directional Movement Index) has also shifted to a bearish posture, and the ADX component of the indicator is also rising, confirming a strengthening downtrend. 3. The KnowVera Research Trend Channel (bottom of chart) has just turned bearish for the first time in 20 months; this indicator is remarkably whipsaw-proof, and is a highly reliable trend following indicator. 4. Note also that last week APC made its first close beneath its 50-week moving average, the first such occurrence since November 2012. So, we have ample confirmation that a bearish trend change is well underway (and confirmed) in APC. How are we to play this developing bear market in the shares now, since it seems that perhaps all of the "easy" money has already been made? |

|

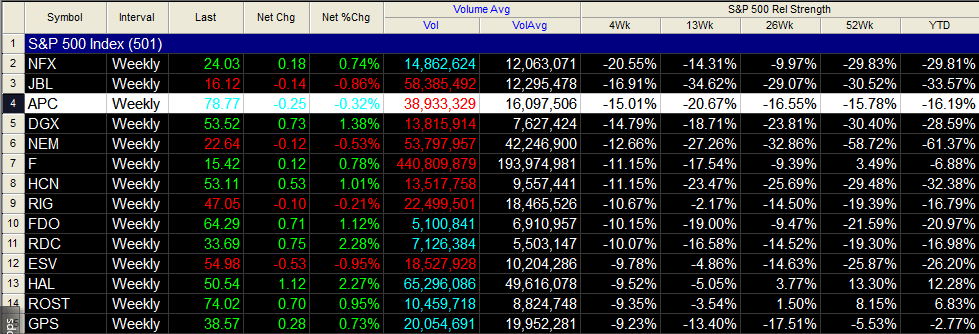

| Figure 2. APC has been underperforming the S&P 500 index (.SPX, SPY) over the past 4-, 13-, 26- and 52-week periods. |

| Graphic provided by: TradeStation. |

| Graphic provided by: TradeStation Radar Screen. |

| |

| The simplest way to play this bear decline in APC is to wait for the weekly low at 73.60 to be taken out again, intending to ride the stock lower down to the next set of key weekly support levels. Here's the logic: * Stocks that have just entered strong weekly downtrends (as measured by points 1-4 above) tend to have several more weeks of declines before finally exhausting; with APC's ADX now rising it's a high-probability short trade to latch onto this tremendous downside momentum. * Note that APC had a minor bounce up from the lows at 73.60; once this little counter-trend rally fizzles and the stock takes out 73.60, investors and traders are very likely to start selling aggressively again. * APC has two well-defined support areas that are tailor-made for use as profit targets once 73.60 is cleared to the downside; the upper one is near 71.80 and the lower one is near 65.80. These are your profit targets for this short trade. Conservative traders should take most if not all their profits near 71.80, while more aggressive traders should use the lower target instead. The initial stop loss should be set near 79.90 and the account risk for the trade should be limited to 1% maximum, possibly a little more if you are an experienced short seller. While the nominal risk-reward ratio for this trade seems rather poor at first glance, remember that the real "edge" in this trade is the powerful bearish momentum behind it, and such momentum isn't usually dissipated all at once, at least not until key support levels are reached. The other trading edge is your use of logical weekly chart support areas that will help you milk the "meat" of the anticipated move without overstaying your welcome. If you feel adventurous, give these kind of bearish trade setups a shot; you may be surprised at how the use of a little creative market analysis can help keep your trading account in the black and out of the red. Trade wisely until we meet here again. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Date: 01/02/14Rank: 5Comment:

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog