HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Chaitali Mohile

While going through a long-term consolidation period, HSBC maintained bullish sentiments by developing an interesting pattern and support levels.

Position: N/A

Chaitali Mohile

Active trader in the Indian stock markets since 2003 and a full-time writer. Trading is largely based upon technical analysis.

PRINT THIS ARTICLE

CONSOLID FORMATION

Consolidation Of HSBC

12/31/13 04:31:46 PMby Chaitali Mohile

While going through a long-term consolidation period, HSBC maintained bullish sentiments by developing an interesting pattern and support levels.

Position: N/A

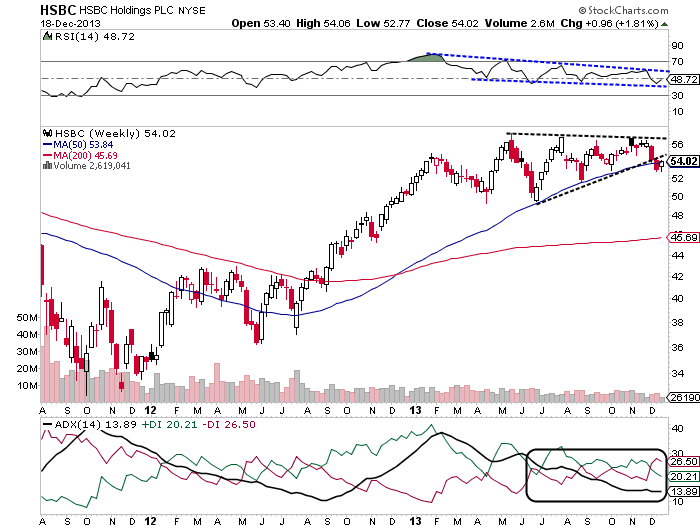

| HSBC Holding PLC (HSBC) underwent a bullish moving average breakout in mid-2012. Since then the stock steadily surged with the robust support of the 50-day moving average (MA). After the moving average breakout, the stock also witnessed a bullish moving average crossover (Figure 1). This developed confidence about the stability of the breakout journey. Hence it was confirmed that the rally was initiated on healthy bullish notes. However, as the stock reached higher levels, the indicators on the weekly chart in Figure 1 turned overbought and showed reversal signs. |

| The relative strength index (RSI)(14) indicated negative divergence, and the average directional index (ADX)(14) reached overheated uptrend levels. This resulted in reversing the bullish rally to a sideways move. During the horizontal price action, HSBC formed higher lows with stable top. The stock has been consolidating for six months, forming an ascending triangle or a flag & pennant formation. Since the triangle is formed after the bullish rally, we will consider it as the flag & pennant pattern. The declining RSI(14) and the weakening uptrend induced selling pressure in the bullish consolidation. Eventually, the price breached the bullish continuous pattern in the downward direction, indicating a major bearish reversal breakout. |

|

| FIGURE 1: HSBC, WEEKLY. |

| Graphic provided by: StockCharts.com. |

| |

| The ADX(14) has plunged below the 15 levels, and the RSI(14) is forming lower lows and highs. This indicates that the stock is likely to remain under bearish pressure. The various higher lows formed by the price rally during the consolidation will extend intermediate support to the fresh bearish breakout. However, the 200-day moving average (MA) will be the ultimate technical support for HSBC. |

| The Fibonacci retracement tool used on the monthly chart in Figure 2 will highlight the strength in the stock support and resistance levels. The top formed by HSBC in years 2010 and 2011 have reversed from the 61.8% Fibonacci retracement level. The descending 50-day MA was additional technical resistance for the previous relief rallies. Later, as the ADX(14) initiated a fresh uptrend, the volatile price rally was able to establish support at $40 which is also the 38.2% retracement level. The stock surged with the MA support and recovered the previous losses. Gradually, the stock reached resistance at $54, resulting in sideways consolidation. |

|

| FIGURE 2: HSBC, MONTHLY. |

| Graphic provided by: StockCharts.com. |

| |

| Currently, the stock is moving horizontally with the support of the 61.8% Fibonacci levels. Since the trend indicator is facing equal bullish and bearish pressure at 19 levels, HSBC is likely to witness volatile consolidation. In addition, the ascending RSI(14) is jittery in the bullish levels between 50 and 70. In such a scenario, the stock would plunge a few points from the current levels and remain range-bound between 61.8% and 50% Fibonacci retracement levels. Any downside price action cannot be considered for long-term short selling position as the stock is likely to move in a narrow range between $50 and $54. Thus, the volatile bullish consolidation of HSBC should be watched carefully. The various support levels would help HSBC to maintain its bullishness. |

Active trader in the Indian stock markets since 2003 and a full-time writer. Trading is largely based upon technical analysis.

| Company: | Independent |

| Address: | C1/3 Parth Indraprasth Towers. Vastrapur |

| Ahmedabad, Guj 380015 | |

| E-mail address: | chaitalimohile@yahoo.co.in |

Traders' Resource Links | |

| Independent has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog