HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

One billionaire's company is soaring higher and, if you play it right, you could score a big winner in today's market...

Position: N/A

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

STOCKS

Raider, Greenmail, Active Value Investments

11/22/13 10:26:22 AMby Billy Williams

One billionaire's company is soaring higher and, if you play it right, you could score a big winner in today's market...

Position: N/A

| Icahn Enterprises, L.P. (IEP) was founded by Wall Street legend and infamous corporate greenmailer Carl Icahn and acts as a vehicle for his various investments including private companies, real estate, gaming, and others. Icahn began his career back in the 60s using his poker winnings to buy a seat on the NYSE and through shrewd investments and a razor-sharp mind has managed to leverage those humble beginnings into a billion dollar fortune. Now, his company is surging higher due to his decades of experience in deal making and presenting new opportunities to traders like you to outperform the market. In order to understand the opportunity that IEP is presenting to traders now you have to understand the mechanics behind IEP's price action. Icahn is considered to be an "activist investor", or probably more accurate, an "activist value investor". Great investors like Buffett, Soros, Templeton, and Icahn have developed investment styles and criteria that suit their personalities and employ rigid discipline in applying it to their individual investments. Icahn looks for investments that have unrealized value potential and then sets about taking a position in the company while aggressively seeking to pressure the board of directors to free up that value in the form of spinning off a piece of the company's business, distributing large cash holdings in the form of dividends, going public, etc. |

|

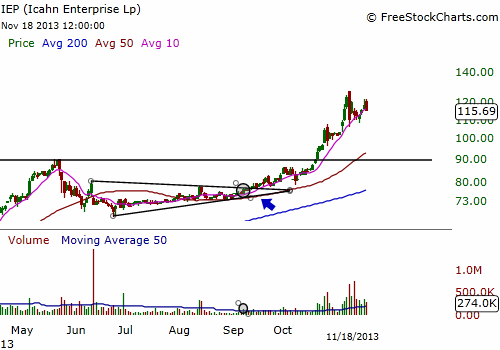

| Figure 1. IEP peaked at $90 and then formed overhead resistance which kept the stock range bound for most of the year. |

| Graphic provided by: www.freestockcharts.com. |

| |

| This aggressive style has built IEP up to a market cap of $13.5 billion and a net worth for Icahn of $24.9 billion dollars. Earlier this year, IEP peaked at $90.75 a share and then corrected before attempting to rally again. This past May, IEP made another go of it but ran into resistance at the $90 mark and couldn't overcome it. This was a retest failure of the $90 level where price attempted to resume the trend to higher ground but the bulls couldn't muster the strength or support to do so. So, the baton was handed to the bears and price was forced down. This time, however, the decline was much more controlled and shallow than the previous correction and price contracted into a tight trading range at the bottom of the pullback. Eventually, it formed a Triangle pattern that acted as a base pattern of sorts and became the launching pad for price to take another run at the $90 resistance point. |

|

| Figure 2. In September, the stock signaled a pocket pivot entry as price formed a triangle pattern. This entry let you get in early on a potential home run trade before anyone else noticed. |

| Graphic provided by: www.freestockcharts.com. |

| |

| There were a couple of ways to play this: Look for an early entry or wait for price to breakout above the $90 resistance price point. On September 9, 2013, IEP formed a pocket pivot for an early entry into the move. Using this as a buy signal, it's important to keep in mind the 10-day rule which states that if a stock doesn't make progress within 10 trading days of a pocket pivot entry then you have to exit. Fortunately, this pocket pivot did show progress and went on to trade through the upper trendline of the triangle pattern and on to challenge the $90 resistance point. If you chose to wait for a breakout above the $90 level, then there are a couple of things you have to keep in mind when trading a breakout. First, is that if a stock gaps up at the point of the breakout then you don't need a spike in volume to confirm that breakout entry, though if volume is on your side then that is a positive. Next, if there is no gap but price trades up through its overhead resistance then you should look to enter on volume that is 40% greater than its 50-day daily average volume. When price broke out on October 18, 2013, it was a price gap which was a valid entry signal. |

|

| Figure 3. A second entry was possible as the stock broke out above the $90 resistance level and soared more than 52% in a matter of weeks. If you took a position then you should sit tight, but if you didn't enter the move then you should wait for a pullback or for price to trade past its new high of $127. |

| Graphic provided by: www.freestockcharts.com. |

| |

| Price went on to rally and gain almost 52% before pulling back. Since the stock has gained more than 25% within 8 weeks of the original entry, then the 8 Week Rule is in effect. This rule states that when you gain 25% or greater within 8 weeks of entry, then you want to move your stops to break even and sit on the stock in order to attempt at catching a bigger move. Stocks that perform so well in such a short time can usually go on to gain 100% or more, but you still want to use a trailing stop of some sort to lock in some gains and protect yourself from unexpected downside volatility. However, the other opportunity offered by IEP will be during a pullback or a resumption of its trend. Since the stock has already pulled back some I would wait for the stock to consolidate a bit and then take a second entry as it trades above its previous price high of $127. As always, set stops no more than 7% from the entry price once you take a position. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog