HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

Shares of ExxonMobil have traced out an incredible, potentially bearish, Fibonnaci-derived chart pattern.

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

CHART ANALYSIS

ExxonMobil: Bearish Turn Ahead?

11/08/13 04:09:40 PMby Donald W. Pendergast, Jr.

Shares of ExxonMobil have traced out an incredible, potentially bearish, Fibonnaci-derived chart pattern.

Position: N/A

| H.M. Gartley is reputed to be the man to have first identified a remarkable price pattern — the one that now bears his name — way back in 1935. The Gartley pattern is formed when the price points of four consecutive market swings create an identifiable, proportionally meaningful shape, one that suggests a high probability entry point in the reverse direction of the final swing of the pattern. Here's a remarkably symmetrical, bearish Gartley pattern, one found on the daily chart for ExxonMobil (XOM) in Figure 1. |

|

| Figure 1. ExxonMobil (XOM) may be setting up for a proportional pullback; the ideal price target for a move down from point D is toward $90.00, which is a strong area of support. |

| Graphic provided by: TradeStation. |

| |

| It's not just the Gartley pattern shown here than makes XOM an attractive short trade candidate. There are numerous technical indicators that suggest the energy giant's stock price may have gotten a bit ahead of itself: 1. Long and short-term money flows are weak, far below the levels seen at previous swing high price zones. 2. The current rally in XOM can only be described as near-parabolic. 3. XOM has been up for 14 of the last 20 trading sessions, with the gains on the up days absolutely dwarfing the losses on the down days. 4. The stock is now colliding with the 93.25 resistance barrier formed by the May and July 2013 swing highs. 5. XOM has now also reached the nominal Fibonacci 78.6%price target for swing CD (93.22). The Gartley pattern is pretty straightforward: 1. Generally you want to see the time distance between swing XA equal to that of the respective time distances between swings AB, BC, and CD. In this example, the time duration is quite close for each set of swings. 2. The Fibonacci ratios should also be close to that of an 'ideal' bearish Gartley pattern. Without going over all of the 'official' rules for the pattern, as long as you see a pattern that visually conforms to the general proportions of the one in XOM, you can be reasonably sure it's a bearish Gartley as long as the final CD swing is about 79% of the length of swing XA. Typically, price targets for a potential bearish reversal down from point D would be at the 38, 50 or 62% retracement level of swing CD; while those are all valid tools to calculate targets, a better way to look for key support areas (identified by previous clusters of high-volume price bars and/or wide range price bars) is to visually ID previous zones of major support. In the case of XOM, significant support can be seen in the 92.00, 90.00 and 88.50 areas, with the 90.00 area being exceptionally strong as it coincides with previous swing highs and/or high volume, wide range price bars. |

|

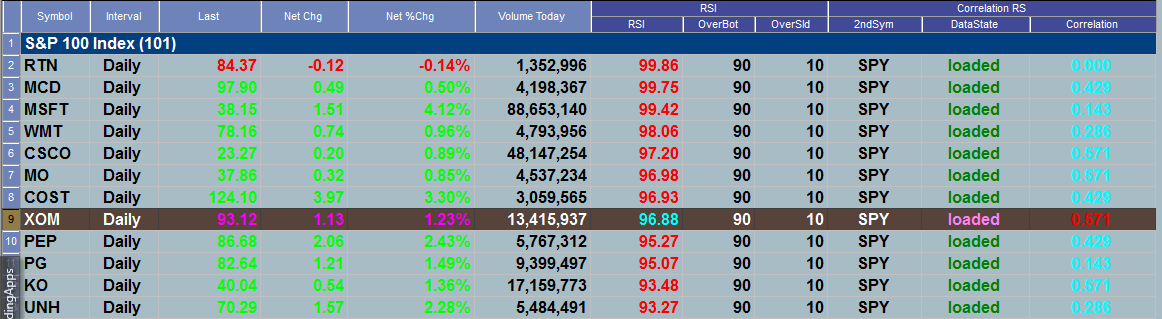

| Figure 2. XOM has a fairly close correlation with SPY at .571. The two-day RSI is getting close to 97.00 and long- and short-term money flows are mediocre. |

| Graphic provided by: TradeStation. |

| Graphic provided by: TradeStation RadarScreen. |

| |

| As far as actually timing a short trade in XOM, look for the stock to break back below 92.12 before assuming this pattern is valid; swing CD, however, can conceivably run even higher, so consider waiting for some sort of exhaustion candle or reversal pattern to appear on its daily chart, entering a portion of your short on more bearish follow through. Consider shorting more on further weakness, being aware of the 90.00 support level. Playing this potential short in XOM can be done by way of: 1. Shorting the stock 2. Buying put options 3. Selling near-term out-of-the-money call options (rather risky) Since this is a reversal style trade you should only risk a maximum of 1% of your account value. Remember to take some profits if the trade goes as anticipated, always noting beforehand where the major support areas reside in the stock. Trade wisely until we meet here again. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog