HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

An unknown drugmaker is setting up to soar but don't get sucked up in the hype until these two things happen.

Position: Hold

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

Bio-Pharmaceuticals Are Flying

11/07/13 04:23:31 PMby Billy Williams

An unknown drugmaker is setting up to soar but don't get sucked up in the hype until these two things happen.

Position: Hold

| Drug makers are in a firm bull trend and the fourth best performing industry in the stock market right now and look ready to go higher. A number of impressive companies are included in the roster that makes up this industry including some well-known names like Alexion Pharmaceuticals (ALXN) and Biogen (BIIB). Both have recently reported strong earnings, but there is one company not so well known that may emerge as the true leader and become the next big name in the investment world. Gentium SpA (GENT), a biopharmaceutical company, engages in research and development of drugs derived from DNA and DNA molecules. The company is based in Italy and is listed on the Nasdaq after its IPO in June of 2005, and, for the most part, has been a resounding failure as far as stock performance is concerned. |

|

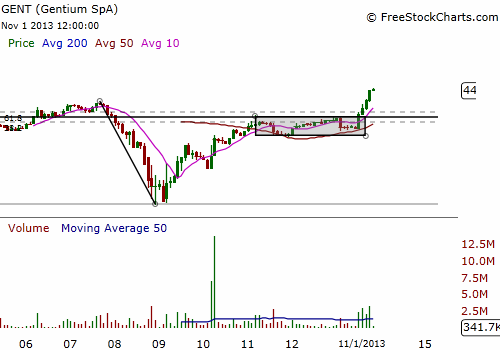

| Figure 1. Monthly chart for GENT. |

| Graphic provided by: www.freestockcharts.com. |

| |

| Like most IPOs, after the stock is made available to the public, and the common investor rushes in and buys up the stock, the stock usually falls off a cliff and bleeds out into a steep decline. This is what happened to GENT in late 2007, and was only made worse in the following year, in 2008, when the stock went down with the rest of the market. GENT fell from a price high of $26 all the way down to 26 cents. It serves as a perfect example of why you should avoid most IPOs. But, in time, some IPOs recover and serve as good trading opportunities after the stock's price develops a following. At the end of 2008, after GENT hit its all-time price low, the stock began to climb its way back from the steep decline. Most fundamental investors were avoiding the stock which is why they failed to notice that the stock's volume was slowly increasing, bit-by-bit, over time. |

|

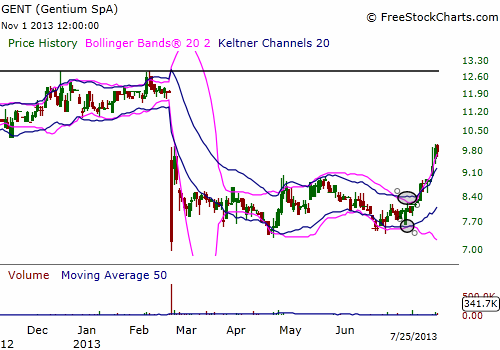

| Figure 2. In late July, a squeeze setup formed signaling an early entry was in the making. |

| Graphic provided by: www.freestockcharts.com. |

| |

| Traders, however, took note and knew that the stock was under accumulation which meant that institutional traders were buying up the stock. You can see this more recently by looking at the 50-day average daily volume of the stock just over a year ago where it was registering just over 20,000 shares traded versus 120,000 shares traded today. In just a year, trade volume has increased over 500% with price steadily trading higher at the same time. Still, a rise in volume isn't reason enough to take a position. |

|

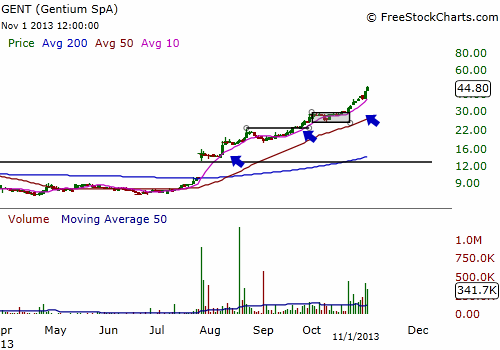

| Figure 3. After the squeeze setup fired off a signal, a breakout on higher volume followed allowing GENT to break free of its trading range. The stock offered several new entry points along its trend where you could have taken a new position or added to an existing one. GENT has tripled in price so far but is now a good time to consider a new position? |

| Graphic provided by: www.freestockcharts.com. |

| |

| Even if you had bought GENT in early 2011, you would be sitting in a position with GENT in a long-term base pattern that lasted for almost two years. Again, you have to let the stock prove that it's worthy of your investment capital. While it set up in a first stage base pattern and had rising volume, the stock had to confirm a bullish trend in its price action by breaking above resistance on greater volume on the day of its breakout. On July 26, 2013, GENT finally accomplished just that and signaled to traders it was time to enter as the stock's price exploded higher on a price gap above the resistance price point of $12.84 on daily volume of almost 2,400% of its 50-day average. |

| Since then, the stock has gained almost 80% within two months, signaling that you need to move stops to break even and ride the stock higher since it has homerun potential. You can determine the stock's potential if it gains 20-25% within two months of its breakout, which GENT did, tripling in price from that original signal. If you missed the entry, there were three more entry points along the way but if you still haven't entered into the stock's bullish run, then you need to wait for one of two events to happen: a pullback to the 50-day SMA or a pocket pivot signal. Buying now is too risky since anytime a stock advances 25% or more, it's due for a correction. Either one of the events listed above are actionable setups to enter into GENT's advance but be sure to risk no more than 2% of your overall capital and set stops no less than 7% from your entry point. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog