HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

The smart money has been quietly accumulating shares of PetSmart Inc. during the stock's recent 10% correction.

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

SUPPORT & RESISTANCE

PetSmart: Gap Down To Major Support

11/05/13 04:35:34 PMby Donald W. Pendergast, Jr.

The smart money has been quietly accumulating shares of PetSmart Inc. during the stock's recent 10% correction.

Position: N/A

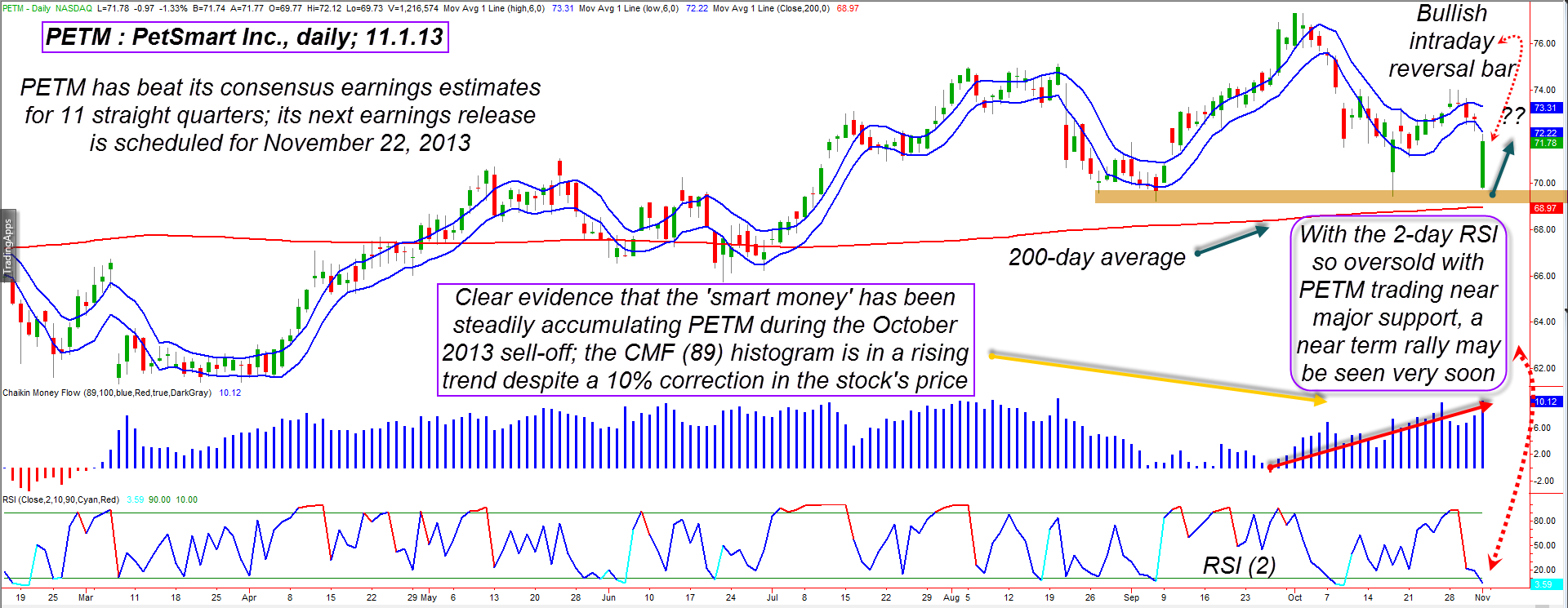

| Shares of PetSmart Inc. (PETM) pulled back by 10% between October 1 and October 17, 2013, dropping by as much as 10.24% during that time; after an eight-session rally — one that closed a recent bearish gap — PETM sold off hard again, gapping down by 5.37% at the open on November 1, 2013. Yet, despite what appears to be a bearish set of chart dynamics at first glance, PETM may now be in a position to recover some of its recent losses. Here's a closer look (Figure 1). |

|

| Figure 1. PetSmart Inc. (PETM) has successfully tested the 69.00/70.00 area on several occasions since late August 2013; with the smart money having been steady buyers during October's decline, the odds of a November rally are quite good. |

| Graphic provided by: TradeStation. |

| |

| PETM has enjoyed a nearly five-year long bull run; the stock bottomed in November 2008 at $13.27 per share and has managed to rally by more than 430% in just under 60 months. Like most other stocks that make long-term advances, PETM's positive earnings growth rates combined with its ability to consistently beat its quarterly earnings estimates have been the key pair of drivers of this high volume, large cap stock's upward price advance. In fact, PETM has beat earnings estimates for 11 straight quarters now, and that is pretty much all you need to know about the primary cause of its strong multiyear run. So, long-term, PETM still appears to be in great shape, offering everyone from swing traders to covered call traders a chance for potential profits. Near-term, the situation is also modestly bullish too, despite the nasty month long correction just seen in the stock, and here's why: 1. The long-term money flow histogram (based on the 89-day Chaikin Money flow) has actually been trending higher (while still above the zero line) for the entire duration of the 10% correction in the stock. This is slam-dunk evidence that the "smart money" has been accumulating PETM aggressively as it declined toward major support. 2. PETM is respecting the support zone (gold shaded area) defined by the 69.00 to 70.00 range — the 200-day moving average and the swing lows established on August 27, September 6, September 10-17 and November 1, 2013 — all combine to form a powerful support "floor" for this stock that the big money players have accumulated; of course, they know where the major support is before they begin to build a new long position, and so should you, FYI. 3. The RSI(2) indicator is best used when it reaches an oversold level of 5.00 or less near a major chart support level; this short-term timing mechanism can be effective in timing "buy on dips" or "support bounce" type swing trades and right now the two-day RSI is showing a reading of only 4.14. 4. Friday's powerful intraday reversal higher from major support is another clue that the smart players in the market are intent on driving PETM higher from here, hoping to cash in on their investment. All in all, it appears that PETM could reclaim even more of October's losses heading into November 2013, so here's a way to consider playing this volatile issue. |

|

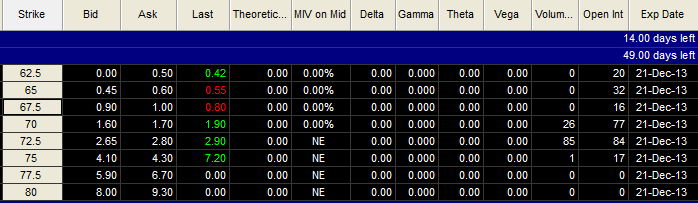

| Figure 2. Open Interest in the December '13 PETM puts is modest, but the bid/ask spread is acceptable. |

| Graphic provided by: TradeStation. |

| Graphic provided by: TradeStation RadarScreen. |

| |

| You'll notice that PETM was able to close most — but not all — of its Friday morning gap the very same day; frequently when a stock closes a large gap like this (more than 5%), the sellers will come back in and attempt to drive the price lower. So, wait a day or two to see what the line of least resistance is in PETM: 1. If the sellers can drive the stock back down toward (but not all the way to it) major support, you may have been given a wonderful, low-risk long entry point. 2. If the stock only pulls back slightly and then quickly regains upward momentum, consider selling a near-term, out-of-the money put option such as this one: * The December '13 PETM $67.50 put has a strike price well below the gold support zone and offers a decent (but not great) bid/ask spread. On a rise back above 72.20, consider selling that put and then just sit back and let daily time decay work its wonders over the next seven weeks until options expiration. If the put increases in value by 80% or if PETM dips below 68.00 immediately buy it back for a loss; if PETM rallies strongly and the option declines by 60% buy it back for a nice gain. Since PETM is really volatile right now, use modest position sizing and keep your max account risk at no more than 1%. Trade wisely until we meet here again. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog