HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

Despite no change in the Fed's $85 billion monthly bond purchase plan, the US dollar surges and the Euro heads south.

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

REVERSAL

EUR/USD: Euro Breakdown As Dollar Surges

11/04/13 04:22:19 PMby Donald W. Pendergast, Jr.

Despite no change in the Fed's $85 billion monthly bond purchase plan, the US dollar surges and the Euro heads south.

Position: N/A

| The forex markets offer abundant opportunities for potential profits for every kind of trader, including scalpers, day traders, swing traders, and long-term trend followers; the "king" of all FX markets since the early 2000s is the EUR/USD pair, and right now it is offering swing traders a relatively low risk shorting opportunity; here's a closer look (Figure 1). |

|

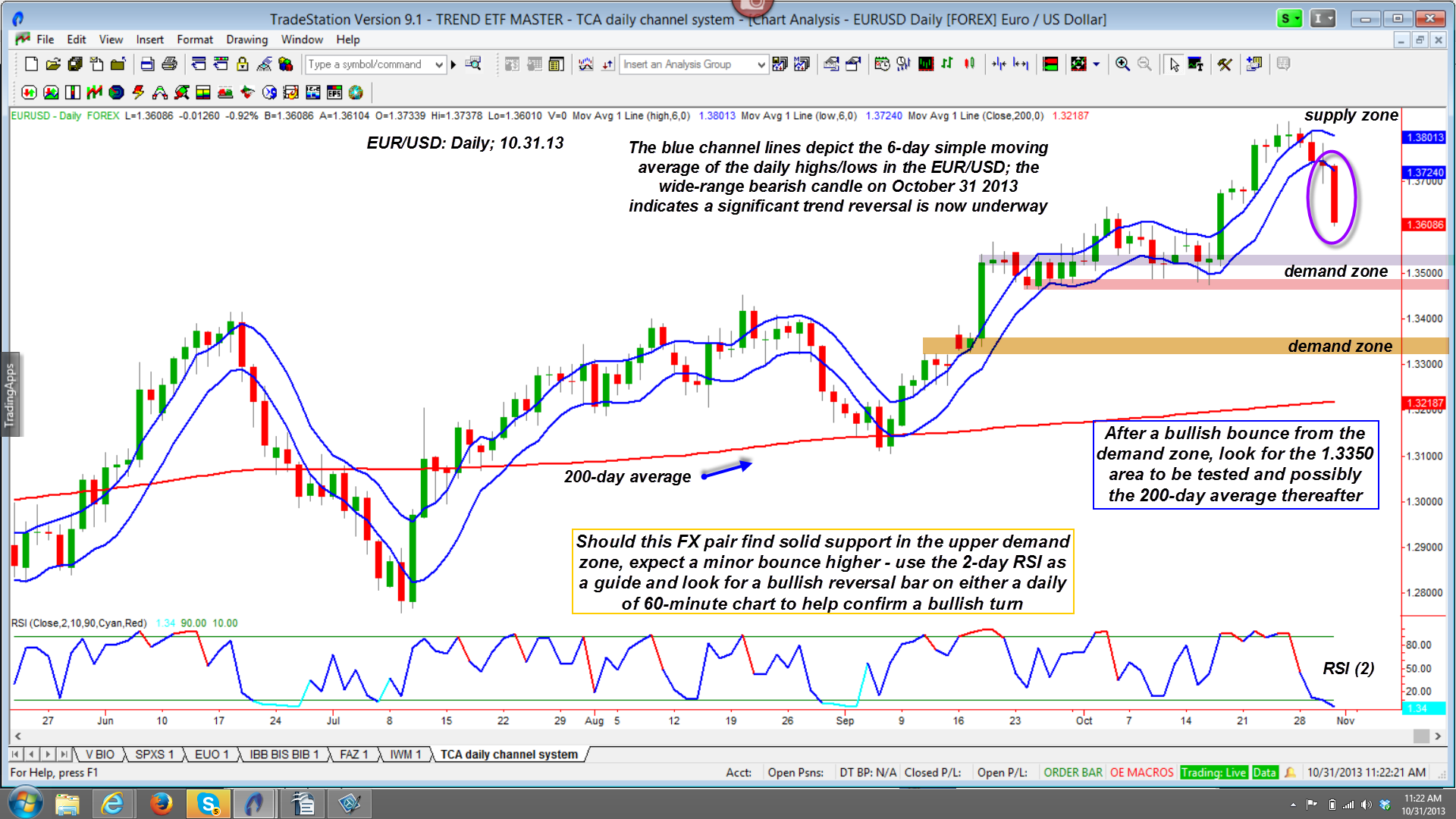

| Figure 1. When a wide-range reversal candle prints after a major set of rallies, it usually signifies that a bearish trend reversal is underway. Look for either of the two "demand" areas to act as some measure of support on further declines. |

| Graphic provided by: TradeStation. |

| |

| The Euro (EUR/USD,EUO) had a very good summer/fall rally, strengthening by approximately 8.44% against the US dollar index (@DX, UUP) between early July and late October 2013; the rally even managed to exceed the February 2013 swing high of 1.37105 by a modest amount, suggesting a possible move toward the monthly channel resistance line near the 1.3900/1.4000 area, but with wide range reversal candles now printed on the daily and weekly time frames in the pair, a retest of support in the 1.3500 area is likely before making another run higher. The daily EUR/USD chart features a basic intermediate-term swing/trend following system, one that uses a six-period simple moving average of the daily highs and lows to construct a set of price bands; while this kind of system is far from perfect, it will usually permit a trader to profit from the more sustained moves seen on a regular basis in this or any other freely traded stock, ETF, FX or futures market instrument. The price bands act as entry/exit triggers and it doesn't take 20/20 vision to see that the EURUSD has broken below the lower moving average band — and in a big way. This sort of wide range reversal bar typically signals the start of a trend reversal, especially if it prints after an extended rally — like the one just witnessed in the pair since July 2013. The two-day RSI indicator is all the way down to 1.34 so this is a major sell-off, with lots of selling pressure; since the next "demand" zone is in the 1.3500 area, the wisest course of action is to let the pair fall into that zone (depicted on chart) waiting to see if a bullish reversal bar forms before even considering a chance to get long again. Those who are already short may want to hold on and take partial profits in the demand zone, letting some of the position ride in hopes of further gains. Expect any bounce higher from the upper demand zone to be short-lived, with another test of the 1.3500 area; this subsequent test, if a failure, should help set up another wave of selling down toward the lower demand zone between 1.3200 and 1.3350. |

|

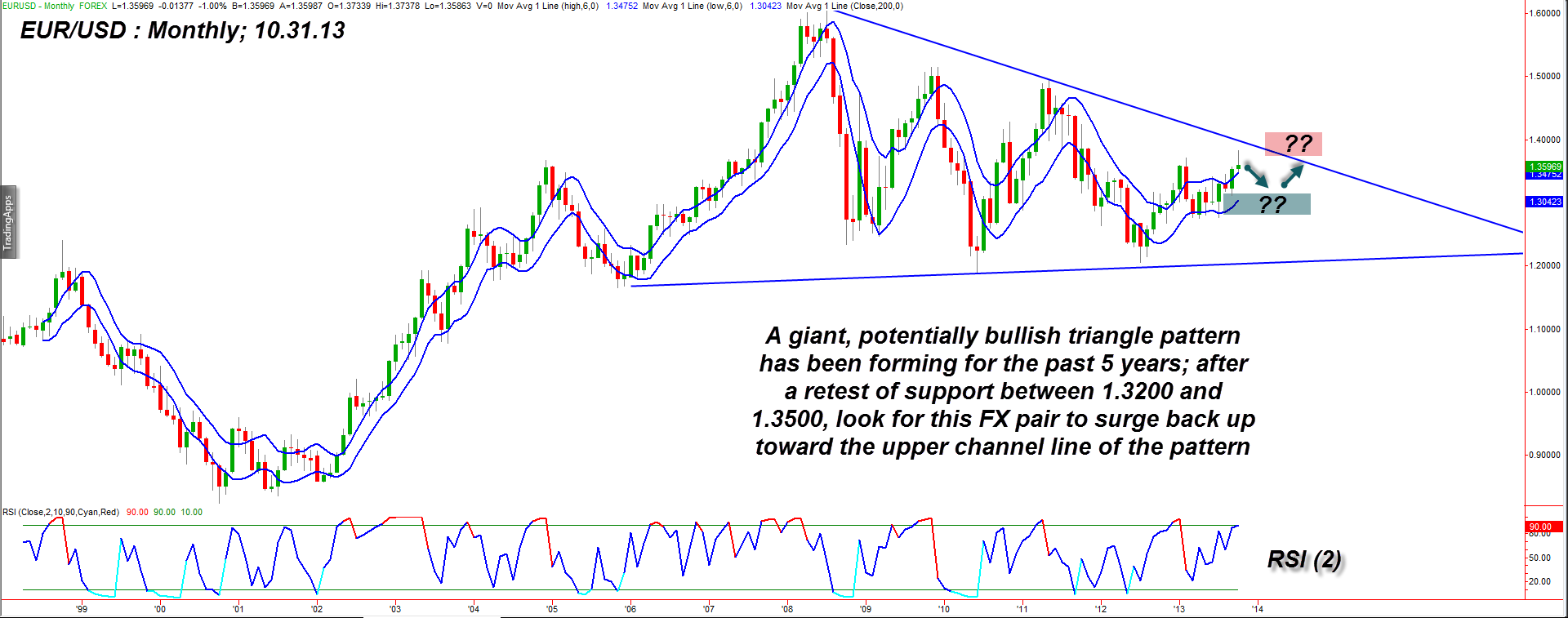

| Figure 2. The large-scale pennant formation on the monthly chart of the EUR/USD may attempt to seek a bullish resolution within the next six to 12 months. |

| Graphic provided by: TradeStation. |

| |

| Looking at the monthly chart of the EUR/USD in Figure 2, we find that a gigantic, multiyear pennant pattern is well underway, one that definitely has a bullish flavor to it; the price action is becoming progressively more restricted and a resolution (likely to the upside) may manifest within the next six to 12 months. A break and subsequent monthly close above the upper channel line should set the stage for the EUR/USD to attempt another run up toward the all-time highs seen back during the US financial crisis days of late 2008. There are many ways to trade the EUR/USD, by the way: 1. As an FX pair, with 50, 100 or even 200:1 leverage. 2. As a leveraged exchange-traded fund (EUO, ULE, among others) 3. As futures contracts (@DX, @6E, @EC) There are also non-leveraged ETFs you can use to trade the EUR/USD, but those listed above are the way to go for those seeking to leverage this highly liquid FX market. Newer traders should use small lot sizes in their FX accounts or stick with small share quantities if using the 3x leveraged ETFs, until they generate a consistent pattern of successful trades using this or any other trading system or methodology. Only the most skilled and experienced (and well-capitalized) traders should attempt to trade the US Dollar index (@DX) or Euro (@EC, @6E) futures contracts. Regardless of which mode of trading the EUR/USD suits your needs, remember to keep your account risks small (1 to 2% max) just in case some trades don't work out as planned. Trade wisely until we meet here again. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor