HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

Lots of companies are trying to profit in energy but one company is servicing them all and breaking higher right now.

Position: Buy

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

STOCKS

Northern Energy Boom: An Unlikely Opportunity

10/29/13 03:41:06 PMby Billy Williams

Lots of companies are trying to profit in energy but one company is servicing them all and breaking higher right now.

Position: Buy

| In 1853, Levi Strauss came from Bavaria to San Francisco during the great Gold Rush days to stake his claim and strike it rich in prospecting for gold. Soon after, he became discouraged by his slow progress and began to take notice that he would make more money by supplying the other prospectors with tools and resources that they could use in pursuit of their own gold strike. Noticing that the clothes that prospectors wore soon fell apart, he designed clothes made of durable denim and Levi's Strauss & Co. was born. Levi's became the first well-known "shovel-and-pick" company which didn't follow the trend but looked for alternative ways to profit from it. Today, that there is a world-wide energy boom is no surprise, but what screams for your attention is that if everyone is trying to trade the energy bull market then it might be wise to look for different angles to profit from it. When you think of energy you naturally think of oil, natural gas, wind, solar, coal, and the like; what you may not think of are the shovel-and-pick plays that service those markets. |

|

| Figure 1. CP has been trending higher for decades now as the premier rail transport of Canada which puts it in the plum position of servicing the booming energy market taking place. |

| Graphic provided by: www.freestockcharts.com. |

| |

| Canadian Pacific Railway Ltd. (CP) is a classic shovel-and-pick play. The company is headquartered in Calgary, Canada and provides rail transportation services over a network of approximately 14,400 miles serving the principal business centers of Canada, from Montreal, Quebec, to Vancouver, British Columbia; as well as the Midwest and Northeast regions of the United States. The company has been on a decade long bull run but showed some significant price weakness in mid to late 2008, when the stock market as a whole was taken down by the bears after the U.S. housing crisis. Still, the stock managed to climb back until mid-2012 when price weakness took place again and caused the stock to drift, and then decline. |

|

| Figure 2. In 2012, CP traded back-and-forth, forming a triangle pattern which also served as first stage base pattern. Shortly after trading through the triangle's upper trendline, a pocket pivot signaled a buy entry on higher volume. |

| Graphic provided by: www.freestockcharts.com. |

| |

| From there, CP formed a new base pattern — a triangle pattern — where price broke through its upper trendline and, later, a pocket pivot setup formed. An entry was triggered on July 25, 2012 between $77 and $78 on almost twice its 50-day average daily volume. CP went on to trade higher at a steady clip, offering low-risk entries along its 50-day SMA where it found support giving traders the opportunity to add to an existing position by scaling in or taking new positions. Less than a year later, in May 2013, the stock peaked just under $140 a share, almost doubling in value since its entry signal, before declining and entering a period of price contraction. The stock went under some distribution after its new price high but showed support well above its major moving averages, staying within 20% of its all-time price high. It was during this phase where it formed a new base pattern, also entering a "squeeze" setup where its Bollinger Bands traded within its Keltner Channels. |

|

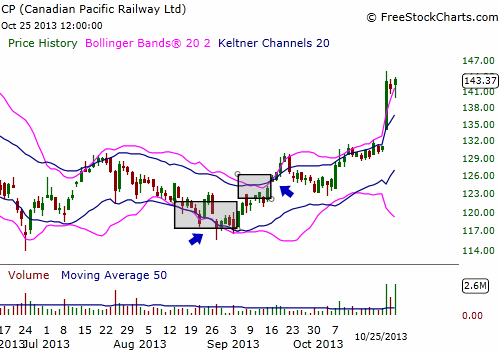

| Figure 3. CP went on to rally from it's pocket pivot entry to just under $140 a share before entering a "squeeze" setup. Above, you can see where the Bollinger Bands entered the stock's Keltner Channels indicating an explosive move was developing. On October 23, 2013, CP broke out above its former price high on volume almost 500% its normal average. |

| Graphic provided by: www.freestockcharts.com. |

| |

| On October 23, 2013, CP exploded upward and broke out above the $140 price level on trade volume in excess of 500% of its 50-day average volume level. This type of volume spike at this price level reveals strength and a lot of potential momentum in favor of the bulls. The breakout move has already begun, however, and the wise play is to wait for a pullback on low volume and then enter as CP resumes its bull run. I would advise trading the stock itself or call options since strength is on the side of the bulls and the end-of-year rally is going to just add wind to your sails as you ride the momentum into the new year. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor