HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

Positive earnings are lifting the market and here are two stocks set to explode higher.

Position: Buy

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

STOCKS

Google, Inc. and Chipotle, Together At Last

10/23/13 02:19:49 PMby Billy Williams

Positive earnings are lifting the market and here are two stocks set to explode higher.

Position: Buy

| Earnings reports are coming in on a positive note and the market is soaking up the good news after getting a boost earlier this week after the U.S. government was back at work. Positive earnings are exceeding expectations causing stocks across a broad group of the market to trade higher as investor enthusiasm gets a lift. This is shifting control of the market firmly into the hands of the bulls and some stocks are exploding higher. So, now that these moves are underway, how do you profit from it if you missed the initial move? Fortunately, it's not too late to find new opportunities and, in fact, it might be good for you to have missed the initial upward move for a better entry to follow. First, you have to understand some of the key players in this latest price surge and the technical action that took place leading up to it. Once you understand how the market got here, you'll be in a much better position to catch the real move that is likely to follow. Two key players that made news recently and whose stock exploded into new territory — Google (GOOG) and Chipotle (CMG). Both have unique traits that helped their stock explode higher but the new price highs are only the tip of what could lead to bigger opportunities for you as the end of the year rolls forward. |

|

| Figure 1. Google has formed a steady series of base patterns followed by higher highs and higher lows in its price action before exploding higher on positive earnings. The stock gapped higher on a spike in volume but is now the time to buy? |

| Graphic provided by: www.freestockcharts.com. |

| |

| Google's IPO was marked by a lot of press and fanfare when it first debuted in late 2004 but price action floundered a bit in the following years as the company explored new strategic directions. In the last 18 months, give or take, the stock has been forming a series of base patterns, breaking out from those patterns and forming a series of higher price highs and higher price lows. Now that the stock has gapped higher, it is trading at an all-time price high which gives it a statistical edge in going even higher since there is no overhead supply, or resistance, in the path of its price movement. Plus, it has gapped higher on huge volume almost 500% over its 50-day average. CMG struggled a bit in its first years following its IPO, but after setting a significant price low, the stock started to rally higher. Almost a year ago to the day, CMG hit an all-time low of just under $234, and now trades at $509.74. |

|

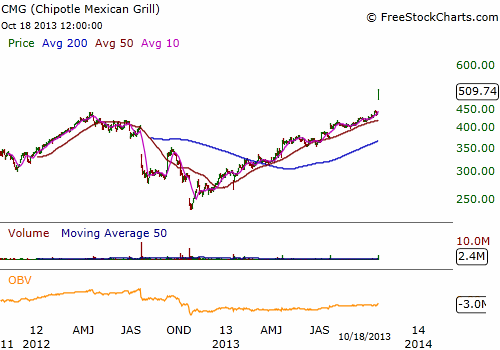

| Figure 2. Chipotle rallied off an all-time low and barely paused to climb its way back up to the point where it has exploded higher on greater volume to an all-time price high. But do you want to chase the trade or is there a better way to enter into this move? |

| Graphic provided by: www.freestockcharts.com. |

| |

| During the rally off that low, CMG climbed out of a deep hole where its price action formed a steady series of higher price highs and higher price lows. The only base pattern that it paused to form was between May and July of this year where it traded along its 50-day SMA. Later, it broke higher and resumed its trend to trade to a current all-time price high. On the day of its earnings release, its daily volume swelled to almost 700% of its 50-day SMA which caused price to gap higher. But, before chasing the trade, you need to give the market time to digest the trade. If you chase its performance, then you're setting yourself up for unnecessary losses. |

| Give both stocks time to consolidate their gains with a low-volume pullback and time for the 50-day and 200-day SMAs to catch up. When price moves too far away from these key MAs it tends to revert to the mean by trading back to the MAs. Once price consolidates a bit, enter a new position near the intraday high made by each price bar that formed on the day of the gap. Entering at that level will let you ride the next wave of momentum with the rest of the seasonal end-of-year rally. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog