HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

Over the last five months, the yield on longer-term bonds and mortgages has gone ballistic. But recent action suggests the run is done.

Position: Buy

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

BULL/BEAR MARKET

It's Time To Sell Yield And Buy Bonds

10/01/13 04:17:08 PMby Matt Blackman

Over the last five months, the yield on longer-term bonds and mortgages has gone ballistic. But recent action suggests the run is done.

Position: Buy

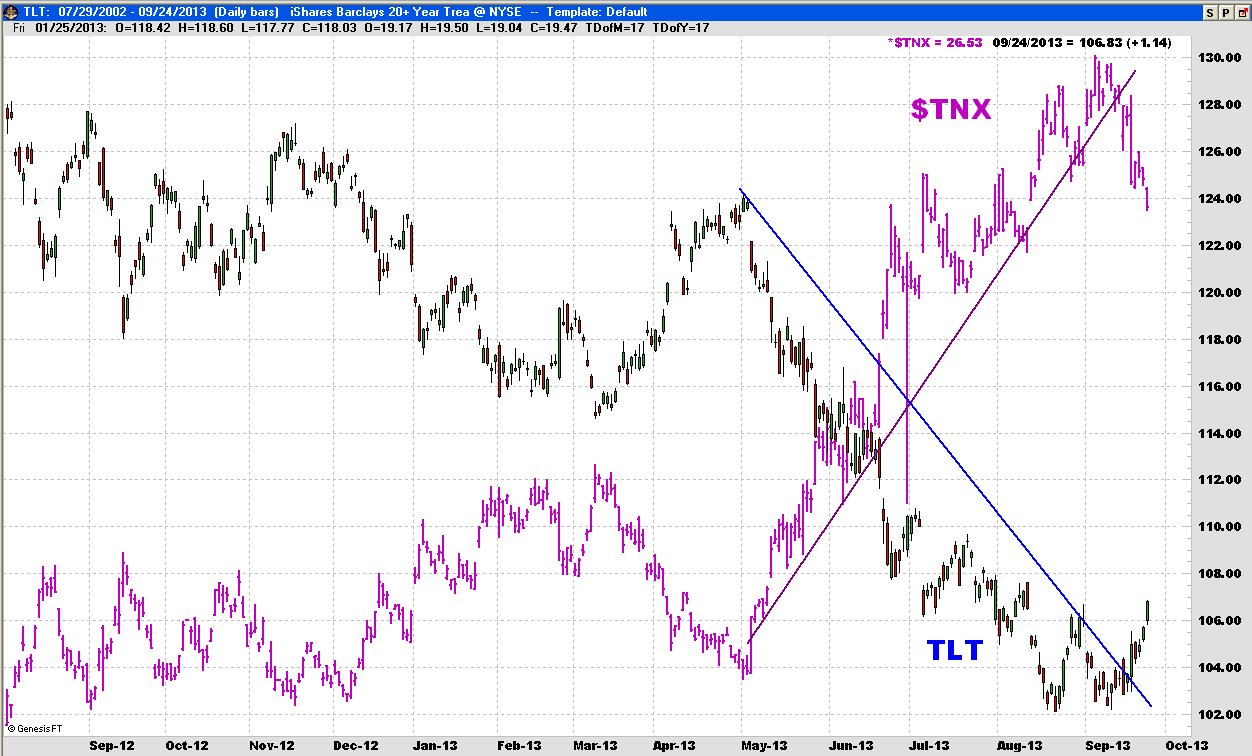

| Between the first week in May and the first week in September 2013, the yield on the 10-year Treasury ($TNX) jumped more than 80% and in the process pushed the cost of the 30-year fixed mortgage up nearly 25%. This move was fueled by expectation that the Federal Reserve would begin to taper the most recent Quantitative Easing (QE) initiative to buy $85 billion worth of government bonds monthly. This, in turn, caused investors to bet that the cost of borrowing money would go up which would have a negative impact on longer-term bond prices. But what few saw coming was the Fed announcement last week that the taper would be delayed indefinitely. And as the chart in Figure 1 shows, the reaction was dramatic. Yields fell on longer term instruments and bond prices took off. |

|

| Figure 1. Weekly chart comparing the CBOE 10-Year Treasury Index ($TNX) with the iShares Barclays 20+ Year Treasury Bond Fund ETF (TLT). |

| Graphic provided by: www.GenesisFT.com. |

| |

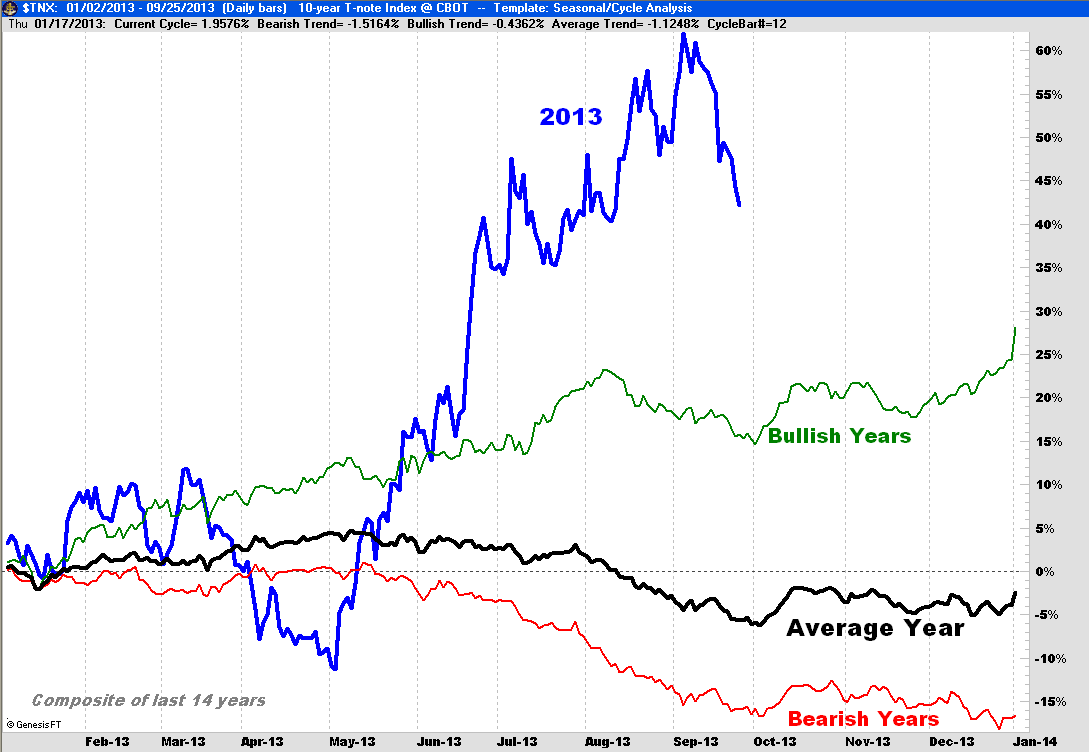

| The TNX has broken uptrend support after putting in a top and 20 year bonds have broken the downtrend after posting a double bottom chart pattern. With QE remaining in place and the taper off the table, investors are running for the safety of longer-term bonds. It is a trend that could see interest rates drop significantly. Figure 2 provides another perspective on just how much yields soared. The last time yields jumped this much was in 2009. Yields fell more than 35% in 2010 before recovering somewhat into year-end. As the chart shows, the average in bullish years for yields (1999, 2001, 2003, 2005 and 2006) was a 28% gain. For the bearish years (2000, 2002, 2004, 2007, 2010, 2011 and 2012) yields dropped an average 16%. |

|

| Figure 2. Composite chart showing TNX performance in the current year (blue) together with the average performance (black), bullish years (green) and bearish years (red) between 1999 and 2013. |

| Graphic provided by: www.GenesisFT.com. |

| |

| What would cause yields to reverse and start to head higher once more? With the market so singularly focused on the Fed, it would take an announcement that QE tapering was going to start. However, with interest-rate dove Janet Yellen a shoe-in as the next Fed Chairman, and with another fiscal cliff approaching, the chances of that happening in the next few months are slim to none. Then 2014 is a mid-term election year when the incumbent president generally initiates policies to kick the economy into high gear as he gets ready for the next election. Any tapering would be counterproductive to achieving this goal. |

| As Richard Koo, Chief Economist for Nomura Securities, opined recently, the Fed has created its own "QE Trap" by its decision not to taper and in the process established what he believes is "a vicious cycle of rising rates and economic weakness" (see here) In other words, they have trained market participants to punish any move to stem tapering efforts and reward a QE continuation decision. And what politician would wish to invoke the wrath of Wall Street and Main Street investors with an election approaching? |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

| Company: | TradeSystemGuru.com |

| Address: | Box 2589 |

| Garibaldi Highlands, BC Canada | |

| Phone # for sales: | 604-898-9069 |

| Fax: | 604-898-9069 |

| Website: | www.tradesystemguru.com |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog