HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Donald W. Pendergast, Jr.

Shares of PG&E may soon have the opportunity to test two important support levels as October approaches.

Position: N/A

Donald W. Pendergast, Jr.

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

PRINT THIS ARTICLE

SUPPORT & RESISTANCE

PCG: Important Support Test At Hand

10/01/13 02:56:09 PMby Donald W. Pendergast, Jr.

Shares of PG&E may soon have the opportunity to test two important support levels as October approaches.

Position: N/A

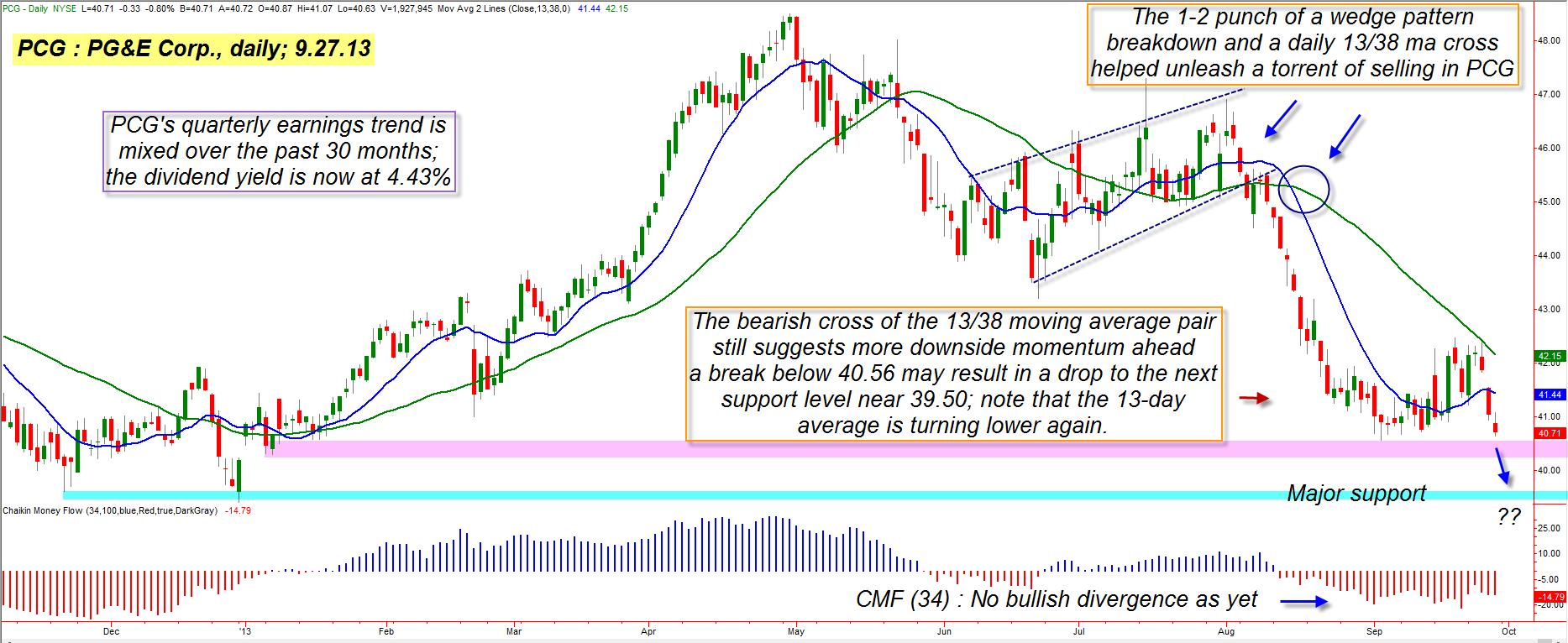

| Down by more than 15% since August 1, 2013, shares of PG&E are close to testing a key pair of support levels now that it has completed the second wave down of a powerful bearish continuation move — one that launched after the stock broke down from a well-formed wedge pattern a few days before the stock's 13- and 38-day simple moving averages staged a bearish crossover. Is the worst of selling done for now, or does this key electric utility stock still have some more down side work to do until finding a new support level? Here's a closer look (Figure 1). |

|

| Figure 1. While the worst of the selling may now be over in PCG, only a successful retest of the pink and/or blue support zones will be able to give the bulls the reassurance they need to consider going long again. |

| Graphic provided by: TradeStation. |

| |

| Utility stocks aren't the fastest moving equities, but they can, and do, manifest the same kind of chart patterns and trending/consolidating characteristics of their higher-volatility large-cap brethren in the S&P 500 index (.SPX). One stock with decent trending/swing tendencies is PCG; the stock is at or nearing the end of a robust continuation move — of the bearish kind — and is now attempting to re-test the recent swing low seen at the end of the second wave of the pattern. That low was made on September 3, 2013 (at a price of 40.56). Typically, a major continuation move (note how similar the length of the first wave — the one heading down into what would become a bearish wedge pattern — is almost identical to the length of the bearish wave that erupted once the wedge finally broke down) like this one will exhaust a great deal of selling (buying) pressure, and all a savvy trader needs to look for is the following if planning on taking any reversal setup that appears: 1. First, an attempted retest of the continuation move low (high). 2. Second, a bullish price/money flow and/or price/money flow divergence; preferably on at least a 34-day basis, using the Chaikin Money flow histogram (CMF)(34) or a 10 to 12- day RSI indicator. While PCG is moving lower, close to retesting the early September low, you also see that there is as yet no bullish price/money flow divergence apparent. This suggests that the "smart money" has not yet begun to build a large enough position in the stock that would be easily identified by the money flow histogram. Thus, the line of least resistance — for now — in PCG must be assumed to be toward lower prices. If PCG soon descends below 40.30, expect a fast drop down toward the pink shaded support line near 39.50; look to see if there is a bullish divergence on the (CMF)(34) and you'll be in much better position to begin scaling into this high-dividend paying utility stock (pays 4.43% annualized — not bad at all). |

|

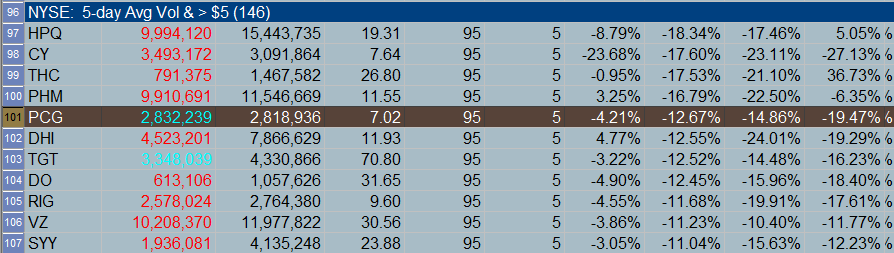

| Figure 2. PCG has been underperforming the .SPX over the past 4-, 13-, 26- and 52-week periods. |

| Graphic provided by: TradeStation. |

| Graphic provided by: TradeStation Radar Screen. |

| |

| Once signs of a bullish divergence are firmly in place, simply look for a key reversal bar — one that shows a wide daily range and a close above the previous session's high — as one of the tip-offs that a bullish entry is soon to appear. Use you favorite mechanical system/trigger to help time your entry after the final low is made and then manage your trade wisely by doing the following: 1. Limit your maximum account risk to 1%. 2. Use a fairly close initial stop, one based on the average daily volatility of the stock. 3. Trail the stock based on an exponential moving average (a 5 to 9-period EMA can be effective) or a volatility-based trailing stop. If the federal budget/health care law mess gets resolved within the next week, there could be a modest bullish reversal in many sectors of the market, so this potential for a reversal in PCG is definitely worth watching out for. Trade wisely until we meet here again. |

Freelance financial markets writer and online publisher of the Trendzetterz.com S&P 500 Weekly Forecast service.

| Title: | Market consultant and writer |

| Company: | Trendzetterz |

| Address: | 81 Hickory Hollow Drive |

| Crossville, TN 38555 | |

| Phone # for sales: | 904-303-4814 |

| Website: | trendzetterz.com |

| E-mail address: | support@trendzetterz.com |

Traders' Resource Links | |

| Trendzetterz has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog