HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

IPOs launch with lots of fanfare and almost never perform as advertised, but China's version of Amazon.com is the exception to the rule.

Position: Buy

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

VIPS, IPO's, Price Volume

09/23/13 05:01:35 PMby Billy Williams

IPOs launch with lots of fanfare and almost never perform as advertised, but China's version of Amazon.com is the exception to the rule.

Position: Buy

| Initial public offerings, or IPOs, often debut with a lot of buzz and fanfare but once the dust settles, most IPO's fail to live up to their billing, at least in the beginning. A closer look at the historical performance for most IPOs show that they tend to spike in stock price and then began a rapid decline. IPOs don't deliver a lot of "bang for the buck" after its initial launch but, in time, they can develop into strong trading candidates. Successful trading involves watching for key technical points to gain an understanding of how a stock's price is behaving in the present in order to gain a sense of where it is going. Two of the best indicators to accomplish this are observing price action and trade volume. For example, Chinese companies were en vogue in recent years due to the promise of China developing into an economic superpower with young businesses leading the way. |

|

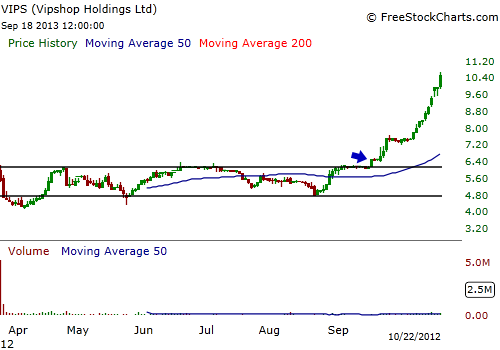

| Figure 1. VIPS went public in March of 2012 but the stock fell apart and settled into a trading range. The stock did manage to breakout on higher volume but it still wasn't a good time to go long. At least, not yet... |

| Graphic provided by: www.freestockcharts.com. |

| |

| In March 2012, Vipshop Holdings Limited, or VIPS, went public with a lot of fanfare on the US market as the next Amazon.com. The company, through its subsidiaries, operates as an online discount retailer for various brands in the People's Republic of China and offers a broad range of branded discount products, such as apparel for women, men, and children. As soon as the shares went public, they began to decline and found their bottom at the $4 price level. VIPS managed to trade its way back up to the $6 price level but found resistance at this point and became range bound. The stock traded between $4.25 and $6 for several months on low volume with little interest for investors or traders to participate in the stock. |

|

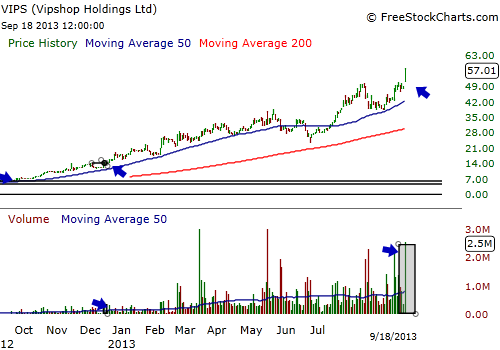

| Figure 2. VIPS began experiencing accumulation by traders and institutional investors causing the volume to rise. By the end of November, the stage was set to get ready to go long which was signaled on 12-14-12. |

| Graphic provided by: www.freestockcharts.com. |

| |

| During this time, VIPS had a couple of negatives working against it: trying to attract sponsorship and public participation with the low stock price and low volume. As a guideline, stocks should trade above $10 a share, preferably $20 a share or higher. Also, stocks that trade on less than a 50-day average of 100,000 shares daily are often too thin to move in or out of and are typically avoided. The reason is that if a stock is thinly traded on low volume and something happens like a flash-crash in the stock or the larger market, then it makes it difficult to liquidate your position. Likewise, if you want to buy a large block of shares, it can be difficult to get a good fill and you may end up paying more for the stock. On September 19, 2012, VIPS broke through its $6 resistance level on higher volume but the 50-day average volume was still well under the desired 100,000 daily average, so an entry should have been avoided. |

|

| Figure 3. VIPS went on to trade from an entry of $14.25 to as high as $57 a share. Another long signal was signaled on 9-18-13, but it might be a good idea to trade the stock in the short-term due to price and the 50-day SMA being too far extended from the 200-day SMA. |

| Graphic provided by: www.freestockcharts.com. |

| |

| But, the stock began to be accumulated by investors and institutional traders causing a rise in share price along with increasing daily volume. By the end of November 2012, the average 50-day daily volume was in excess of 100,000 shares and the stock was trading above $10 share. On December 14, 2012, VIPS traded higher past its previous high on December 4, 2012 at $14.25, and on volume that was over 250% of its 50-day average, both good signs to enter a position in VIPS. VIPS has gone on to trade up to $57 a share with its price trading above its 50-day SMA and 200-day SMA revealing strong technical strength, and increasing volume revealing that traders are still accumulating shares. VIPS is a good example of why you want to play an IPO after the noise dies down and the stock has a chance to mature and prove itself. |

| The stock has recently fired off another buy signal on September 18, 2013, but you should look to trading the stock in the short-term. Both price and the 50-day SMA are becoming extended from the 200-day SMA and when such a state exists, price usually reverts to the mean which means that price could decline in order to find balance before going higher. If you trade the stock, tighten your stops and shorten your profit targets to adjust for any adverse price reversal. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog