HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

The banking sector has been radioactive to traders since the 2008 crash but one stock is emerging from the ashes.

Position: Buy

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

Radioactive Stocks And First Republic Bank

09/19/13 04:09:10 PMby Billy Williams

The banking sector has been radioactive to traders since the 2008 crash but one stock is emerging from the ashes.

Position: Buy

| The banking sector was hit hard in 2008 as the tsunami of bad mortgages washed over the market, making most bank stocks radioactive to traders. Nowadays, even the mention of bank stocks makes most traders sick to their stomach with images of bailouts, Wall Street paydays, and an almost unlimited amount of foreclosures left in the wake of subprime toxic assets that touched off the housing crisis. But, in trading the market, yesterday's pariah can be tomorrow's high performer. First Republic Bank has a $6 billion market cap and a strong price chart that shows price reaching new highs along with a steady series of higher lows and higher highs in its price action. On September 18, 2013 FRC fired off a "pocket pivot", a price bar that has experienced higher than normal trade volume which happens to be higher than the 10 previous trading days. |

|

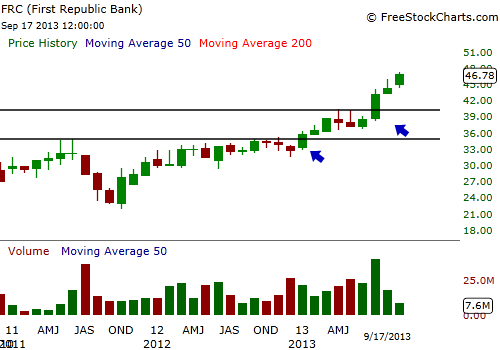

| Figure 1. FRC bottomed in October of 2011 and traded up through two major resistance levels on its way to where it currently trades at a new all-time price high. |

| Graphic provided by: www.freestockcharts.com. |

| |

| Pocket pivots were discovered by Gil Morales and Dr. Chris Kacher, disciples of William O'Neil, founder and publisher of Investor's Business Daily as well as the author of "How to Make Money in Stocks" which is considered the bible of momentum trading. Pocket pivots are a way to get an early position in a stock that is forming a base pattern or is in a current uptrend. Breakout patterns were few and far in-between after the dotcom crash in 1999 which caused a lot of difficulties for momentum traders who tried to follow O'Neil's guidelines of entering a stock as it was breaking out and up through its resistance price level. In the post-dotcom era, stocks that appeared to be breaking out lacked the follow-through experienced in the past and left momentum traders with a steady series of losses. |

|

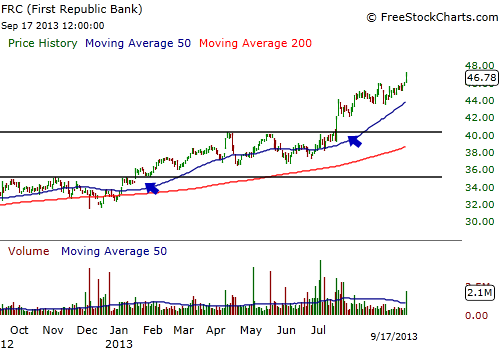

| Figure 2. At each resistance point, $35 and $40 respectively, a pocket pivot was formed at the time of the breakout. Each price entry was clearly indicated by the formation of the pocket pivot combined with the breakout on higher volume. |

| Graphic provided by: www.freestockcharts.com. |

| |

| Morales and Kacher identified price movements that occurred just prior to the breakout that gave traders an edge by getting in early just before the breakout to limit losses and make greater gains. The pattern also works for stocks that are in a current uptrend like FRC presently. FRC has been in a long-term bullish uptrend after hitting a bottom in October 2011 and then climbed higher. In early 2013, on January 16, 2013, a pocket pivot formed as price traded up through the $35 resistance price level on higher trade volume where the bulls took FRC to higher ground before entering a period of price contraction and formed another base pattern (Figure 2). |

|

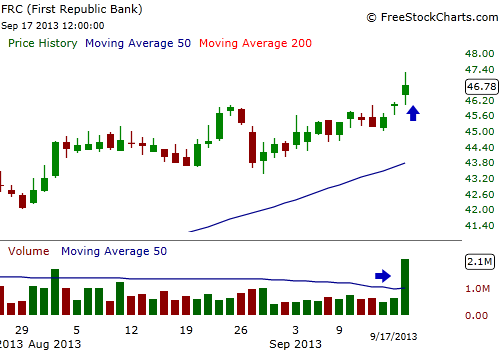

| Figure 3: Another pocket pivot was formed on 9/17 as FRC resumed its uptrend, but you would be advised to trade the move in the short-term using call options to limit your risk. |

| Graphic provided by: www.freestockcharts.com. |

| |

| This second base pattern gave traders another opportunity to take a position if they missed the first move or add to an existing position. The stock traded above its 200-day SMA and along its 50-day SMA. It remained firmly in control of the bulls. On July 17, 2013, a pocket pivot formed as the stock traded up through the $40 resistance level and quickly gained another 15%. |

| Despite the pocket pivot on September 18, 2013, you would be wise not to chase the stock into higher ground. The stock has just emerged from a base pattern and the greater market is still a bit weak, so you would be advised to trade the stock in the short-term. I'd suggest using call options that have a delta reading as close to 1.00 as possible. Look for a solid 3:1 payout and exit at the first sign of trouble. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog