HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Koos van der Merwe

With Obamacare somewhere in the future, should you start buying any stock involved in healthcare?

Position: Accumulate

Koos van der Merwe

Has been a technical analyst since 1969, and has worked as a futures and options trader with First Financial Futures in Johannesburg, South Africa.

PRINT THIS ARTICLE

HEAD & SHOULDERS

A Look At Community Health Systems

09/17/13 03:23:15 PMby Koos van der Merwe

With Obamacare somewhere in the future, should you start buying any stock involved in healthcare?

Position: Accumulate

| Community Health Systems, Inc. is one of the nation's leading operators of general acute care hospitals. The organization, through various affiliates own, or lease 135 hospitals in 29 states. What does the market think about how Obamacare will influence the profitability of the company? |

|

| Figure 1. Monthly chart showing inverse head & shoulder pattern. |

| Graphic provided by: AdvancedGET. |

| |

| The monthly chart in Figure 1 suggests an inverse head & shoulders pattern. The target suggested, should the price move above the neckline at $41.97, is $73.30 (41.97 -10.64=31.33+41.97=73.30). The chart shows that in February 2013 the share price did break above the neckline, rising to a high of $51.55 by June 2013 before falling back to its present price of $40.32. The RSI indicator is suggesting a further move to the downside. |

|

| Figure 2. Weekly Chart showing support and resistance lines. |

| Graphic provided by: AdvancedGET. |

| |

| The weekly chart in Figure 2 shows a falling RSI, with the support line suggesting that the price could fall to $37.59 before a buy signal is given. Notice how the price reacted at the support and resistance lines as it moved suggesting that the probability of a reaction at $37.59 is high. |

|

| Figure 3. Daily chart showing a VOTE line BUY signal |

| Graphic provided by: Omnitrader. |

| |

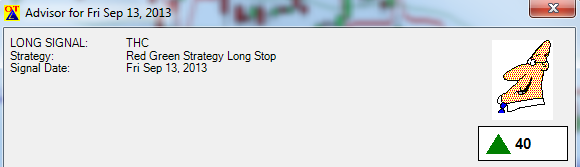

| The chart is Figure 3 is a daily chart that show a buy signal on the Vote line. The Advisor rating shown in Figure 4 is only 40, not a strong rating, but that doesn't mean the buy signal should be ignored. The share price did flirt with the lower external band line, suggesting that the buy signal given by the strategy Red Green Long Stop shown in green below the Vote line, could be effective. Note the RSI 14 indicator is trending upward, and the TDIJak indicator is flirting with a buy signal. |

|

| Figure 4. Advisor Rating. |

| Graphic provided by: Omnitrader. |

| |

| Community Health Systems is a share that I would buy for a long-term hold. As Obamacare asserts itself, and more and more US citizens become accustomed to the change in the medical system, the hospitals will definitely become busier. |

Has been a technical analyst since 1969, and has worked as a futures and options trader with First Financial Futures in Johannesburg, South Africa.

| Address: | 3256 West 24th Ave |

| Vancouver, BC | |

| Phone # for sales: | 6042634214 |

| E-mail address: | petroosp@gmail.com |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog